Are Heat Pump Subsidies Regressive?

New research finds little relationship between heat pump adoption and household income.

One concern with subsidies for low-carbon technologies is that they tend to go predominantly to high-income households. Previous research has shown, for example, that the 20% of households with the highest income receive 60% of U.S. federal tax credits for rooftop solar and 90% of U.S. federal tax credits for electric vehicles.

My new Energy Institute working paper finds that heat pumps are an important exception. Using newly available U.S. nationally representative data, the paper shows that there is remarkably little correlation between heat pump adoption and household income.

This lack of correlation has important implications for a growing number of federal, state, and local subsidies aimed at heat pumps, including the new $2,000 federal tax credit. Most importantly, the results suggest that the distributional impacts of heat pump subsidies are likely to be quite different from previous low-carbon technology subsidies.

Near Zero Correlation

The figure below shows how the percent of U.S. households with a heat pump varies by annual household income. Nationwide, 15% of U.S. households have a heat pump as their primary heating equipment, and this is essentially the same for all levels of household income, ranging from the bottom of the income distribution (less than $30,000 annually) to the top ($150,000+).

–

This figure was constructed using household-level microdata from the latest wave of the Residential Energy Consumption Survey (RECS). Conducted approximately every five years by the U.S. Department of Energy, RECS collects rich data about household energy-related durable goods and behaviors. The total sample for the 2020 RECS is 18,496 households, including more than 2,600 households with heat pumps.

Is this Surprising?

Yes! I informally polled a number of my colleagues prior to sharing this figure and all expected there to be a positive correlation between heat pump adoption and income. High-income households tend to have more of almost everything, and a new heat pump can cost more than $8,000, so I definitely was not expecting this.

