Fleet-wide fuel economy for vehicles sold in the U.S. has stumbled, according to the EPA's recently released 2022 Automotive Trends Report. The report points to increased SUV sales as one reason for the stagnation of efficiency.

The real-world fuel economy of light-duty vehicles sold in the U.S. remained flat for the 2021 model year, at 25.4 mpg, according to the report. That's the highest it's been since the EPA began logging data for new vehicles with the 1975 model year, but still shows improvement has slowed.

That's due at least in part to the continued shift toward less efficient SUVs and pickup trucks, according to the report. For the 2021 model year, sales of sedans and wagons fell to 26% of the market, compared to the 50% market share they held as recently as 2013, and 80% in 1975.

2021 Honda Accord Hybrid

At the same time, "truck SUV" sales (representing vehicles with a gross vehicle weight rating of 6,000 pounds or higher) reached a record 45% market share for the 2021 model year, while pickups increased to 16% market share.

Yet these categories of vehicle saw some of the lowest improvements in efficiency for the 2021 model year. Average fuel economy for pickups increased by just 0.1 mpg, while "truck SUV" fuel economy rose by 0.3 mpg, compared to 0.5 mpg for sedans/wagons, 2.6 mpg for "car SUVs," and 3.9 mpg for minivans/vans. That's with significant growth in hybrid powertrains for pickups and "truck SUVs," which helped increase overall hybrid market share to 9%, according to the report.

"The trend away from sedan/wagons, which remain the vehicle type with the highest fuel economy and lowest CO2 emissions, and towards vehicle types with lower fuel economy and higher CO2 emissions has offset some of the fleetwide benefits that otherwise would have been achieved from the improvements within each vehicle type,” according to an executive summary for the report.

2021 Ford F-150 tow technology

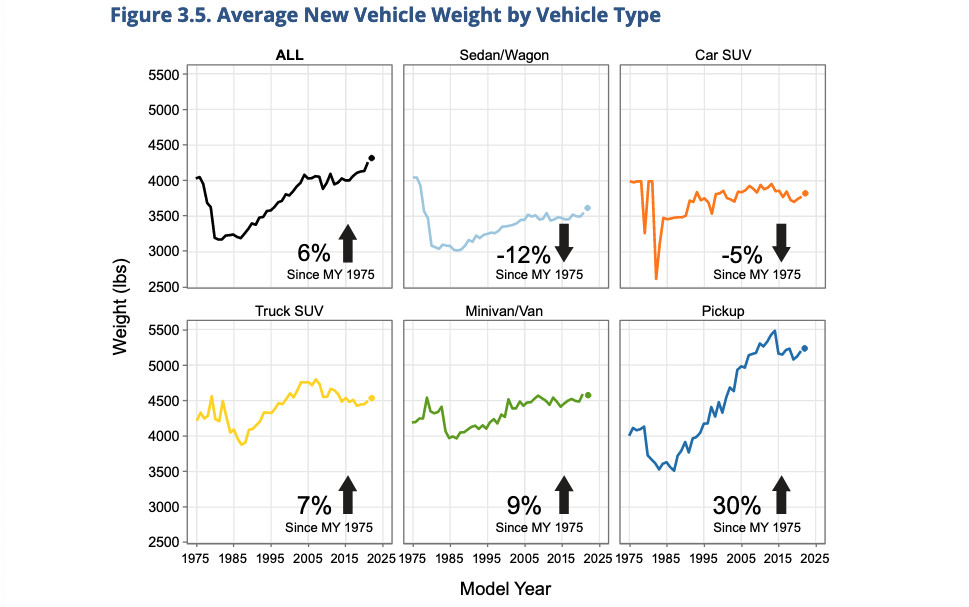

While fuel economy is at a record high, so is average vehicle weight, the report noted. Pickups saw the biggest increase, growing 30% heavier since the 1975 model year, while the average weight of sedans/wagons and "car SUVs" has actually decreased, by 12% and 5%, respectively, the report said.

Automakers don't need to improve fuel economy urgently to meet emissions targets. They have a large bank of emissions credits stored up to deal with any shortfalls, the report noted. Twelve of the 14 largest automakers ended model year 2021 with zero or positive credit balances, the report said, and leftover credits can be carried forward as far as the 2026 model year in some cases.

Average new vehicle weight by vehicle type (from EPA 2022 Automotive Trends Report)

The stagnation of vehicle efficiency can also partly be blamed on the Trump administration's lowered gas mileage targets. The Biden administration aims to reverse that policy, with tougher standards that will bring more hybrids and EVs sooner. That will create a new set of questions for policymakers and automakers to ponder.

Some interests want to see both EV efficiency and related upstream emissions included in U.S. vehicle standards, in a straightforward manner. Increases in vehicle weight will also continue unless automakers find an alternative to big battery packs. In the future, optimizing EV weight vs. battery size may be the new frontier of fleet-wide efficiency.