“Public policy implementation is hard even if everyone supports a policy,” says University of Michigan professor emeritus John Leslie King, who has studied policy management and administration for decades.

It becomes infinitely harder when the technology is complex and depends on several other equally complex technologies; where the stakes are huge; where there is a myriad of players involved each with competing missions, interests and policy-making boundaries to protect; and when time is short.

The EV Transition Explained

This is one in a series of articles exploring the major technological and social challenges that must be addressed as we move from vehicles with internal-combustion engines to electric vehicles at scale. In reviewing each article, readers should bear in mind Nobel Prize–winning physicist Richard Feynman’s admonition: “For a successful technology, reality must take precedence over public relations, for Nature cannot be fooled.”

Such is the case with the Biden Administration’s attempted transition of the U.S. economy away from dependence on fossil fuels like petroleum, coal and natural gas to 100 percent carbon-free electricity by 2035. Driving that timeline is the shift to electric vehicles, which the Administration wants to account for 50 percent of all new cars sold by 2030.

Implementing an EV national policy that aims to transform the economy is an exercise in mind-boggling complexity. Not only are several federal departments and agencies directly involved, including the Departments of Agriculture, Commerce, Energy, Interior, Labor, Transportation, the Environmental Protection Agency, the Small Business Administration, the Federal Regulatory Commission and the Federal Trade Commission, but the different and often competing policy objectives and statutory regulations covering multiple industries must be coordinated, agreed and implemented across all 50 state governments, some 3,000 local counties, and 19,000 municipalities.

The US electrical power industry alone “is influenced by a variety of decision-makers, including over 200 investor-owned utilities, 10 federal power authorities, over 2000 publicly-owned utilities, about 900 rural electric cooperatives, seven RTOs [Regional Transmission Organizations], 48 state regulatory bodies [e.g., Public Utility Commissions (PUCs)] and many state and federal agencies,” states a report by the non-profit group Americans for a Clean Energy Grid. Reproduce that across the numerous EV-involved industries from mining to recycling and the complexity involved becomes clearer.

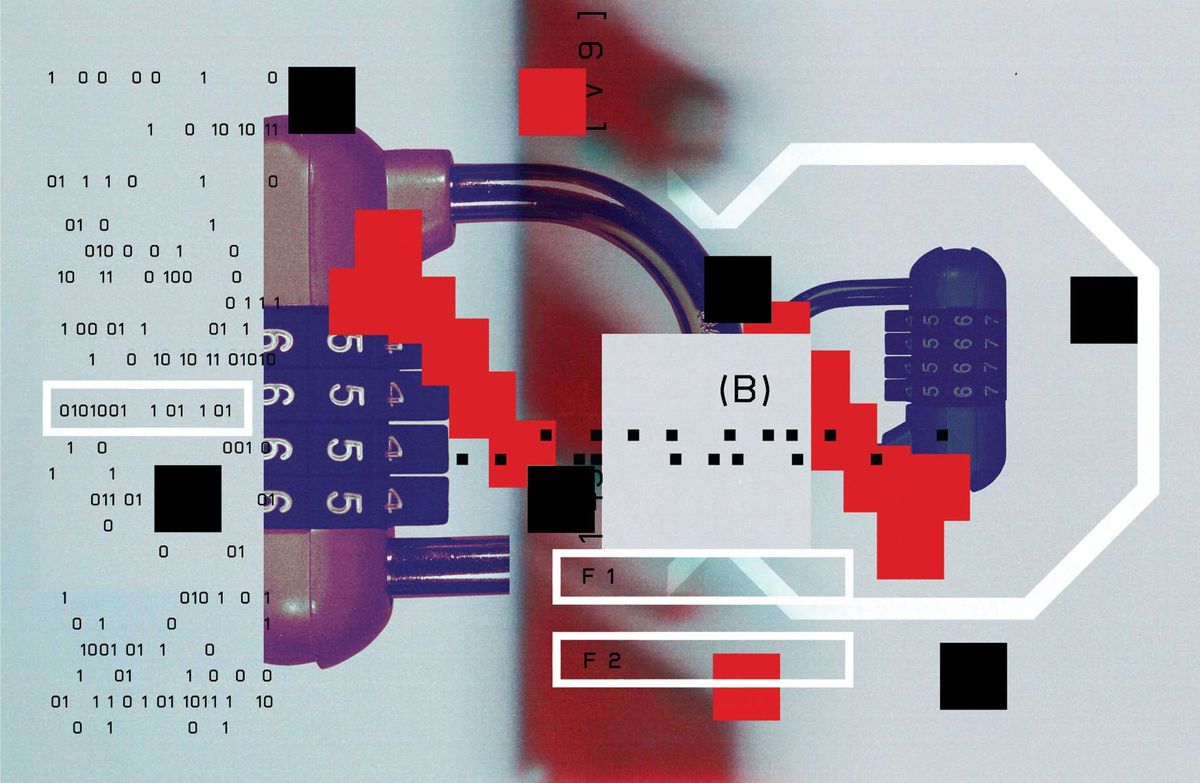

By 2050, as many as 1 million circuit miles of new transmission lines may be needed, with some 140,000 miles required just for the replacement of existing aging transmission lines.

