Why Tesla and BYD could dominate electric car sales for a long time yet: The rise of China

Tesla and BYD are the top selling electric cars in Australia and the world – and that doesn’t look like changing any time soon.

That’s one of the take-outs from a detailed analysis by investment analyst UBS Research, which released a report on its forecasts for EVs and the automotive industry over the next decade.

UBS is forecasting Chinese EV manufacturers will continue to steal market share from traditional car brands as they leverage their head start on electric tech and further implement modern lean manufacturing techniques.

Back to electric car basics

In stripping every panel, nut, bolt and trim item off the upcoming BYD Seal electric sedan, UBS evaluated the core engineering and estimated manufacturing costs. The results that could startle rival brands.

The company says BYD has healthy profit margins on the Tesla Model 3-rivalling Seal and that it could leverage them to bolster market share.

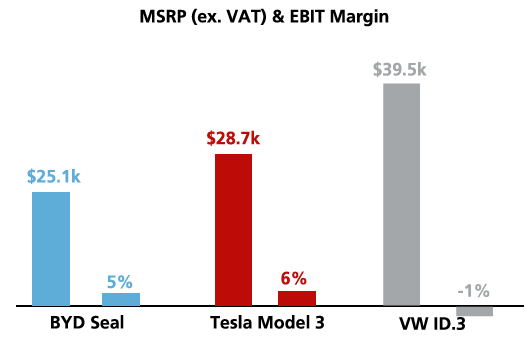

UBS estimates the BYD Seal has a 16 per cent margin – in part because 75 per cent of the value of the car is manufactured in-house – accounting for about US$3700 ($5800) per car.

“The LFP battery that BYD manufactures in-house is a real asset in terms of the way you can integrate it into the vehicle – so-called cell to body design – as well the cost per kilowatt-hour, which is absolutely world class and resulting in a cost advantage over the legacy car makers of about (US)$3000 per vehicle, just on the battery side,” says Patrick Hummel, the UBS head of EU and US autos research.

Crucially, UBS estimates the Seal is about 15 per cent cheaper to manufacture than a made-in-China Tesla Model 3.

However, Tesla’s control of its own software – something most brands outsource – helped it fight back and log a similar profit per car.

China = profits as Europe struggles

UBS estimates a chasm between BYD and legacy car makers, asserting “there’s a sustainable 25 per cent cost advantage (to BYD)”.

All of which is bad news for the likes of Volkswagen and Toyota, according to UBS.

The company estimates that Volkswagen’s profit on its ID.3 electric hatchback – a car due in Australia in 2024 – is “basically non-existent”.

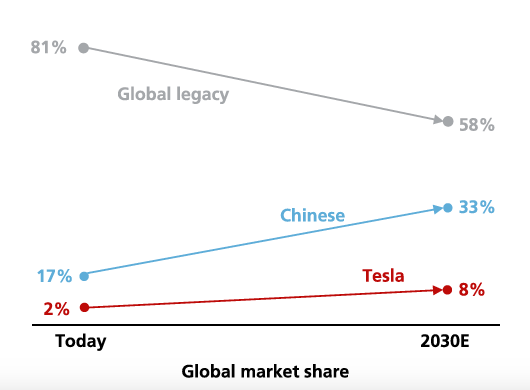

The company is forecasting that traditional car makers could shed 20 percentage points of market share because they are struggling to compete with hard-charging Chinese electric car brands.

At the same time, UBS forecasts “Chinese OEMs will double their market global share from 17 per cent today to 33 per cent by 2030”.

“Tesla will keep expanding its global market share as EV penetration goes up,” says Hummel.

Made in-house

Further benefiting BYD is a high level of vertical integration – the company manufactures its battery packs, whereas most brands buy them externally – that helps contain manufacturing costs.

“The battery itself is a real asset,” says Hummel. “They are amongst the lowest cost battery producers in the world.

“They basically revived the LFP chemistry when everybody else was not interested.”

UBS also predicts Tesla “could be one of the world’s leading car makers by 2030”.

However, despite Tesla declaring it wants to sell 20 million cars annually by 2030 – about double what Toyota currently sells – UBS believes Tesla will only amass about 8 per cent of the overall EV market, which to be fair is still a healthy number.

Tesla to become a dominant EV player

That would give Tesla around seven million annual sales, which would still cement it as a dominant force in the global car market.

UBS also believes Chinese brands have an advantage over rivals in the speed they can bring cars to market.

Whereas traditional brands can take four years or more to introduce cars to market, BYD can achieve the same result in around half the time.

“BYD will decide on a product that enters the market in 2027 in the year 2025 probably,” says Hummel.

“It’s a totally different development cycle and speed to market [to how the industry has traditionally operated].”