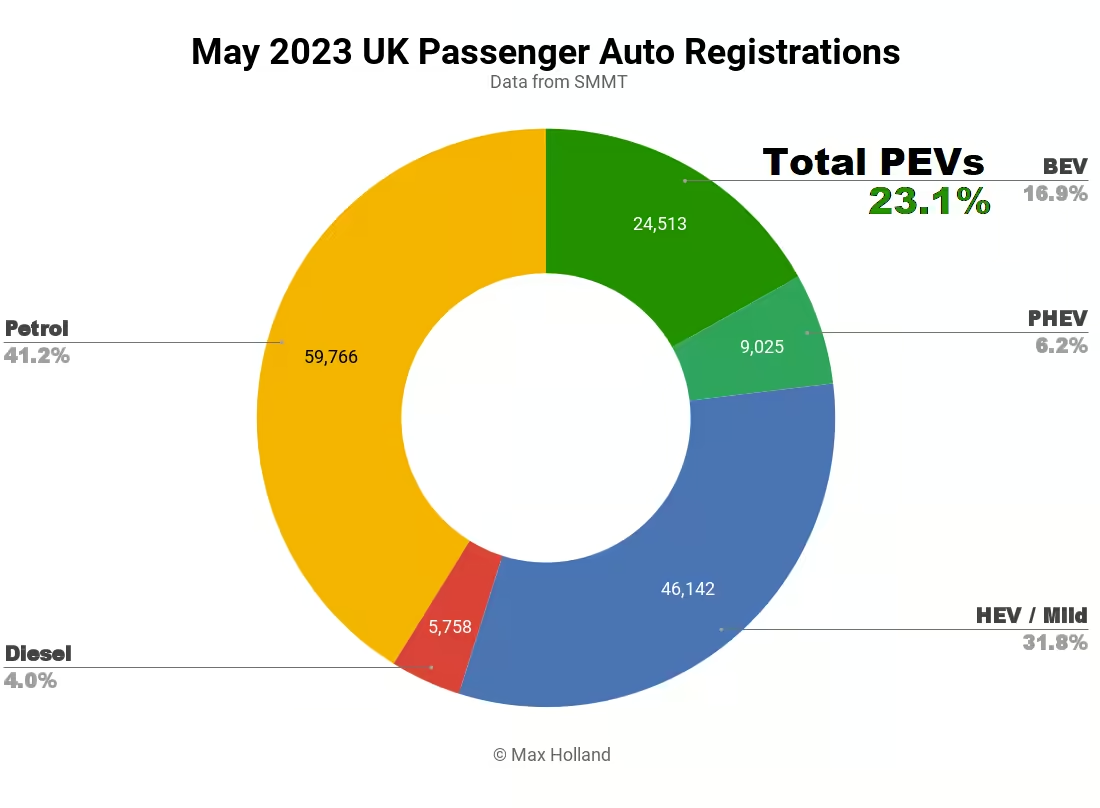

Tesla hits the UK with its strongest ever May, helping lift the plugin electric vehicle market share to 23.1%, up from 18.3% year on year. BEVs have grown well, whilst PHEVs have remained mostly flat. Overall market volume was 145,204 units, some 17% up YoY, though still below the pre-2020 norms. The Tesla Model Y was the bestselling BEV in May.

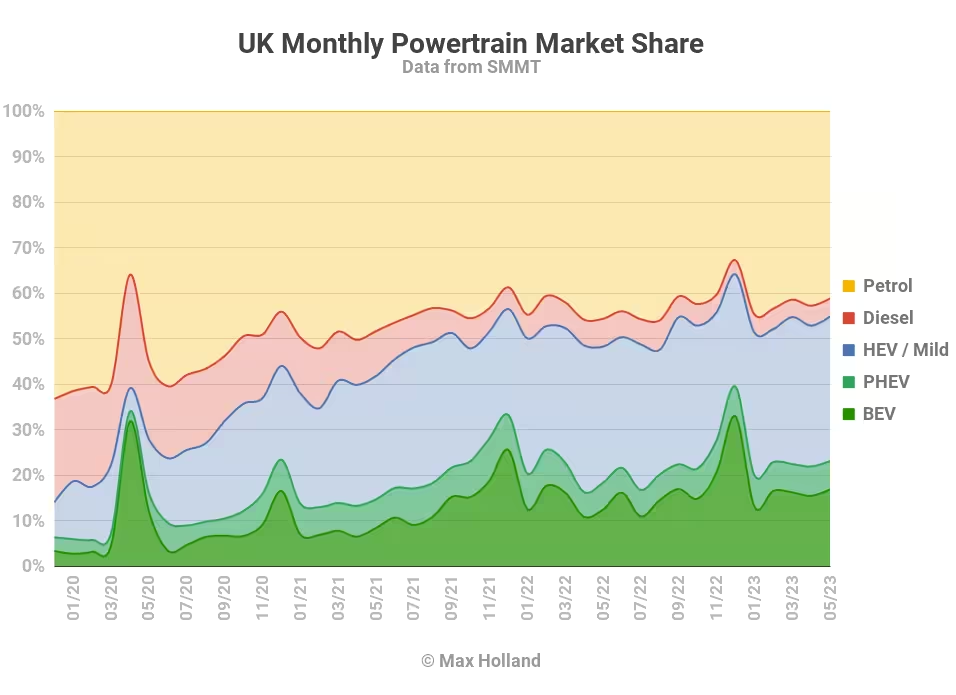

May 2023’s combined plugin result of 23.1% comprised 16.9% full electrics (BEVs), and 6.2% plugin hybrids (PHEVs). These figures compare with 18.3%, 12.4%, and 5.9% in May 2022. We can see that PHEVs have slightly grown share over the past 12 months, whilst BEVs have gained share at a healthy clip.

