A new study on the reliability of DC fast chargers in the San Francisco Bay Area provides some much needed data and independent analysis to help hold EV charging networks accountable to a higher level of charging customer experience.

The Reliability of Open Public Electric Vehicle Direct Current Fast Chargers study by UC Berkeley with support from Cool The Earth, SLAC National Accelerator Laboratory, and GISMo Group, revealed what most industry observers and EV drivers already knew — that using public DC fast chargers is often a frustrating and less-than-ideal experience. The study enlisted 20 volunteer EV drivers in testing “open” (meaning no Tesla Superchargers were tested) 657 DC fast EVSE (chargers) at 181 charging stations (charging locations) in the San Francisco Bay Area. The vehicles used for testing were the Chevy Bolt, Kia Niro, Hyundai Kona, Ford Mustang Mach E, and Porsche Taycan.

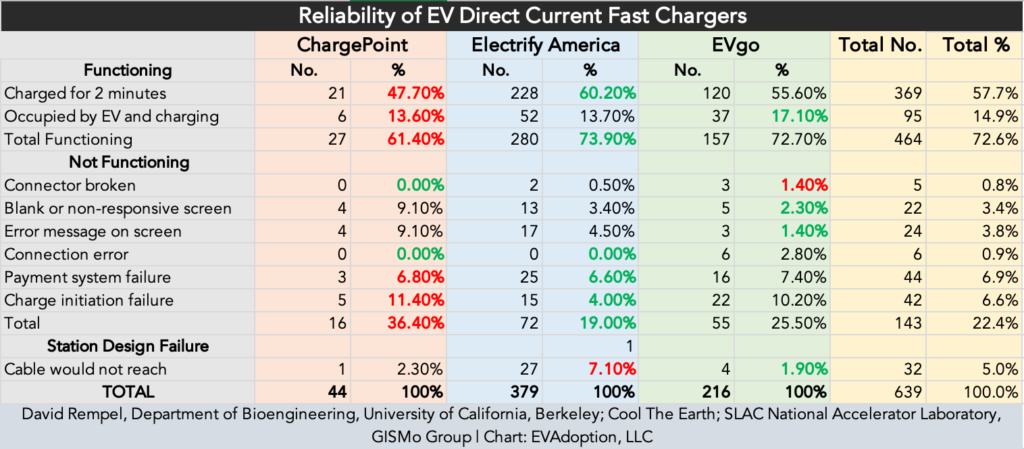

The researchers were not able to charge at 23% of the DC fast chargers, meaning that more than 1 out of every 5 charging attempts was unsuccessful. Reasons ranged from broken connectors to pay system and charge initiation failures.

But EV drivers don’t care what is the cause of the inability to charge their EV. It makes little difference if it is a hardware, software, or cellular connection issue, a broken connector, an EV or ICE vehicle parking but not charging, or the charger simply unavailable due to limited hours of operation. This level of failed charging attempts is simply unacceptable.

While chargers from a total of nine charging network companies were evaluated, three charging networks, ChargePoint, Electrify America, and EVgo accounted for 97.3% (639 of 657) of the DC fast chargers evaluated.

Among these three major charging networks it was actually not surprising that chargers from ChargePoint had the highest percentage of charging issues. Why? The key reason I believe is that while ChargePoint bills itself as a charging network it’s business model is actually very different from most of the rest of the charging networks — sometimes referred to as “charge point operators” — including Electrify America and EVgo.

Most, but not all, of the major charging networks generally own and operate their charging locations and equipment. ChargePoint, however, sells it’s charging hardware and online reporting data services to site hosts such as hotels, restaurants, and retail stores. The difference in these business model approaches can be significant as in the other charger operating models by Electrify America and EVgo, for example, they are responsible for the overall charging customer experience of the EV driver.

In the case of a restaurant or hotel owner that purchases ChargePoint equipment and services, the hotel or restaurant owner and staff are actually responsible for managing the charging equipment, maintenance, customer experience, and resolving any issues. The reality is that the day manager at a hotel or a restaurant manager knows little-to-nothing about EV charging and are ill-equipped to make sure the equipment works, connectors aren’t broken, and software is up-to-date.

To be clear, ChargePoint is not the only guilty party across the EV charging ecosystem, however, the UCB study underscores that the charging networks increasingly must be more like gas stations where a single entity is responsible for the reliability of the charging equipment and resolving any customer experience issues.

Increasingly, federal and state grants, incentives, and loans will require a certain level of uptime and reliability that may be verified through third-party audits. Charging providers that cannot show they will meet these uptime requirements will not qualify for funding. And those approved that cannot maintain uptime minimums may be assessed penalties, have funding dollars reversed, or the charging sites transferred to a different provider.

A reliable EV charging experience is fundamental to EVs becoming mainstream in America. It is no accident that Tesla dominates EV sales in the US and will continue to do so for many years to come. There are many contributing factors to Tesla’s US sales success, but arguably its biggest competitive advantage from a driver’s perspective is a combination of the company’s Supercharger DC fast charger and Level 2 Destination Charging networks.

But as long as this actual or perceived chasm exists between the Tesla charging experience and that of owners of other EV brands and users of non-Tesla EV charging networks — many consumers will choose to buy a Tesla EV simply due to a better charging experience. This doesn’t just result in a higher market share of EV sales for Tesla, but it means that many “on-the-fence” consumers who may not want to buy a Tesla, will simply choose to not purchase an EV altogether and opt for another ICE vehicle.

In an upcoming article I will share all of the elements that should be included in a comprehensive charging customer experience framework.