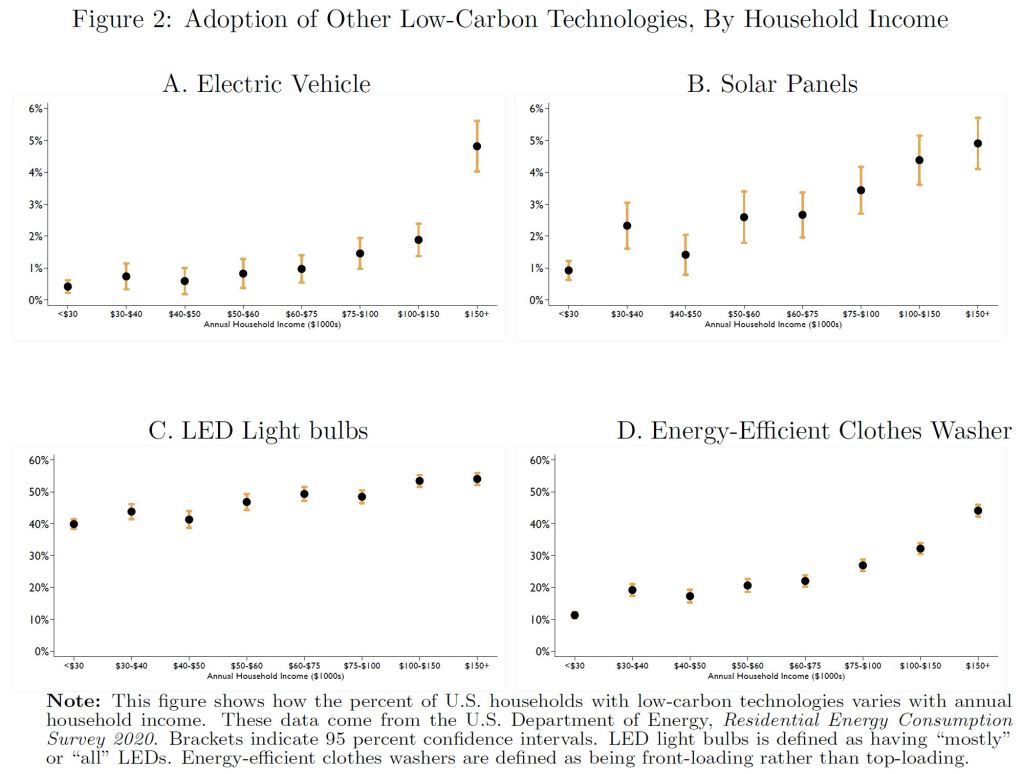

My expectations were also driven by the evidence I’ve seen in the past from other low-carbon technologies. Building on previous related research, the figure below uses these same RECS data to plot U.S. adoption rates by income for electric vehicles, solar panels, LED light bulbs, and energy-efficient clothes washers.

–

There is a strong (and statistically significant) positive correlation in all four cases. Households in the highest income category are, for example, ten times more likely to have an electric vehicle, and five times more likely to have solar panels, relative to the lowest income category.

Previous research (here and here) has argued that signaling to others is a key driver of these types of decisions, but these results suggest that “conspicuous conservation” is not the only factor. Notably you see this positive correlation for technologies that are highly visible to other households (e.g. EVs), as well as for less visible technologies like clothes washers.

Other Determinants

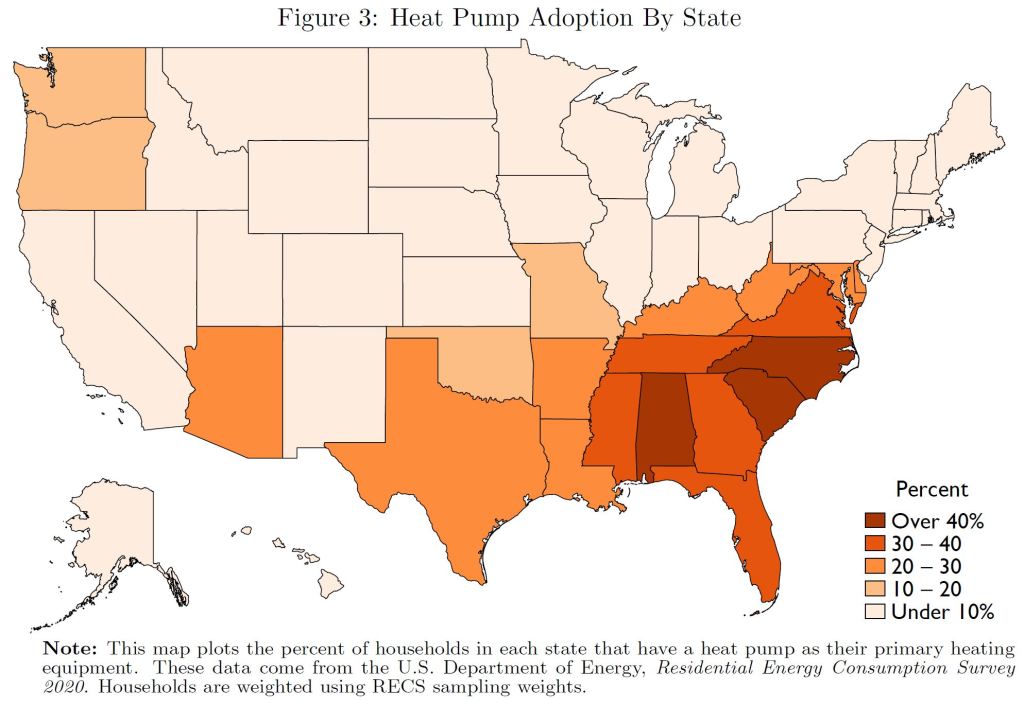

Instead, the paper shows that heat pump adoption is strongly correlated with geography, climate, and electricity prices. The figure below maps heat pump adoption by state.

–

Heat pumps are most common in southern states. South Carolina (47%), North Carolina (43%), Alabama (42%), Tennessee (40%), Mississippi (33%), Florida (33%), Virginia (32%), and Georgia (30%), all have adoption rates twice the national average.

