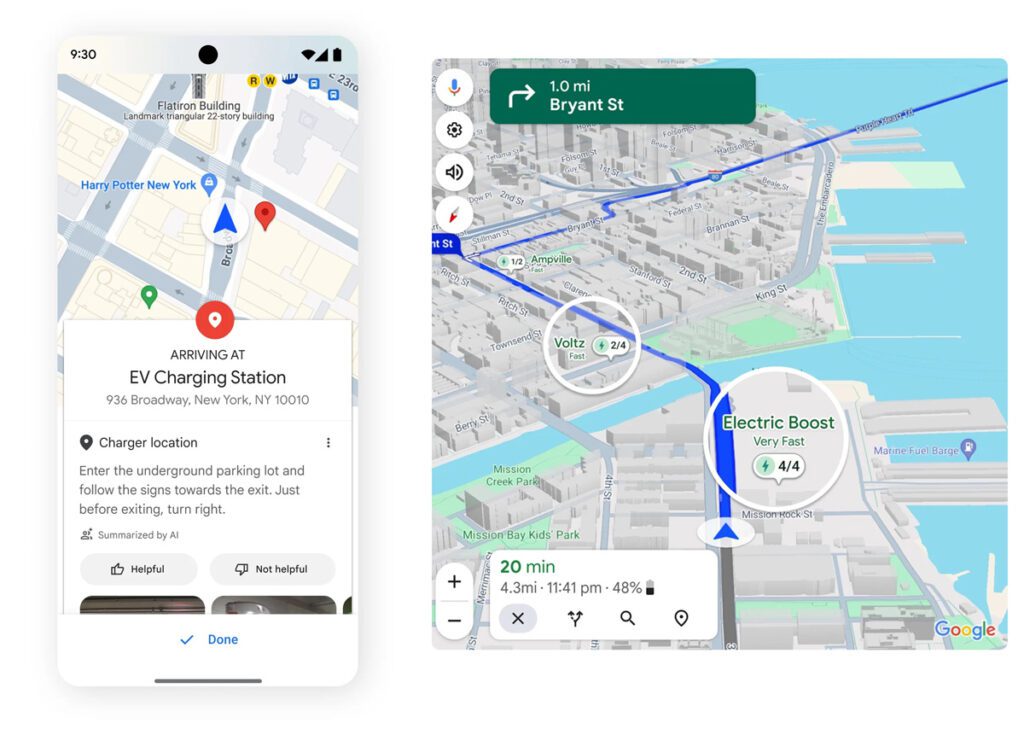

- AMPECO’s software can control charging stations from different vendors, provide a custom-branded app to EV drivers, and handle subscriptions, revenue sharing, load management, diagnostics, reporting and more.

- Public charging is expected to be a low-margin business, and this makes it even more important to manage networks in an efficient way once operators emerge from “land grab” mode and start focusing on profits.

- The US is learning from some mistakes that have been made in Europe. “The NEVI program has very clear centrally-defined requirements for charging operators, like requiring open standards that are future-proof, and requiring certain levels of availability of the service.”

Q&A with AMPECO CEO Orlin Radev

Large hardware installations need complex software to keep them running, and EV charging infrastructure projects are no exception. Any organization running more than a couple of EV chargers—whether it’s a public charging provider, a fleet operator, a multi-unit residential property, or just a business that offers EV charging to employees or customers—depends on software to coordinate a host of issues, from user authentication and billing to load management to remote diagnostics…the list goes on.

As EV adoption spreads, an ecosystem of companies that provide charging management services is rapidly growing. Charged has covered a number of firms that offer varying menus of products and services. Some companies specialize in procuring and installing charging stations, while others offer a turnkey service that includes ongoing management and maintenance.

In every case, software is what makes all the pieces of the charging puzzle work together seamlessly. Some charging providers have developed their own in-house software systems, but others rely on third-party software products. Some of these, although they’re unlikely to volunteer the information, may well be customers of AMPECO.

