As more and more people switch from gas-powered cars to electric vehicles (EVs), we hear a lot of questions along the lines of “can the grid handle it?” Sometimes that question is about supply and emissions (i.e. will we have enough clean energy resources to supply all the kilowatt-hours of electricity those EVs will need?), sometimes it’s about reliability (can the infrastructure handle it?), and sometimes it’s about costs. We've written before about how we have time and tools to prepare for this transition. This blog specifically addresses the question of the grid costs of increased EV adoption.

Increased Costs and Increased Revenue

As more and more people go electric, there will absolutely be costs associated with upgrading infrastructure to make sure they can charge. There are wires to replace, transformers to install, and parking lots to trench through for new charging stations. However, all those EVs enabled by grid improvements also pay into the system by, of course, buying more electricity. Lots of data demonstrates that EV drivers pay more into the system than they cost and can therefore push rates down for EV drivers and non-EV drivers alike.

Here are some key studies to illustrate this point:

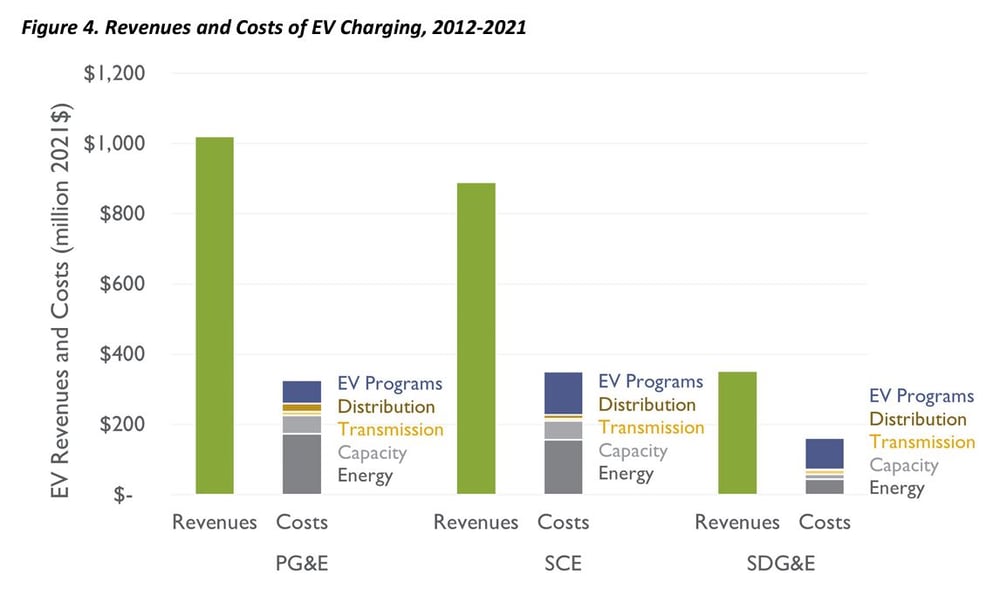

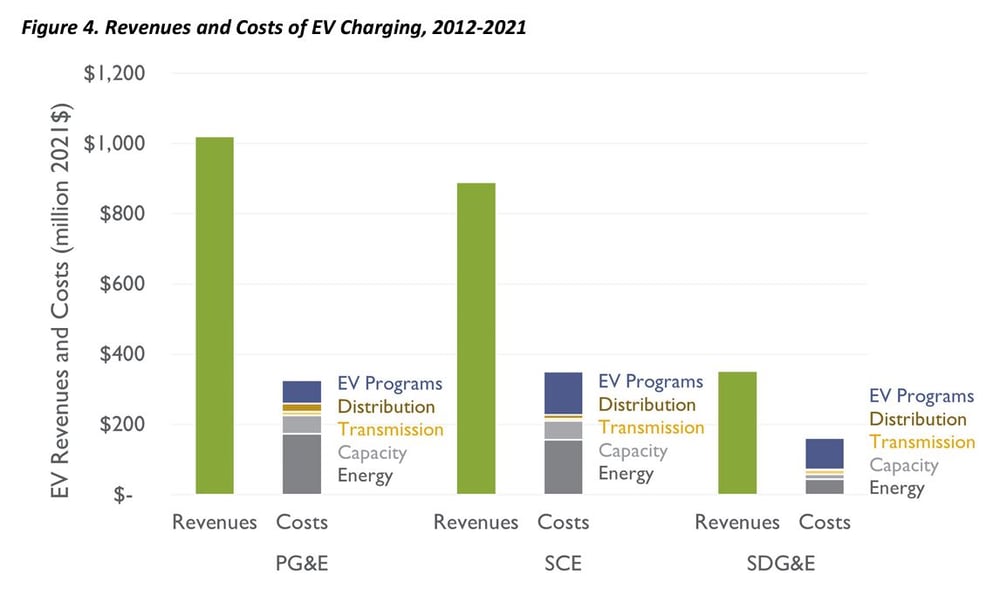

- This 2020 analysis by Synapse Energy Economics considers the costs and revenues associated with EV adoption in the service areas of Pacific Gas & Electric (PGE) and Southern California Edison (SCE) in California between 2012 and 2019. The territory covered by these two utilities has some of the highest EV adoption rates in the country, and Synapse finds that EV revenue exceeded costs by $806 million.

- A 2022 update repeats this analysis, extending the time period from 2012 to 2021 and adding a third utility, San Diego Gas & Electric. This time, Synapse finds revenue exceeding costs by $1.7 billion. (Note that California is way ahead of Massachusetts and Rhode Island on EV adoption, which suggests that our states are likely to experience the same results for at least a few more years.)