Heat pumps are relatively rare throughout most of the rest of the country. Arizona (30%), Washington (13%), and Oregon (15%), are notable exceptions, but otherwise low single-digit levels of heat pump adoption are typical throughout the West, the Midwest, and the Northeast, as well as Hawaii and Alaska.

The paper shows that climate and electricity prices matter too. Regression evidence shows, for example, that a one standard deviation increase in heating degree days decreases heat pump adoption by one-fifth, while a one standard deviation increase in electricity prices decreases heat pump adoption by one-third. The latter finding underscores Jim Sallee’s recent post arguing that high electricity prices are a barrier to building electrification.

Interestingly, the lack of correlation between heat pump adoption and income persists even in richer analyses which control for geography, climate, and other factors. For example, when you restrict the sample to only homes in southern states, the basic pattern is very similar, albeit at a higher overall adoption level. See figure below.

–

Policy Implications

These patterns have important implications for a growing number of subsidies aimed at heat pumps. The Inflation Reduction Act provides two different types of subsidies: (1) income tax credits and (2) direct point-of-sale rebates.

The tax credit has been available since January 1, and is equal to 30% of the upfront cost of a heat pump, up to a maximum of $2,000. Thus if a household spends $6,000 purchasing and installing a heat pump, it can receive a tax credit of $1,800. This tax credit has long been available for heat pumps, but at much lower subsidy levels, e.g., only $300 during 2022.

The rebates are being implemented via a grant program to states. States will have some discretion with regard to implementation details, but the rebates will be generous (up to $8,000 per household), and only available for households with annual income below 150% of median local income. Funding for these rebates will likely be distributed to state agencies in 2023, with rebates available to consumers by late-2023 or 2024.

Conclusion

The main takeaway is that, at least in the United States, there is very little correlation between heat pump adoption and household income.

Of course, this does not guarantee that heat pump subsidies will be equally adopted by all income groups. There are important issues of salience, tax refundability, credit constraints, landlord-tenant asymmetries, and other issues which mean that it will be important to revisit this question in the future once these subsidies have been in place and data becomes available.

Still, the results suggest that heat pump subsidies have the potential to be much less regressive than previous experiences with solar panels, electric vehicles, and other low-carbon technology subsidies which have tended overwhelmingly to go to households at the top of the income distribution.

–

Suggested citation: Davis, Lucas “Are Heat Pump Subsidies Regressive?”, Energy Institute Blog, UC Berkeley, June 5, 2023, https://energyathaas.wordpress.com/2023/06/05/are-heat-pump-subsidies-regressive/

For more details, see Davis, Lucas W. “The Economic Determinants of Heat Pump Adoption”, NBER Environmental and Energy Policy and the Economy, forthcoming, University of Chicago Press.

Keep up with Energy Institute blog posts, research, and events on Twitter @energyathaas.

Categories

Lucas Davis View All

Lucas Davis is the Jeffrey A. Jacobs Distinguished Professor in Business and Technology at the Haas School of Business at the University of California, Berkeley. He is a Faculty Affiliate at the Energy Institute at Haas, a coeditor at the American Economic Journal: Economic Policy, and a Research Associate at the National Bureau of Economic Research. He received a BA from Amherst College and a PhD in Economics from the University of Wisconsin. His research focuses on energy and environmental markets, and in particular, on electricity and natural gas regulation, pricing in competitive and non-competitive markets, and the economic and business impacts of environmental policy.

This is a case of spurious uncorrelation. Heat pumps are more cost-effective in mild climates and where electricity prices are relatively low. These happen to occur more often in states with lower (measured) incomes. Account for these and the expected relationship between adoption and income will reappear.

P.S. Heat pumps are not that rare in Hawaii. It’s just that we use them mostly for heating water, which the DOE presumably doesn’t count as the “primary heating source,” even though it is. (Only high elevation folks heat their houses.)

