Bosch’s business focus areas include electrification, hydrogen technology, power tools, and powertrains. Premiumisation in vehicles, driven by increased electronic architecture, is enhancing user experience and adding features like connectivity, ADAS, and over-the-air updates. In India, the shift towards premiumisation in vehicles is aligning with global trends, leading to increased content per vehicle, including safety features and advanced technology. Guruprasad Mudlapur, President of the Bosch Group in India, and Managing Director, Bosch Limited shares details on how these emerging trends are influencing the company.

In 2023, you mentioned that going forward, the company focus would be on electrification, hydrogen, power tools and powertrain technologies. How do you read the market now?

Simply put, we are shifting from internal combustion engines to electrification. And as we make this shift, one fundamental thing that is changing is the electric vehicles. There is no legacy to follow in this space.

Many global OEMs today have given up on their legacy and are moving into new technologies. In the process, they are bringing in new features into the vehicles. This trend is also coming into India but at a small scale. However, this is a global trend, and it will become big here eventually.

How would you define premiumisation?

Look at the high levels of Electrical Electronic (E/E) architecture in modern cars where OEMs or technology providers are able to bring in a lot of new features in terms of premiumisation. These could be in the form of connectivity, ADAS, new software downloads, and so on. For us, these are great ways to increase the user experience of a vehicle for the consumer.

Globally, we’ve always been at the forefront, doing this for several global OEMs and we are doing the same in the Indian context as well. For instance, most of the cars recently launched in India have an extremely wide screen for customers to engage with. Earlier, the dashboard would contain a small analogue cluster and the user interface of the vehicle would only enable looking at the speed, RPM, fuel gauge, etc. However, these days, with a larger screen (or multiple screens at times), a lot of content is being exchanged with the driver or the occupants of the car. Premiumisation is not just about bringing in the comfort aspects, but also the add-on features and technologies in the car like driver drowsiness monitoring that we are offering.

What’s the impact of premiumisation in a price conscious market for Bosch?

Until a few years ago, OEMs sold perhaps majority of its cars in the sub Rs 7.5 lakh to Rs 8 lakh range and that scale has now shifted to around Rs 12 lakh to Rs 15 lakh.Most of the cars in the latter price bracket are coming with many technology features. Without any legislation, ESP became a norm and about 70-75% penetration of electronic stability control is there in the car these days. From digital signal processing, higher fuel efficiency norms to advanced user experience controls in the car or other features above and beyond electrification, Bosch is a leader in several of these technologies. Hence, both in terms of technology upgrades and content per vehicle updates, we stand to gain quite a lot.

In your view, how will the ‘premiumisation’ market shape up for Bosch?

To start with, we need to be distinct about which category of vehicles we are talking about. Earlier, cars usually had typical features like fuel injection equipment, some ABS or ECUs, and so on. However, today, the content has moved up to include a lot of software led features, which are sometimes hard to quantify in terms of numbers, but they could either be a one-time delivery or on a pay-per-use kind of business model.

If you take an EV, the contents in an e-axle have substantially increased. In ICE, in the transition from BS4 to BS6, our content has gone up significantly and the safety norms have increased as well. In fact, content has nearly doubled in terms of safety norms. On top of that, premiumisation revolving around user experience and related features have also come in. So, it’s difficult to state one specific number because it varies widely.

What’s the score on growth and revenues considering some sectors like CVs are witnessing sluggish trends?

Overall, I think the volume growth will certainly be both in passenger vehicles and two-wheeler segments. Three-wheelers have caught up as well and we are back on track in this space. With commercial vehicles, there is a little bit of sluggishness. But owing to multiple changes in legislation and axle norms, the sector has risen from the all-time low it experienced a couple of years ago. Moreover, good roads and infrastructure have enabled more usage of vehicles today and typical driving distances have increased. All of these have changed the base for commercial vehicles so there is a little bit of sluggishness. But heavy commercial vehicles have recovered. We are already the third largest auto market worldwide, and we will see substantial growth in vehicle volumes by 2030.

How do you see the H2 market evolving for Bosch?

It’s essential to understand that there are segments where hydrogen is extremely well suited, and there are segments where it may not be so. Heavy commercial vehicles and long-haul trucks are better suited for hydrogen than battery electric vehicles, simply because of the dead weight of the batteries that they will need to carry. So, trucks weighing 14-tonne and above perform better with hydrogen. OEMs are aware of this, and we have technologies that support in this space. In terms of market differentiation, I think battery electric vehicles will largely be for short-haul, last mile, and maybe medium distances, whereas longer haul trucks will run on hydrogen.

There is a clear distinction between segments where hydrogen comes in vis-à-vis electrification or battery-operated electric vehicles. We believe that the market is leaning towards hydrogen ICE and there could be conversion of today’s engines to hydrogen. We already have a truck running on a BS4 ICE engine with hydrogen and this year we will have a BS6 vehicle. I think the market will initially adopt this because the technological changes required in commercial vehicles will not be so major for hydrogen. However, there is a huge amount of work to be done in bringing up the infrastructure for hydrogen generation, distribution, and dispensing. In the years to come, we will ideally see hydrogen ICE coming in first, followed by fuel cells or electric vehicles at some point in time.

For the hydrogen ecosystem, what can Bosch offer?