In terms of volumes, BEVs grew by a strong 59% YoY, to 24,513 units. With overall market volume growing by 17%, PHEVs stayed just ahead with 23% growth, and 9,025 units.

Combined combustion-only share fell to 45.1% of the market, down from 51.8% YoY. Diesel in particular continued its steep decline, to 4.0% (from 6.1% YoY), at 5,758 units.

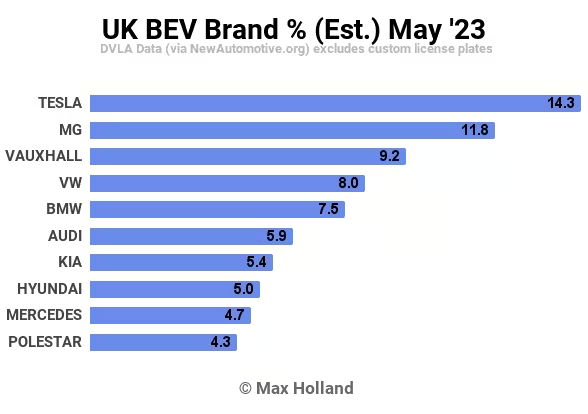

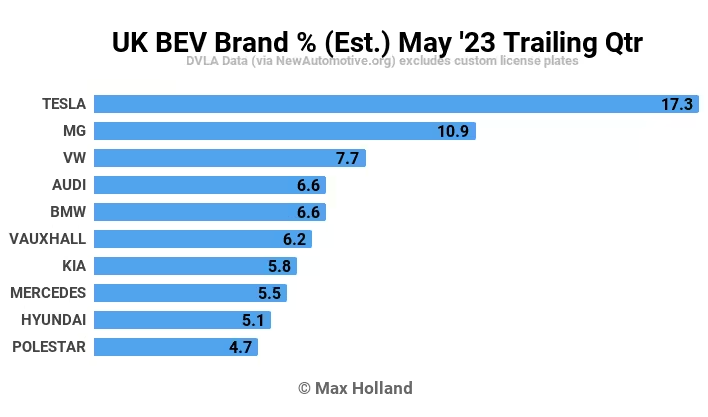

UK Bestselling BEV Brands

Tesla was once again the UK’s leading BEV brand in May, selling 3,439 vehicles, of which 2,509 were the Model Y.

This is a big YoY improvement for Tesla, and the best May result on record, by a wide margin. May 2022 only saw a couple of dozen Tesla vehicles delivered.

The Tesla Gigafactory Berlin-Brandenburg’s ramping output has allowed more stabilization of Tesla’s European deliveries. At the same time, vehicles for left hand drive markets like the UK (and Japan, and many others throughout Asia), which are all made in Shanghai, can now be given a bit more frequent (or consistent) batching.

The Model Y was also the overall 9th best selling vehicle in the UK in May, and is the 7th bestseller year to date.

There were no huge moves in the monthly brand rankings. Vauxhall/Opel climbed a few spots, presumably due to a shipping a new batch of RHD vehicles, and Volkswagen fell a few spots, likely for the inverse reason.

Let’s have a quick view of the 3 month results:

Here Tesla confirms its UK brand lead, ahead of MG Motor in #2, and Volkswagen in #3. Tesla currently has around 17% share of the UK’s BEV market.

With the new MG4 now delivering in good volumes, MG Motor has climbed from 5th position in the December-to-February period, to 2nd position over the trailing three months. This is just reward for a brand offering some of Europe’s best value BEVs, with 7 year full vehicle warranty.

Due to data anomalies at the UK DVLA, we don’t have very comprehensive market data this month, so we can’t dive into much detail about manufacturing group share. All being well, we will be able to review group share again next month.

UK Outlook

The UK’s economy is drifting between recession and scanty growth, with recent forecasts improving from a previous negative 0.4% GDP for 2023, to positive 0.3%. Inflation however remains at much higher rates, currently at 8.7% headline rate, though improved from 10.1% a month ago.

These conditions of increasing prices for essentials like food and energy, at the same time as zero growth and potential job insecurity, don’t inspire consumer confidence. This is especially the case for large outlays like cars, and particularly BEVs.

Nevertheless, savvy consumers (and fleet buyers) who are still in the market for new vehicles, can make substantial lifetime running cost savings from a BEV over a combustion vehicle, if they are able to pay the higher entry price. For this reason, although overall auto market volume may be lacklustre in the months ahead, plugins should continue to grow share.

What are your thoughts on the UK’s transition to EVs? Please jump in below to join the conversation.