AMPECO offers a white-label, hardware-agnostic EV charging management platform that covers public, private and home charging and currently serves more than 150 customers in 50 markets, representing over 95,000 charging points on all 6 continents..

You might be surprised to learn that AMPECO is headquartered in Bulgaria—not exactly an e-mobility hotspot. AMPECO has a global footprint—it has offices in England and France, and is rapidly expanding in the US—but I confess I was a bit surprised to find out how knowledgeable and insightful CEO Orlin Radev and Chief Revenue Officer Stefan Ivanov turned out to be about the global EV charging industry. Also worth noting: AMPECO’s web site features an impressive collection of information about commercial EV charging, including a glossary and tutorials on such topics as payment terminals, OCPP and smart charging.

Charged: We’ve spoken to a number of companies that provide turnkey charging infrastructure solutions. You’ve taken a different approach—you just provide the software.

Orlin Radev: That’s right. Those companies that offer a turnkey solution would be able to bundle our software, their service and hardware of choice to cater to B2B customers who want to install charging stations, or operators who want to run a network.

Companies that offer a turnkey solution would be able to bundle our software, their service and hardware of choice to cater to B2B customers who want to install charging stations, or operators who want to run a network.

Some of them are our customers. We are only providing our solution as a white label, meaning that we are always in the background. You wouldn’t even know that a certain network is powered by AMPECO, because our purpose is to enable the charging networks to run their businesses. Also to enable companies who are not necessarily charging networks, but who have EV charging as part of their portfolio of services. These might be utilities, system integrators, or electrical installers and contractors. They use our platform to manage the charging stations, offer monetization to their location hosts, and so on.

Charged: Are most of your current customers public charging providers?

Orlin Radev: In many cases, our customers have at least part of their charging stations as public stations, because this is a way to monetize. You have to offer users a way to use the service to pay for itself, to handle tariffs, payments and so on. This is one of the reasons companies will turn to us. Most (not all) of our customers have some public charging, but only a few of them are solely or primarily focused on public charging.

We have a few in Europe who are classic charge point operators. They invest in the infrastructure, they sign long-term contracts with locations to install charging stations, and they offer fast charging to EV drivers. They use our software to manage the whole network. We’ll provide them with an app, which is under their own brand. This would be used by their EV drivers to locate a charging station, start and stop charging, pay for the charging, manage their subscription plans, and so on.

Other types of customers include companies who cater to B2B. For example, companies who sell and install charging stations for office buildings or for multi-apartment complexes. They install the charging stations, and either sell them to property owners or directly to the tenants, or they will lease them. They will, in some cases, monetize them by making them fee-based and they’ll share revenue. For example, we have a customer that works with housing associations in The Netherlands. They install charging stations, they collect payments from the tenants on a monthly subscription basis, and they keep part of the revenue. The rest they share with the housing association.

They need a system that’s able to control charging stations from different vendors, handle subscriptions, offer an interface to the EV drivers and handle the revenue sharing. This is where we come in—we give them the software, but they’re the ones actually running the charging business and working with the hosts and customers.

Customers need a system that’s able to control charging stations from different vendors, handle subscriptions, offer an interface to the EV drivers and handle the revenue sharing. This is where we come in—we give them the software, but they’re the ones actually running the charging business and working with the hosts and customers.

Charged: I know yours is a white-label product, but can you give me the names of any of your customers?

Orlin Radev: It’s a tricky thing with us. It’s not that easy to do your marketing when your customers don’t want anyone to know that they’re using your services. In most cases we need to ask permission to share our customers’ names, but I can mention one company: The Paz Group, one of the biggest, if not the biggest oil and gas company in Israel. Another one that I can mention is from the Nordics, and they are also now launching in different places in Europe, from Germany to the UK. They’re called Wattif.

But some of the biggest ones that use our system, they leverage the fact that this is a white-label solution.

Charged: I imagine you must customize your installations for different kinds of customers, for example, a CPO versus a utility or a fleet operator.

