Expectations For Tesla [TSLA] Have Just Gotten Too Ridiculous

I just listened to Tesla’s 3rd quarter 2023 conference call for investors, and it didn’t come across at all like normal Tesla [NASDAQ:TSLA] quarterly conference calls. It was very low key and Elon Musk even sounded a bit depressed*. Naturally, gross margins are down (a lot), the Cybertruck is delayed (again), and Full Self Driving appears to be in the same place it’s been for a while (give or take). But aside from the tone and vibe of the call, Musk gave a number of answers and statements that I think he wouldn’t typically give.

He was asked, sometimes two or three times, about plans for expanding production lines, the Mexico gigafactory, Tesla’s target of 50% CAGR, the lower-cost Tesla that is supposed to come to market after the Cybertruck, and robotaxis and Full Self Driving. Rather than giving ambitious, excited, bullish responses — as is the norm at Tesla, Inc. — Musk was muted, reserved in his expectations, and sometimes blatantly self-critical.

With regards to the Mexico gigafactory, it’s delayed indefinitely — until interest rates drop enough. And Musk isn’t bullish on that happening anytime soon. Someone else on the Tesla team noted that they still have plenty of space in the Texas gigafactory to add more production lines if needed. Then they laughed that they actually have 2,000 or so acres of land there where they could expand. Much earlier in the call, Tesla was asked about when it would be adding production lines at its two newest gigafactories, Giga Texas and Giga Berlin, and when the opening schedule for the Mexico factory was. The answer was basically that there was no need to add production lines at the moment. In other words, demand matches production capacity and isn’t growing beyond that for the foreseeable future. They are primarily focused on increasing efficiency on existing lines, and they are “laying the groundwork” to begin construction of the Mexico factory, Musk noted. “But, I think we want to just get a sense for what the global economy is like before we go full tilt on the Mexico factory. I am worried about the high-interest-rate environment that we’re in. I just can’t emphasize this enough, that for the vast majority of people buying a car, it’s about the monthly payment, and as interest rates rise, the proportion of that monthly payment that is interest increases naturally. … If interest rates remain high, or if they [go] even higher, it’s that much harder for people to buy the car. They simply cannot afford it.”

He then talked more specifically about the Model Y, in a way that I and others have been doing but which goes against some common Tesla narratives. “And we are tracking at this point for the Model Y to be the best selling car on Earth — not just in revenue, but in unit volume. If you compare that to the other vehicles that are, you know, #2 and #3 and whatnot, they cost much less than our car. So, we’re just hitting law of large numbers situations here.” This is what Jose Pontes sometimes calls the “natural limits” of different models. Tesla has argued for years — and still does — that its vehicles really compete with cheaper vehicles because of the operational and maintenance savings. We’ve published articles explaining this many times as well, including quite recently. But Musk is now conceding that sticker price is sticker price, and the Model Y is basically at its ceiling for the time being. “I know some people want us advertising. We are advertising. Um, I think there is some, there’s something to, there is a … something to be gained on the advertising front, I don’t think it’s nothing. Um. But, informing people of a car that is great that they cannot afford doesn’t really help.”

But wait a second, isn’t Tesla supposed to be achieving 50% CAGR? Isn’t Tesla supposed to be producing and delivering 50% more vehicles year after year through the 2020s — up to 20 million vehicles a year? Yes, I know, it’s not expected to be 50% every year, but rather a multi-year average of 50% CAGR. Naturally, that’s what investors asked about next. One of the most upvoted questions on SAY was, “Current sell side consensus assumes that Tesla will deliver ~2.3 million vehicles in 2024, representing 28% growth vs. 2023 guidance. Is this growth rate achievable without any mass-market launches in 2024, and when does Tesla expect to return to its 50% long-term CAGR?” Elon Musk started off with a response I did not expect. “At the risk of stating the obvious, it is not possible to have a 50% compound growth rate of 50% forever or you will exceed the mass of the universe.” That makes sense. That’s what I’ve been saying. But that goes against the more common Tesla narrative, as Musk himself pointed out. He also talked at length a few times on the call about high interest rates. Overall, I was legitimately shocked by his phrasing in some of these statements. He sounded more like a Tesla critic than Tesla’s #1 fan. In short, though, 50% CAGR is in limbo at the moment and seemingly not expected in 2024. It’s also not expected for eternity, believe it or not.

