Tesla had 11.2% of the 2022 California new-car market, making it the second-highest-selling brand in the state with a lineup of only EVs, according to a report from the California New Car Dealers Association (CNCDA).

The 2022 results put Tesla behind Toyota's 17.3% and ahead of Ford, which took 8.4% of the market. But Tesla is gaining, as it saw sales increase 43% year-over-year, while Toyota's sales declined 14% in the same period.

In addition to Ford, Tesla also topped Chevrolet, despite both American brands' popular full-size pickup trucks. The Tesla Cybertruck still hasn't arrived after multiple delays, with the company now promising a Cybertruck production ramp in 2024.

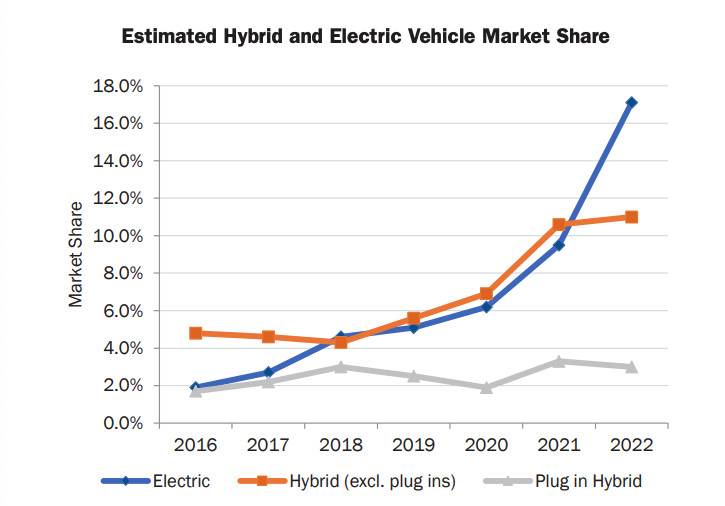

Estimated 2022 California hybrid and EV market share (via California New Car Dealers Association)

Tesla also had two of the top-selling vehicles in California in 2022. The Model 3 was the top passenger car with 78,934 registrations, putting it ahead of the Toyota Camry at 55,967 registrations. The Model Y was classified as the top-selling light truck by the CNCDA with 87,257 registrations, beating the Toyota RAV4's 59,794 registrations for the year.

Tesla's success was helped by overall robust EV sales in California, which reached 17.1% of the overall market in 2022. EV sales in the state increased 50% over 2021, according to the report. In comparison, sales of hybrids and plug-in hybrids seem to have stagnated. The 11% market share for hybrids and 3% for plug-in hybrids were not big changes from 2021.

2023 Tesla Model Y - Courtesy of Tesla, Inc.

Looking specifically at EV sales, Tesla's lead in California isn't showing signs of shrinking yet, although that may happen in the near future as other automakers ramp up EV production.

Ford last week said that future EVs will be "radically simplified" and use smaller batteries and fewer build combinations. While it's tried to ramp up its EVs to keep up with Tesla, the company noted dismal financial results partly from doing so.

Meanwhile, Toyota isn't showing any strong signs of a change in its plans. How soon before those sales lines cross in what's traditionally been Toyota's most important U.S. market?