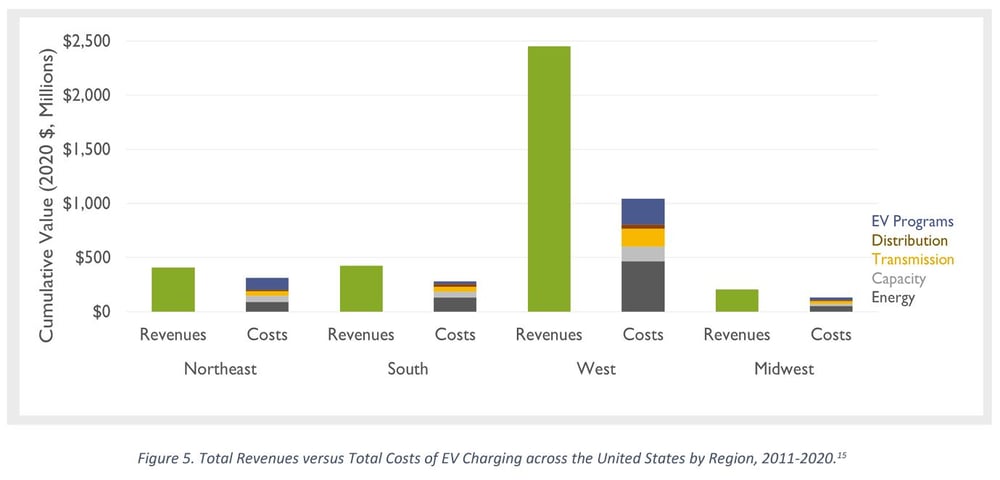

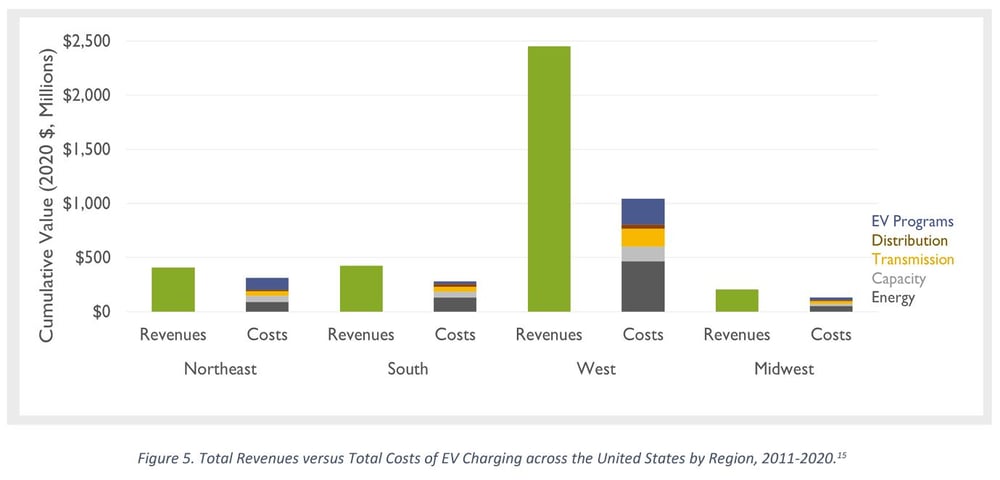

- Most recently, this 2023 update of the Synapse study considers data from across the country, not just California. It finds that “across all regions in the United States, EVs have increased utility revenues more than they have increased utility costs, leading to downward pressure on electric rates for EV owners and non-EV owners alike.” You’ll note that the difference is the greatest in the West, where EV adoption is also the highest.

Source:

- This trend also holds true for medium- and heavy-duty vehicles. This 2023 study of two utilities in New York state found that if the two utilities created programs that pay for all electrical upgrades needed for fleet electrification, revenue should still exceed costs – by hundreds of millions of dollars.

- The Public Advocates Offices at the California Public Utilities Commission recently published a massive report on the impacts of electrification on the distribution grid for the three largest investor-owned utilities in California. They conclude: “we find that electrification applies an overall downward pressure on rates across all three of the large electric utilities... This is because, all other costs being equal, upward pressure on rates due to increased infrastructure costs due to electrification is more than offset by downward pressure on rates due to the increased consumption of electricity resulting from electrification. All ratepayers, even those who cannot (or choose not to) electrify, could financially benefit from electrification.”

Managed Charging is Key

Every single study cited here – and many others that we didn’t have space to include – stresses that managed charging is absolutely crucial to maximizing these cost benefits.

Our electric grid is built to support the maximum needed use. Most of the time, users on the New England power grid collectively need around 15,000 – 20,000 MW of power, but the grid is built to support way more than that so that our lights still turn on when demand tops 25,000 MW (which only happens a handful of times a year). As more and more EVs come online, we want to prevent them from triggering the need to build out more infrastructure for a higher maximum need. Doing so reduces the costs side of the ‘revenue vs. costs' balance we keep referring to in this blog. How do we do that? We incentivize drivers, one way or another, to charge off-peak, when demand is low.