Heat Pumps Use Electricity exclusively. When Electricity is more costly than Coal, Oil, Natural Gas, propane or Firewood, other cheaper forms of heating are used. This is why NEM2.0 was Better for California Than NEM 3.0 that now takes 75% of the electricity banking, that homeowners used to save up for the winter months away, leaving Natural Gas and/or firewood as the cheaper alternatives for most homeowners in California. Off grid solar in the summer for air conditioning and cordwood for winter heating at my home.

Heat pumps are great but there are several limits.

To be assured of stable operating cost, you need electric supply to be mostly

nuclear, wind and solar.

And happily your map shows better adoption in warmer states with more nuclear generation.

It is clear that these are places where dependence on air conditioning dominates, and adequately sized cooling units “also can heat”. They probably didn’t choose a heat pump for the efficiency of heating, but to save money on a 2nd appliance they don’t need.

Reliance on frack methane gas for electricity creates unstable prices and dubious environmental benefits over coal if more than 1% of gas leaks unburned in to the atmosphere, which is universally true considering the entire supply chain. And today’s “100% Renewable” offerings are more than 50% gas by dollar spent.

You can see from the

Heat pumps are also often noisier than comparable gas furnaces so they can cause noise pollution problems in dense housing situations.

Skilled labor to install split unit AC and heat pumps in the USA, lags far behind Asia where everyone has them. If you install it incorrectly and lose a bunch of greenhouse gas coolant, it can damage the environmental impact a lot. But it’s a challenge worth surmounting as split unit HVAC is far superior to the noisy old fashioned “forced air furnace plus AC unit” that American’s usually get sold, often due to the knuckle dragging local building code inspectors. Split units are superior in noise pollution as well as comfort.

It would have been interesting to know the distribution of split units vs “forced air”.

All income tax credits, are, by their nature, regressive. They are only of value to people with enough tax liability to “use” the credit.

They are less regressive than a tax deduction, which offers more savings to people in higher tax brackets (of course, what passes for “higher tax brackets” today is a little less dramatic than when Reagan took office).

A far better solution is to allow the subsidy to apply directly to the purchase price. The impact on government revenues is slightly higher — but only because that form of subsidy is more usable by a household with lower income.

Since I retired, I have a lot of control of my taxable income. As long as I live primarily on savings and Social Security, I have almost no federal tax liability. One element of this is that I can’t use the $7,500 tax credit on an EV. In my case, it’s a choice of which retirement resources to draw on. But half of American families have taxable income below $50,000, and for those households, a $7,500 tax credit is not fully usable.

Perhaps more important, lower income households are less able to afford the higher up-front cost, even if they CAN use the full tax credit. The tax credit is not “received” until a year later. They have to finance the full investment. A point-of-sale discount would work better for these potential heat pump buyers.

I too was surprised to see the income distribution of heat pumps as flat as you show it. Every new apartment being built here in Washington seems to have a mini-split on the patio. It’s simply cheaper for the builder than installing a gas furnace, and it provides the tenants with air conditioning (which we did not think was necessary until recently — our planet seems to be getting warmer!)

As another retiree, I echo Jim’s comment. As the owner of a 32-year-old gas furnace, I’m a prime candidate for a heat pump. With the HEEHRA subsidy coming in the form of a point-of-sale price reduction, the lack of an income tax subsidy for heat pumps doesn’t trouble me, and presumably wouldn’t trouble working age folk with low incomes. The real problem faced by me and many others is that the HEEHRA subsidies, despite being enacted in the fall of 2022, will apparently not be implemented until 2024.

So I expect the income distribution of heat pump purchasers WILL remain flat in the future, but not in 2023.

Thanks for underscoring this important point about non-refundability. Whereas some tax credits like the Earned Income Tax Credit are refundable, the tax credits for heat pumps are non-refundable. Thus, as you point out, about half of taxpayers are ineligible. This was part of the rationale behind the point-of-sale rebates available for low and middle-income households.

