Startup EV brands Tesla, Lucid, Rivian, and Polestar have touted desirable products and a direct-sales business model that avoids dealership hassles. But they may not be connecting as well with prospective customers as traditional luxury brands, according to a recent study from consultancy Pied Piper.

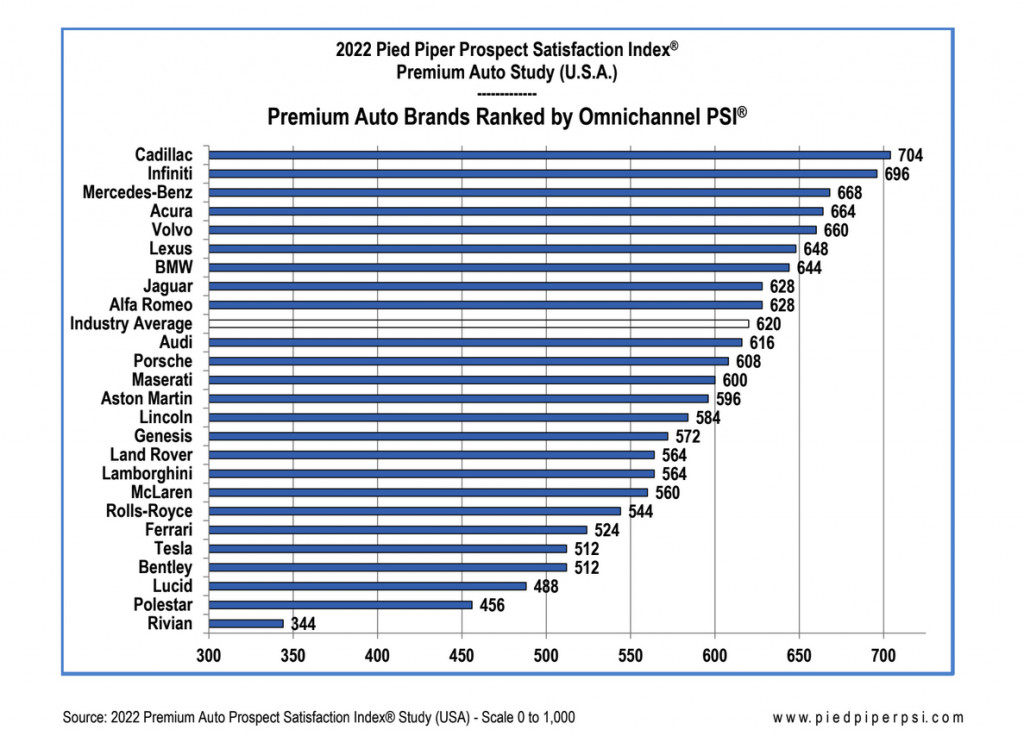

In a ranking of 25 brands, Rivian came in last place, with Polestar and Lucid just ahead. Tesla was ranked 21st. Established luxury brands selling mostly gasoline-powered vehicles—Cadillac, Infiniti, and Mercedes-Benz—took the top three spots.

2022 Pied Piper Prospect Satisfaction Index rankings

This is the first time for this annual study that it included Lucid, Polestar, and Rivian which, like Tesla, all eschew the standard franchised dealership model. While many car shoppers find the dealership experience aggravating, the study dinged these brands for not offering a consistent sales process from location to location (or, in the case of Rivian, phone interactions, as the company hadn't opened any showrooms when the study was conducted).

Meanwhile, Tesla has failed to keep pace with its growing sales volumes, analysts claim. It scored above average in previous studies, but no longer offers adequate levels of customer support either in-person or online.

That's bad news for Tesla, which is more often seen as a rival for luxury brands rather than mainstream brands based on pricing, demographics of its customers, and market share. Tesla price hikes have only underscored that the automaker competes mostly with luxury brands.

2022 Lucid Air Grand Touring Performance

At the same time, EV buyers have long panned the dealer experience for EVs—and as we've underscored in the past, many dealers haven't even wanted to sell EVs.

That appears to be changing with long waiting lists for some EVs, pricing surcharges, and other indications that dealers are no longer losing money on any extra time it might take to sell them—and thus, this study might help indicate, perhaps they're willing to pay some extra effort to answer EV buyers' questions. That in turn may suggest brewing trouble when less-established brands with digital-focused models run out of early adopters who already know the vehicles through and through.