Typically, each of governmental body has some number of elected, appointed and full-time staff which can affect how well, or even whether, a policy is implemented. State PUCs, for instance, have a major role in ensuring the electrical infrastructure needed to support EVs exists. Affordability is expected to be just one highly contentious issue: Who, exactly, is going to pay for grid upgrades? In Kansas, the average customer paid $4 per month on their utility bill for transmission costs 10 years ago, but that has climbed to $20 per month today, and is likely to go higher as billions are spent on new transmission lines to support renewable energy. Increasing electricity rates is politically fraught for elected members of public utility commissions. The fight over how to fairly implement EV charging networks in Minnesota is another example of the tricky politics PUCs are involved with.

Tricky politics are one thing; having enough expertise on hand to accomplish policy goals is another altogether. Utility commissioners and their staffs are now dealing with “rising workloads with limited staff, limited resources, and growing gaps in internal expertise due to the increasingly specialized needs of today’s energy system,” states the Rocky Mountain Institute. In addition, the lack of relevant legal or industry expertise is increasingly worrisome. This may become a major operational and legal problem at the federal level as thousands of new employees are hired across multiple federal departments and agencies to carry out the Biden Administration’s environmental policies.

Staggering amount of new transmission lines needed

A consequence of the multitude of constituencies involved is that the “decision friction”involved in getting any decision approved is white hot. To cool it down requires coordinated communications and joint action among all the participants involved. Given the increased future dependency on renewables, the grid as a whole needs to be much more reliable and flexible than it is today. How to achieve that still requires quite a bit of research, according to the U.S. Department of Energy’s (DOE’s) National Renewable Energy Laboratory (NREL).

Yet, as noted in a Clean Air Task Force report, “To date … there has been hardly any conversation among policy analysts, let alone high-level policymakers, about how such a massive [energy] infrastructure initiative should be undertaken.” When there is conversation, it is frequently combative, with local, state and federal officials fighting among themselves over who has the final say on what is going to be done, where and when.

To have any hope of reaching a carbon-free electricity grid, tens of thousands of miles of new transmission lines must be added by 2030 to add the existing 640,000 circuit miles of alternating current (AC) transmission lines (240,000 operating at more than 230 kilovolts). By 2050, as many as 1 million circuit miles of new transmission lines may be needed, with some 140,000 miles required just for the replacement of existing aging transmission lines.

Unfortunately, between 2010 and 2020, only 18,000 miles of new transmission lines were added to the US grid. Worse, in 2021, just 386 miles were added, according to the American Clean Power (ACP) organization’s 2021 Annual Market Report. The ACP report further notes that “only 5,000 miles is on-track for delivery between now and 2025.”

The proximate causes for the slow installation of transmission lines are the numerous competing federal and state interagency statutory requirements that must be followed. As a result, new transmission line projects take a decade or more to complete and often double or more in cost, if they get built at all. The longer the transmission line, generally the more time it takes to overcome all the statutory hurdles as well as possible landowner objections.

“[T]here has been hardly any conversation among policy analysts, let alone high-level policymakers, about how such a massive [energy] infrastructure initiative should be undertaken.” —Clean Air Task Force

Take the SunZia transmission line project which was started in 2006 to send enough renewable power via transmission lines 520 miles across federal, state and private lands between New Mexico and central Arizona. If no final hurdles appear, that project might begin construction in 2023 and be completed in 2025. The US Bureau of Land Management (BLM) alone spent more than six years reviewing the project. This does not include the numerous other reviews performed by individual state regulators, other regulatory stakeholders, and public entities. The project owners also had to strike multiple deals with the private landowners to run the lines through their properties.

Every major transmission line project in the US faces similar challenges to overcome. The public backlash over the proposed transmission line across Maine and the recently canceled California Colusa-Sutter Transmission Line Project illustrate the contentious issues involved. With many more transmission lines needed to support renewable energy projects, the public fights are expected to get even more cantankerous.

It is little wonder that Alison Silverstein, a former senior adviser to the U.S. Federal Energy Regulatory Commission (FERC) exclaimed in regard to getting energy infrastructure built, “The politics are a freakin’ nightmare.”