Returning to the study published by the Public Advocates Office mentioned above, we'd like to highlight this key conclusion: “The peak load on the distribution grid is a key driver of the upgrades needed, and the time at which EV owners charge is a key contributor to peak load. Approximately 70 percent of the costs identified... – $35 billion – vanish if EV charging is shifted away from hours of peak demand.”

Massachusetts & Rhode Island, Listen Up!

We’ve written about smart charging a lot on our blog. We advocate for time-of-use rates, off-peak charging rebates, and direct load control; there are lots of tools in the toolbox we can use to keep EVs from exacerbating peak demand. But by and large, our states lag behind.

Right now, National Grid has an off-peak charging rebate, but it’s not as comprehensive as we think it should be. Eversource and Rhode Island Energy currently don’t offer any EV-managed charging programs at all. And the agencies in charge of regulating the utilities, the Department of Public Utilities (DPU) in Massachusetts and the Public Utilities Commission (PUC) in Rhode Island, have not pushed the utilities on this issue.

This issue is not just academic; there are important state processes underway that touch on some aspect of this issue.

In Massachusetts,

- The Electric Vehicle Infrastructure Coordinating Council (EVICC) just released its draft assessment, which calls for managed charging but without a clear way to make it happen.

- The Grid Modernization Advisory Council is reviewing Electric Sector Modernization Plans from the utilities; those plans fall woefully short on incorporating managed charging in their estimates of future demand or grid requirements.

- National Grid and Eversource submitted time-of-use rate filing to the DPU as required by last year’s climate law in August, but the DPU has yet to release a notice on the proceeding.

In Rhode Island, the utility Rhode Island Energy is gearing up to make a proposal on electric vehicle programming for approval by the Public Utilities Commission. We have been advocating in advance, calling on Rhode Island Energy to include comprehensive incentives for charging infrastructure for all vehicle segments and off-peak charging rebates that truly account for all the benefits of shifting load off-peak. (You can read our memo to Rhode Island Energy and state agencies here.)

Long story short: As both states look to prepare for the transition to EVs in the coming years and decades, maximizing the grid benefits of managed charging must be a priority.

Comments