I have never heard a coherent economic argument for making these credits non-refundable. In the post I link to an interesting related paper by Batchelder, Goldberg, and Orszag, “Efficiency and Tax Incentives: The Case for Refundable Tax Credits”

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=941582

That paper argues that all tax credits should be made refundable.

Refundable credits “provide a much more even and widespread motivation for socially valued behavior”.

Indeed, there is nothing inherent about zero income tax liability that would motivate such different tax treatment between taxpayers with $0 and $1 in tax liability.

The argument for nonrefundable tax credits is embedded in federal government accounting. Providing tax benefits with no cash outlays does not count against various budget limitations (such as the debt ceiling), but making these refundable would require an additional step of making an appropriation. Much more difficult task politically.

I wouldn’t go so far as to argue that all tax credits should be refundable, but certainly a fair number that are not should be — including this one. If Hollywood film productions can get refundable credits from the state of CA — remember how even big box-office films somehow didn’t really make a profit according to industry accountants — then low-to-middle income heat pump purchasers should too, be it from the state or federal government. As Lucas suggests, point-of-sale rebates address the non-refundable problem most easily and efficiently, but grants can also work well depending on the purpose. Happy to see that Lucas found no evidence of notable regression in this tax credit case at this point.

The way to enhance energy transition equity across all family incomes is to target subsidies at widely distributed renewable resources & solutions. That could be one outcome of the Inflation Reduction Act. For example, IRA subsidies are available to public utilities to upgrade & expand critical transmission, but those improvements will take a lot of time and benefits will not necessarily be widely or equitably distributed. In California, new utility transmission needs to be targeted for massive offshore wind resources & strategically distributed Advanced Geothermal power plants to replace aging nuclear & fossil gas plants.

What is “widely distributed?” Well, within predominantly up-scale single family housing neighborhoods, rooftops are widely distributed, but what about multi-family housing, neighborhood shopping centers, business parks & public facilities? There, acres of large under-utilized parking lots provide the most rapidly exploitable, widely distributed solar resource available. Solar parking canopies with behind-meter on-site storage batteries & Vehicle-2-Grid chargers can produce & store cheap, reliable power for property owners, employees & tenants alike, right where most energy is consumed. They also shade enormous asphalt heat islands & can help to create a matrix of reliable networked neighborhood micro grids. All this, without unnecessary new utility transmission spending.

First, an important fact is that all new technologies start off being adopted by wealthier households. They can afford the risks associated with the uncertainty of those technologies. The question then is how do we accelerate the penetration of beneficial technologies? It’s not just about a simple comparison of accounting costs–it’s also the transaction costs and risk tolerance of different households. This situation means that so-called “subsidies” are in fact societal investments to gain traction with a new technology. Eventually the successful ones disperse across most of the income spectrum. A deeper discussion of the purpose of technology investment support is warranted.

Second, increased heat pump penetration generally will be served by increased renewable plants, not increased output from existing fossil plants. It is incorrect to think of the hourly changes in generation to balance system loads as “marginal.” A first principle of economics is that if the average is rising, then the marginal must be rising above the average. A recent paper noted in this blog claimed that average emission rates were falling while the marginal was above the average–that’s mathematically not possible. So the marginal emission rates must be declining over time as load is added with associated renewables. This is the situation across most of the U.S.

“A recent paper noted in this blog claimed that average emission rates were falling while the marginal was above the average–that’s mathematically not possible.”

I don’t know which paper Richard is referring to but one possible interpretation of the statement is that the average emission rate is falling because high-emission plants (e.g., coal-fired units) are retiring, thereby lowering the average rate but not affecting the high-emissions plants that remain in service.

Aren’t semantics wonderful?

Renewables supplied nearly 75% of new US electrical generating capacity in 2022

Richard’s response to my comment essentially proves my point, though in a different way.

In addition to high-emissions plants retiring, there were zero-emissions plants being added. Both of these activities lowered the average fleet-wide emissions rate while not affecting the marginal emissions rate of existing plants.