Orlin Radev: Well, our aim is to build a product that can be universally applicable. There are different business models that can be applied with our software. It’s mostly configuration rather than development and new customization for each customer. Think of it as like Salesforce. You don’t always use everything you get from Salesforce. You use parts of it, and how you use it depends on how you configure it. So, a lot of what we do when we onboard a customer is we help them to configure the system in a way that will serve their use case. It will be different if they’re focused on public charging rather than fleets or residential, for example.

And utilities have their own unique reasons to use a system like this. They often tie this into energy management and how they match the charging with energy generation, matching it by cost or by type of energy production for example matching it to the availability of renewables.

Specifically, when utilities are doing home charging, they want their customers to be able to benefit from variable rates, to be able to have their charging scheduled at off-peak times. Same goes for fleet customers—you can benefit from the cars that are connected for a longer period of time, and you can charge them when it’s cheaper.

Charged: You’re working in a lot of different markets—Europe, Israel. Do you work in the US as well?

Orlin Radev: Yeah, the US has been a stronger focus for us in the past year. We already have more than 13 customers in the US. We started with the UK as our initial market, so maybe a third of our customer base is still in the UK. This is where the oldest of our customers are, the ones that have been with us the longest. Since then, we’ve been able to acquire customers all across Europe, but also in Australia, Southeast Asia, the US and Canada, South America. We have Chile and Brazil, and even a few customers in Africa. It’s really universally applicable because it is purely software.

Charged: Even so, there must be a lot of differences—utilities, regulations, EV usage. Tell me a bit about the differences among the different markets.

Orlin Radev: There are certainly differences in terms of regulations. For example, if you’re a public charge point operator, in some countries you need to report to a central authority on the available public charging networks. In some cases, you need to report usage. In Germany there is the Eichrecht, which requires you to have a certified electric meter. This meter should be able to record information about the energy delivered, and this should be made available to the customer.

There are specific requirements in certain states in the US. What’s interesting is that we’ve seen some of the requirements in California appearing in tenders from utilities in the Nordics. So, there is this cross-market learning that’s happening—things that get adopted in certain markets prove positive, then they get adopted in other places in the world.

We’ve seen some of the requirements in California appearing in tenders from utilities in the Nordics.

Charged: When it comes to public charging and the CPOs, is there anyone who’s really making money “charging for charging?”

Orlin Radev: I don’t think at the moment this is even the focus of the CPOs. It’s mostly a land grab—being able to secure the locations so that you can monetize in the future. It will be a low-margin business, but it is the same as any other infrastructure that eventually should be a commodity.

This makes it even more important to be able to manage the network in an efficient way. This is a lot of what we offer, in terms of the value that we bring to the CPOs. Fast charging networks are difficult to service because they’re quite distributed. You have a lot of locations with individual devices, and you need to make sure each one is working properly. But it gets even more complex when you think about slow-charging Level 2 chargers, when you have tens of thousands of devices that have so little margin that one additional visit a year could wipe out the entire profit.

So, being able to avoid those cases and resolve them remotely, and predict and group your field service accordingly, these are things that I think will be of extreme importance at the point when the market starts to think about making this a profitable business. I think a lot of CPOs today are not operating very efficiently, but they do plan to work on efficiency in the future.

At the moment, I don’t think profitability is the focus of the CPOs. It’s mostly a land grab—being able to secure the locations so that you can monetize in the future. It will be a low-margin business, and this makes it even more important to be able to manage the network in an efficient way.

Charged: Tell me about the load management features that your software includes.

Orlin Radev: The load management features are essential when we think about large-scale infrastructure rollout, because many parking spaces have to be electrified for the convenience of the EV driver, but they don’t necessarily need to be used all at the same time. Or in some cases in city centers, it may be even not possible to upgrade the grid connection to the maximum power of all chargers being used at the same time.

