Cruise’s Valuation Reportedly Cut By More Than 50%

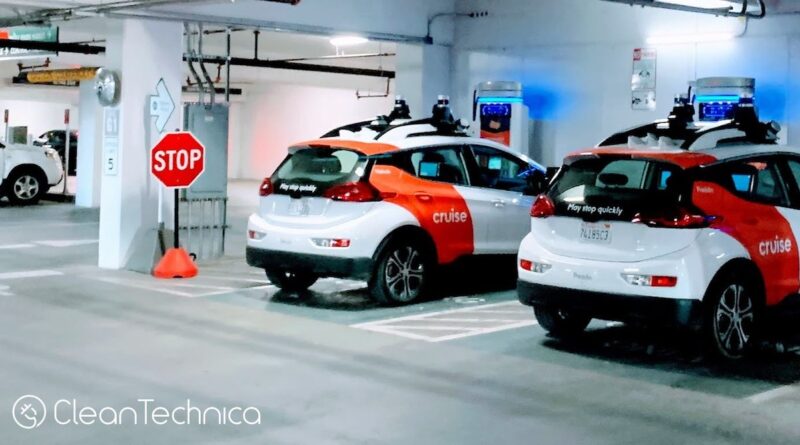

It’s hard to know what is going to come in the autonomous driving world in the next few years, or next decade. Waymo — spun out of Google — has been working on the topic for a couple of decades. I recall seeing a Google self-driving vehicle on the roads of Palo Alto in the summer of 2006. Videos I recorded of it were some of the first videos I ever published to YouTube. Tesla’s been working on it in a very different way for about a decade. Cruise Automation became another major name in this field several years ago, especially when it was acquired by GM.

Cruise has struggled in multiple ways lately following one incident — the very bad and unfortunate case of a Cruise vehicle running over a pedestrian (who was reportedly already hit by another car next to the Cruise vehicle) and dragging her a bit down the street.

One of the ways Cruise has apparently been hurt by this incident is that its share price has been demolished. “Cruise saw its internal share price cut by more than half from a quarter ago as the fallout from an October accident continues to weigh on the self-driving car company,” Reuters wrote recently. “Cruise employees were told the share price had been estimated by a third party at $11.80, according to an email viewed by Reuters. That’s down from a prior estimate of $24.27 just one quarter ago.” Yikes. That’s a big hit. But what else can be expected? Operations have been pulled back and the company isn’t testing on public roads again yet. Production of Cruise Origin robotaxis was halted. Cofounder and CEO Kyle Vogt resigned and cofounder and Chief Product Officer Dan Kan resigned. About 25% of its workforce was laid off. And Cruise lost its self-driving license in California. Naturally, the company’s valuation would be slammed from all of that. Frankly, I’m a little surprised the valuation wasn’t cut even further. But that shows that there’s still a lot of faith in Cruise’s approach and what it has built to here.

However, I guess if you were working at Cruise and hoping for a big cash payout on the company’s shares someday, this would sting a lot and be a bit of a shock (on top of everything else). “We cannot ignore that this estimate is significantly lower than we’ve seen before and that there are real life impacts for each of us,” Craig Glidden, chief administrative officer for Cruise, wrote in an internal email. Glidden also commented that the company had a “longer pathway towards scaled commercialization.”

Before the horrible incident, Cruise had quite ambitious and optimistic plans. It was planning to be operating in about 10 cities before long. Now it’s in zero.

With investigations underway by the Securities and Exchange Commission (SEC), the Department of Justice (DOJ), and the National Highway Traffic Safety Administration (NHTSA), one has to think that Cruise operations will continue to just inch along until some of those are resolved. However, I also expect that progress is being made and the core group at Cruise is eager for a day when it can open up operations again as a new and improved robotaxi operator. The tech and the company has been built on a lot of hard work and a lot of useful coding and AI. It seems like it will have a place in the future. But we shall have to wait to see, and Cruise employees will have to be patient in the meantime.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.