When it came to the Cybertruck, and production being delayed, Musk said, “we dug our own grave with Cybertruck.” It’s a bit more complicated and difficult to produce than initially expected. (Well, some people expected this.) High-volume production — Elon is estimating perhaps 250,000 units a year — is projected to come about approximately 18 months after the start of production, which is planned for the end of 2023. Ramping up production is going to be extremely difficult, according to Musk.

And then there’s the matter of Full Self Driving (FSD). Someone asked about the estimated timeline for a Tesla robotaxi and someone else asked why the price had been reduced when it was supposed to be getting better day after day. Musk sounded downright depressed to me at that point. When he talked about FSD, you could hear him containing himself, holding back and trying not to make overly bold and optimistic statements, even referencing his previous overly optimistic statements. He explained the source of those and he explained (again) why he was so bullish on Tesla’s approach. But there was no “we’ll have robotaxis on the road next year” this time. Either the goals have been extended a lot further out, he just has no idea when Tesla can achieve it, or he bit his tongue repeatedly to not make the same mistakes of the past.

Then there was this statement when asked about FSD being extended to countries beyond the US and Canada: “The more places we try to make it work, the harder the problem is. So, the reason we don’t do it in all countries simultaneously is that it would take much longer to make it work anywhere at all. That’s why it’s currently just North America. And also, for most parts of the world, you have to get approval before deploying things, whereas in the US you can deploy things at risk — or, at least, take liability for what you deploy.”

It was an odd, unexpected conference call. Reflecting on it, I came to one overall conclusion: expectations for Tesla have just gotten too ridiculous. Expecting 50% CAGR at this stage is … a lot. Expecting to get to 20 million vehicles a year by 2030 is a little bonkers. Expecting Tesla robotaxis to arrive soon after years of incorrect forecasts from Elon Musk is … unrealistic. Expecting the Cybertruck to reach a million sales or half a million sales a year, and perhaps even in 2024, is expecting a miracle. Expecting Optimus to replace Tesla factory workers in the next couple of years is its own thing, but the point where Musk talked about that was really something you have to just listen to (28:32 into the YouTube video if that doesn’t jump you there automatically).

Tesla in the 2010s was an amazing story. Tesla in the 2020s is already an amazing story. But expectations can get out of hand no matter what a person or a company is achieving, and I think expectations for Tesla have just gotten out of hand.

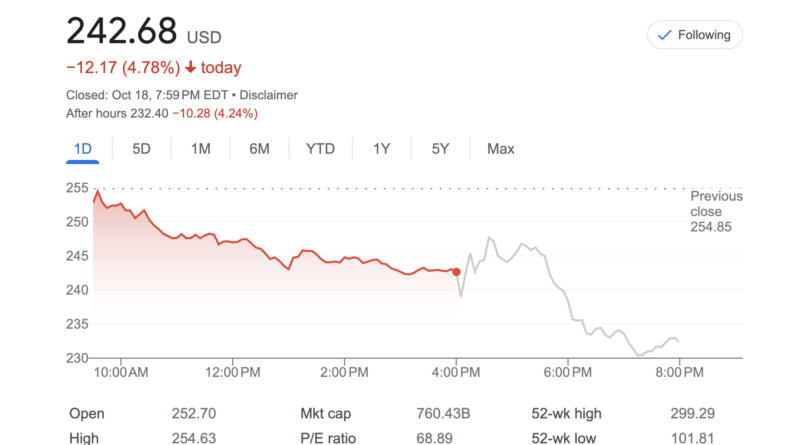

Tesla operating margin was at 7.6%, down significantly from the 17.2% of the 3rd quarter of 2022. Adjusted earnings were 66¢ per share, much lower than the market’s expected 72¢ or 73¢ per share. Total gross profit was down 22% year over year.

*I’m not the only one who thought so. Others have made similar comments under the YouTube video.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.