With load balancing, we make it possible to install more charging stations, manage them in a way which avoids these peaks that otherwise would exceed your grid connection, and at the same time does not worsen the user experience.

We let the operators set the limits, whether they’re static, meaning that they have dedicated power capacity for the parking lot, or dynamic, meaning that they take into account the consumption of the building. An algorithm then calculates which car gets how much and makes sure that in total they don’t exceed what’s available.

Charged: What about bidirectional charging and vehicle-to-grid tech? I know there’s a lot of pilots, but is that something that some of your customers are actually implementing?

Orlin Radev: We know of a few commercial implementations, but not by any of our clients. We have only experimented with V2G at this time. I do believe that it would be useful, and eventually there will be a business case for this. But today, I think we are not utilizing smart charging enough. When you think about V2G, it’s the ability to take from the battery to put into the grid. But at the same time, there’s more cars connected to the grid that are charging. So, being able to control the current load has much bigger effects on balancing the grid and on the efficiency of how you utilize these vehicles, before we tap into the actual batteries.

I think V2G is more important on the very local scale—specifically when we’re talking about outages, because then the value of being able to power a home from the car is immense. I think we’ll see much more in V2G from OEMs like Ford and others that will offer this as backup power for your home. I think this is the use case that we’ll see much sooner. But commercial implementations where you actually give out to the grid, I think these are not a next-year thing, but years in the future.

I do believe that V2G would be useful, but today, I think we are not utilizing smart charging enough. Being able to control the current load has much bigger effects on balancing the grid and on the efficiency of how you utilize these vehicles, before we tap into the actual batteries.

Charged: We know that Northern Europe and California are EV hot spots. What are some other countries where you see a lot of EV growth in the near future?

Stefan Ivanov: We’re seeing that, almost everywhere, things are starting to turn much quicker than they were in the past two years. For example, in the Middle East, the governments in Saudi Arabia, UAE, Dubai, they said we need to electrify much quicker. Even in Dubai, for example, all the taxi companies need to be fully electric by 2027. Saudi Arabia is even building a factory for EVs. They have an investment with Lucid, and they’ll do something together.