However, in reading through the article Richard presented, I noted that the entry of renewable plants was measured in terms of nameplate capacity. Fair enough, but one needs to understand the large disparity between wind and solar nameplate capacities and the actual value of that capacity in terms of load-carrying capability (ELCC), which measures their contribution the power system reliability.

ELCCs of wind and solar are much lower than their nameplate capacities. Furthermore, as solar penetration increases, the ELCCs decline and eventually go to zero.

The bottom line is that high levels of wind and solar entering service are not necessarily a good thing if they jeopardize system reliability. They need to be accompanied by reliable, dispatchable capacity to back them up.

Robert

My point is that the marginal emission reductions are from NEW plants. Existing plants generally do not increase their output to meet incremental permanent load. As I’ve pointed out mathematically that if average emissions are falling, then marginal emissions must be less than average emissions. You are following the engineer’s fallacy that power plant output measures marginal emissions. That fallacy is contrary to the math. You must show us mathematically how marginal emissions can be above average emissions while average emissions are declining. You will also need to show why all of those intro microeconomics textbooks are wrong.

Richard,

The ace rage vs marginal relationship described in economics text books assumes the underlying hood or service is a homogenous product. As we all know, a fleet of generators is heterogeneous.

Back in the 1980s I represented the state of Montana in a lawsuit that claimed a severance tax on coal extraction would reduce demand and economically injure the mining entity. A NERA vice president represented the mining entity and he trotted out the classic Econ 101 supply/demand argument. My response was that the railroad transporting the coal to the market stood between the mine and the buyers and that it had an incentive to reduce its tariff an absorb the tax rather than lose the highly profitable traffic. I backed this up with detailed modeling results. Montana prevailed.

The real world is generally more complex than the textbook examples and one needs to be careful when extrapolating textbook arguments.

“First, an important fact is that all new technologies start off being adopted by wealthier households. They can afford the risks associated with the uncertainty of those technologies.”

Chances are that many wealthier households could “afford” the new technology without a tax credit, and therein lies an inexorable inefficiency in tax credits. It’s an inefficiency that has been widely accepted in government fiscal policy, in which a principal goal should be to minimize it. The track record in this regard certainly leaves something to be desired.

“This situation means that so-called “subsidies” are in fact societal investments to gain traction with a new technology.”

As Robert Borlick noted in another comment on this post: “Aren’t semantics wonderful?” Subsidies are what they are — that is, monetary incentives/augmentations intended to help achieve one or more “worthwhile” goals. But many are not “societal investments” with a notable public benefit. I’m all for subsidizing low-income households to bring greater income and educational equity, and frankly, tax credits that go to other purposes such as technology incentives need to be considered very carefully in this context, particularly when government funding is very tight. Like right now for the state of California. Safety net and related funding has to be a priority. A rising technological tide will not necessarily lift all boats. Every effort should be made to mitigate the age-old problem of government picking winners and losers and having the winners/losers conundrum filter into growing societal inequity. Don’t get me wrong: We need financial incentives for a wide array of purposes. But let’s not gloss over the challenges of this type of policymaking in terms of the greater public good.

Damn, Richard,

Recently I find myself fully agreeing with what you write. It must be something in the water. LOL!

We have to ask the question of whether an important new technology would be adopted at the rate that we believe is beneficial in meeting our societal goals. We might offer tax credits or rebates to lower income households but they have have to be much larger per unit to induce a change in the purchasing decision. And without that increase new technology purchases, the cost of that technology will not come down more rapidly through learning by doing. The incentives for rooftop solar panels induce that type of cost reduction (as did California’s RPS mandate for grid scale renewables) and now those technologies are accessible for a much wider array of households than a decade ago. We have to decide whether we are focused on trying to induce more rapid technology adoption or achieve equity goals–in the nascent introductory period they generally can’t be achieved at the same time, no matter how much we wish otherwise.

