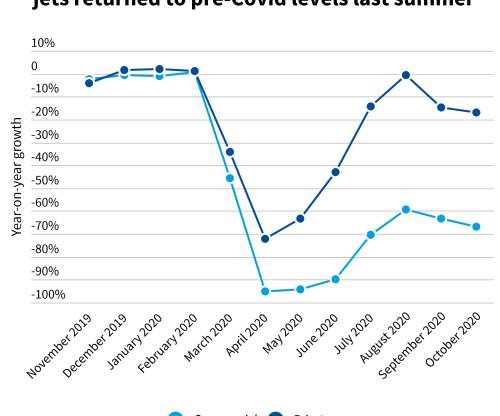

US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

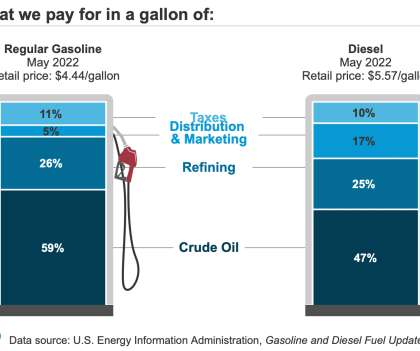

This puts the US on track to meet its annual goals for GHG reduction under the Paris Climate Accord. If traffic remained reduced for one year, the reduction in VMT would allow California to meet half of its 2050 climate change target. Fuel saved, tax revenue lost. Fuel use dropped from 4.6 billion per week.

Let's personalize your content