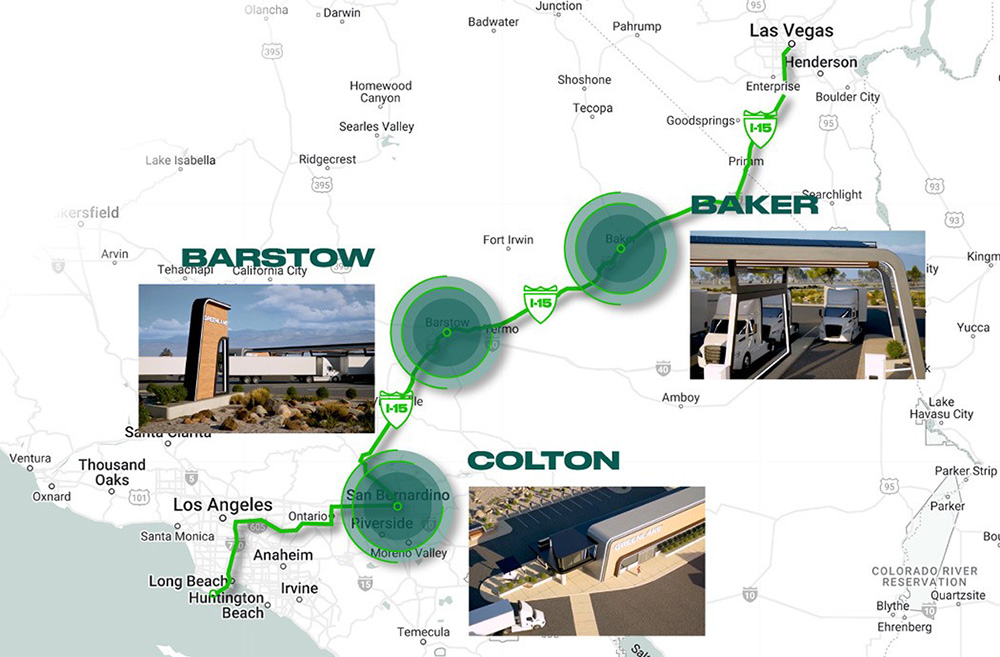

Orlin Radev: I think the US will be a high-growth market for the next few years. It also has the advantage of being able to look at what’s worked and not worked in Europe. The charging infrastructure, compared to Europe, especially the Nordics, we can see a three-year difference. But I think the US will catch up, not in three years but maybe in a year, just because it won’t have to make the same mistakes and it will move quicker.

Stefan Ivanov: In the US, a huge catalyst is government policy—actually, everywhere. In the Netherlands, seven years ago when they really made a huge bump, it was government policy. Same thing for Norway and other markets. When government is looking in that direction, things are accelerating very, very quickly.

What the US is doing really well at the moment is that the NEVI program has very clear centrally-defined requirements for charging operators, like requiring open standards that are future-proof, also requiring certain levels of availability of the service—the hardware, software and connectivity. All of these are things that Europe learned the hard way—at the beginning there wasn’t much understanding of what was needed to provide an overall good solution. It was a bit more focused on just putting chargers in the ground. The US is definitely benefiting from this and applying best practices in a well-organized, centralized way.

Orlin Radev: For example, in the Netherlands there’s still hardware that can’t be integrated with the grid. You can’t control it in a smart way. So, this is infrastructure that eventually will need to be replaced.

What the US is doing really well at the moment is that the NEVI program has very clear centrally-defined requirements for charging operators, like requiring open standards that are future-proof, also requiring certain levels of availability of the service.

Charged: One huge problem with public charging is reliability. Why is it so hard to keep public chargers in service?

Orlin Radev: It’s not one thing—otherwise, I think any of the CPOs would solve it with one big swipe. It’s a combination of things including the ability to recognize problems with the charger, and software plays a part. For example, our software helps CPOs by doing self-healing. It’s an auto-fault recovery, trying to resolve a problem when it occurs and then notifying the operator whether it worked or not.

We’ve already created some proofs of concept with machine learning where we try to recognize faults before they happen. In our proof-of-concept phase, we were able to recognize with 76% accuracy that within the next 10 charging sessions, there will be a fault on the charging station. There’s still a lot to be done in order to be more precise. That 76% is actually not that high when you think about whether you’re deciding to send a technician out there. You need to be in the 90% range to do this. But it’s about data and usage. We are now working on training models to start recognizing this, so we can help the operator to predict and know how to act before a fault happens.

Another thing is hardware. There was for some time quite a shortage of hardware, and delivery times are quite long, so you have to juggle different hardware options, and it’s not always possible to have the best available hardware. Plus, it’s not that easy to know what’s the best available hardware when this is a new technology. Some models have been on the market for only one year, and how much experience can anyone have in order to know whether this is good hardware or not?

The other thing is regulations, which have to put a focus on reliability. When you’re mostly focused on the land grab, you may not put enough effort into field service and customer support, but when this is a requirement for whether you get your government grant, I think this will incentivize the CPOs to be more focused on the level of service that they’re providing, rather than just securing the locations.

Charged: How long has your company been around, and how did you get into this?

Orlin Radev: We’ve been in software development for over 10 years. Myself and our CTO, we had a software company where we developed products for other companies, for enterprises and startups.

I personally had an affair with e-mobility in 2010. I started a company with the intention to convert regular cars to electric. But what I really wanted to do was to be part of this transformation, and I found a way to do this in 2018. I convinced Stefan and a few other of my friends, who are good at software development. And so, we started AMPECO at the end of 2018 and we went to market with our product in 2019. This is when the first EV drivers were charging using our platform. So, four and a half years we’ve been on the market.

We’re at the heart of this transformation in a way, because, while we are not customer-facing, we are enabling this on the infrastructure level in a quite significant way.