Nightmares for everyone

The same kinds of political and legal nightmares are replicated for every other EV infrastructure challenge. That includes gaining the necessary mining permits for the critical minerals needed for EVs. Both Ford and Rivian are pushing the US Department of the Interior to speed up mining permits in the U.S. and limit the permitting process to last no more than three years, like in Canada and Australia. Currently, permitting takes up to ten years in the United States. Even after permits have been approved, however, there is no guarantee that a mine will become fully operational, as Nevada’s Thacker Pass lithium mine’s ongoing controversy shows.

Permitting issues also bedevil wind power projects. For example, Iowa is one of the best states for wind power farms. In 2021, Iowa generated over 55 percent of its electricity from wind power, a larger share than any other state. However, as wind turbine farms have increased, so has local opposition to them. As a result, 49 percent of potential Iowa wind turbine sites are no longer available. In addition, there is also strong opposition to building the high-voltage transmission lines needed to connect wind farms to the Midcontinent Independent System Operator (MISO) and Southwest Power Pool (SPP) grids. Public opposition to wind turbine projects is growing in Illinois, Indiana and Ohio as well.

“EVs are part of a larger system that involves the electric grid, mining, and so on, increasing dramatically the regulatory scale involved.” —Lee Vinsel

Yet even when a popular EV-friendly policy is passed, that doesn’t not mean it will be implemented without difficulty. For instance, seven years ago, California passed a state law streamlining EV charging-station permitting. However, the law is widely ignored by local jurisdictions who want to have their own say. This helps explain why California is next to last for the time it takes to get a permit for a direct-current fast charger approved. Equally, the state has long had a subsidy plan to help low-income residents buy EVs. Unfortunately, applications for the subsidies take months to get approved if they are at all. The fund often runs out of money, discouraging future EV purchasers

Making policy implementation harder still is that some regulatory bodies assume that other regulatory bodies will implement their policy for them. For instance, the California Air Resource Board, in setting the state’s 2025, 2030 and 2035 EV sales mandates, assumed that the California Public Utilities Commission would be able to mandate the requisite EV-supporting electrical infrastructure. As one CARB member has stated, their concern is climate, whereas solving power generation is the responsibility of the CPUC.

This highlights something that seems to be a critical weakness in EV policy making, says Lee Vinsel, a Virginia Polytechnic Institute technology historian, and expert on how regulatory policy has improved auto safety and lowered pollution. Historically, auto regulation has dealt with “the negative externalities associated with the auto itself,” he explained. “Issues like auto safety and pollution were the chief concerns. These issues are self-contained to the auto itself.”

However, Vinsel points out that with EVs “the negative externalities are generally outside the auto. EVs are part of a larger system that involves the electric grid, mining, and so on, increasing dramatically the regulatory scale involved.”

It is not surprising, therefore, that John Bozzella, president of the industry trade group Alliance for Automotive Innovation Leads, questions the feasibility of California’s mandates. “Whether or not these requirements are realistic or achievable is directly linked to external factors like inflation, charging and fuel infrastructure, supply chains, labor, critical mineral availability and pricing, and the ongoing semiconductor shortage,” Bozzella says. “These are complex, intertwined and global issues well beyond the control of either CARB or the auto industry.”

Vinsel further notes, “Successful regulation is fragile.” It depends acutely, he says, upon the government possessing “reliable knowledge, substantial expertise, and organizational capabilities.” EVs are a different regulatory beast from ICE vehicle regulation, needing regulatory expertise that may not exist across government at the depth and breadth needed across so many different industries, Vinsel observes.

As a result, Vinsel warns, “I do think there are real social risks if the government messes this transition up.”

In the next articles of this series exploring transition to EVs at scale, a topic that has been scarcely studied but will act to exacerbate or reduce EV-related social risks, namely, who will become the winners and losers in the transition to EVs, will be explored.

- The EV Transition Explained: Local Policies Shape Global Competition ›

- The EV Transition Explained: Can the Grid Cope? ›

- The Full Cost of Electricity - IEEE Spectrum - IEEE Spectrum ›

- For the First Time, Offshore Wind Power Will Be Profitable Without Subsidies ›

Robert N. Charette is a Contributing Editor to IEEE Spectrum and an acknowledged international authority on information technology and systems risk management. A self-described “risk ecologist,” he is interested in the intersections of business, political, technological, and societal risks. Charette is an award-winning author of multiple books and numerous articles on the subjects of risk management, project and program management, innovation, and entrepreneurship. A Life Senior Member of the IEEE, Charette was a recipient of the IEEE Computer Society’s Golden Core Award in 2008.