First, let me clarify, Bosch will not produce hydrogen. We will provide the technology to the companies which are entrusted to produce and dispense hydrogen. We are working on electrolysers that can be used in hydrogen generation, but we won’t produce hydrogen ourselves. Those are at an advanced stage of development in Europe. Like every technology application we don’t do it for just one geography only.

Yes, there are regional variants that we develop but everything we do at a broad scale is available for all regions because the technology is prevalent everywhere. Lastly, for the ecosystem, factors like process of generation, cost of generation and distribution must be kept in mind. Hydrogen generation requires a lot of water and energy so it would largely depend on how the infrastructure develops as well.

And on eletrolysers…

We’ve begun discussions with all the key players in the hydrogen production market. In India, there are primarily two technologies for hydrogen generation: PEM (Proton Exchange Membrane) and Alkaline methodology. We’re focused on PEM, not Alkaline. Currently, we’re in talks with several major ecosystem players in India regarding PEM technology.

Given the growth trends in India, does Bosch plan to go in for major portfolio expansion?

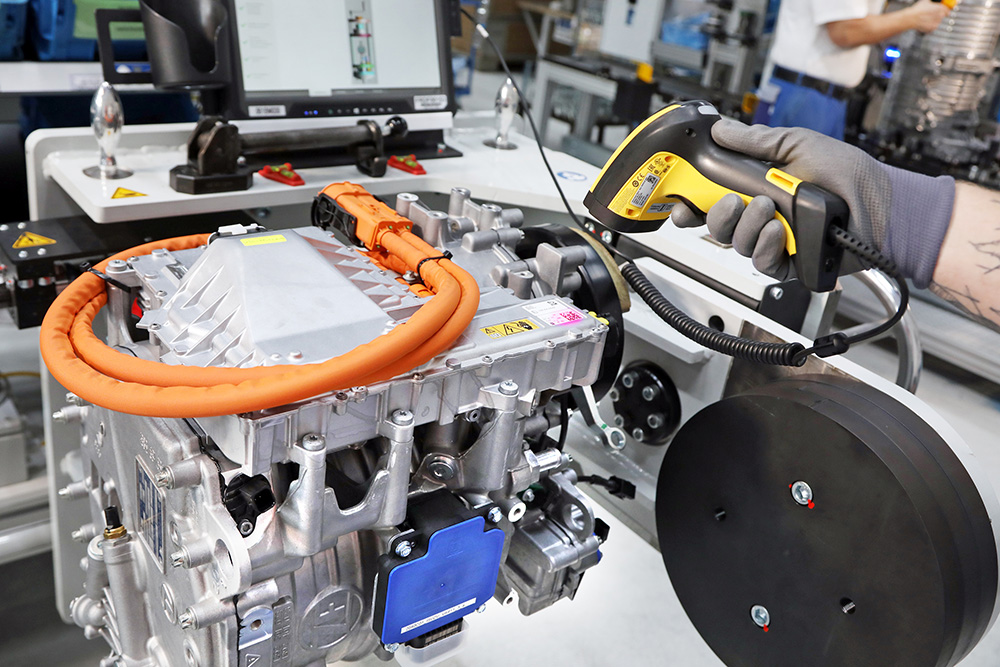

I wouldn’t say we have something particularly new. However, we are talking to OEMs in several areas around electrification. Power electronics is an area that will see substantial progress and we will continue to expand the electrification portfolio.

Having said that, auto market technologies do not change overnight and the most significant change that we will see is the introduction of hydrogen. When it comes to H2 for commercial vehicles, we are at a good level of piloting right now. We have our own demo truck running locally as well. That is one area on which we will continue to focus.

How do you foresee the market transition for alternative technologies?

We believe heavy commercial vehicles moving into hydrogen engines will be the first transition followed by fuel-cell electric vehicles. For smaller trucks and small commercial vehicles, the transition will most likely be into battery electric vehicles, CNG, or hybrid technology. So multiple fuel combinations might exist in the times to come. By the end of this decade, that is 2030 onwards, we believe around 10-15% of the trucks will run on hydrogen. It’s a conservative estimation but this could be the number of vehicles domestically.

What’s your take on Fuel Cells?

We can expect the fuel cell vehicles (FCVs) to come in around 2028-2030. It’s important to remember that the commercial vehicle market works very tightly on cost per kilometre. Whatever technology is eventually adopted, needs to have that as the key measure. So, if the cost per kilometre turns out to be effective, then hydrogen will certainly have a big role. But if that doesn’t happen, either due to the technology around vehicles, hydrogen generation or distribution costs, then hydrogen of course won’t be that feasible. However, based on the investments that are going into the different segments (generation, renewable energy, dispensing) and several big ecosystem players claiming that around USD 1.0 per kg of generation cost is leading to around sub USD 3.0 of distribution costs, we believe this will have a good total cost of ownership (TCO) compared to diesel. And if the cost per kilometre is good, hydrogen trucks will find more adoption.

This further improves with fuel-cell electric vehicles. While the initial cost could be higher, the total cost of ownership will be comparatively less. There are still some factors like Indian road conditions, weather conditions, and the purity of hydrogen that will have a role to play in how you can use fuel cell technology. Those will need to mature over the next few years.

This interview was first published in Autocar Professional’s May 1, 2024 issue.