Back, when solar panels were $8.00 per watt installed and Electrical bills were 8 cents to 12 cents per kilo watt hour, only rich eccentrics were willing to do the right thing and go “GREEN” with them and that is why the Tax Credits were used to entice those with money to do the right thing. Today’s high prices of electricity, in California, and tax credits have made Solar panels mainstream and thus the CPUC has seen fit to cut the gains to homeowners with NEM 3.0 hoping that the tax credits will be enough to get people to start installing batteries with their solar panels even though the payback is now lengthened to what they were when solar panels first came out at $8.00 per watt rather than today’s price of under $3.00 per watt for panels without batteries and $6.00 per watt with batteries. The same can be said about switching from natural Gas to heat exchangers in California. Why replace a perfectly good, forced air gas furnace with a heat exchanger, that will cost more to use and cost 3 times more to install? Only when the furnace needs to be replaced anyway and natural Gas gets as expensive as electricity, will most people do the swap out at any income level. Tax Credits might again help people make the move like they did with early Solar panels adopters, but this is not a case of lowering one’s bill with heat exchanger that was the lure with solar panels. Monthly bills will go up ith heat exchangers over natural gas.

Could disposable income be a better yardstick to use in research that involve adoption of superior but expensive technologies? If subsidies are reformed to favor the “incapable”, the “incapable” lower income group, in spite of progressive subsidies will still not be able to adopt the superior technologies simply because it is above their disposable income and though they desire to use the incentive, it they cannot.

A cursory look at the percentages show that affordability is probably reason why while 40% of lowest income group buy LED lights, and 11% bought clothes washers, only 1% bought solar panel and 0.5% bought electric vehicles.

Using disposable income could make a progressive incentive more effective than using overall income.

Perhaps a more interesting question is whether the heat pump subsidy is an efficient use of government resources for GHG reduction. I’m a fan of heat pumps, but as noted, they are used primarily in milder climates. The fundamental thermodynamic advantage of heat pumps is that they can pump significantly more energy than they require to run, a ratio referred to “coefficient of performance” or COP. While COP can be quite high in mild climates, it goes down quite a bit in colder temperatures, and most heat pumps use electrical resistance heating as a backup for really cold days.

Heat pumps would be the desired technology for heating and cooling if all our electricity came from renewable resources. However, from a climate standpoint, the COP advantage of heat pumps is mostly cancelled out by the inefficiency of power generation. For natural gas, for example, the thermodynamic efficiency of power generation may average about 40%, which means that a heat pump would need to deliver a COP of about 2.5 to have the same carbon footprint as a natural gas furnace (which may operate at >90-95% efficiency). On the coldest days of winter in the northern US, however, COP’s would likely be much lower, (as low as 1.0 if electrical resistance heating kicks in). At the same time, marginal power generation would likely come from natural gas “peakers” with efficiencies closer to 25% – i.e., on a cold winter day, a heat pump might be responsible for 3-4 times as much CO2 as a natural gas furnaces.

Presumably (hopefully), at some level policymakers have analyzed all this and have concluded that the $2000 subsidy for heat pumps is a wiser investment than other options.

Great comment!

I agree with the above comment. The penetration of heat pumps you presented are for states that have historically relied on electricity for cooling and heat since they are very warm climate states to begin with. the real “game” here are the states with natural gas and fuel oil home heating as their primary heat source. Maine, for example, has a massive program underway to replace fuel oil home heating (60%+ for Maine households) with subsidized heat pumps with higher subsidies for low income. But, penetration among low income is very low compared to rebates to middle and upper income households.

Thanks for your research, Lucas. Given that heat pumps are primarily used in the SE and a few other states, which seems to be a byproduct of primarily climate and geography (e.g. established practice of using heat pumps and workforce capable of installing them), it doesn’t feel like the current adoption rates are likely to be predictive of adoption with the new credits and rebates in place. It would be great if heat pumps buck the trend we saw in EVs and rooftop solar, but the factors you list in your conclusion leave me wary that the zero correlation with income that exists now will regress substantially in the next few years.