Fighting Climate Change With Tax Credits

Can we get more carbon mileage out of politically passable climate policy?

Build Back Better (BBB) prospects are not looking so good. And the problem with swinging for the fences is that, if you swing big and miss, you can end up with nothing. So the time has come for a pragmatic pivot.

Last week, Senator Elizabeth Warren was talking about breaking up BBB to get the passable pieces across the finish line. Senator Edward Markey was warning that the time has come to focus on a smaller package that has the votes. Biden conceded that it’s time to break it up.

If Democrats are looking for passable pieces, the clean energy tax credits in the current BBB proposal look like a relatively safe bet. But can these tax-based subsidies get us on track to meet our GHG targets? Recent research suggests they won’t be near enough. If we are going to fight climate change with tax incentives, can we build them better?

The do-nothing option (not a good option)

It’s been hard to watch BBB falter. This feels somewhat familiar. Back in 2009, we had a new administration with unprecedented climate ambition. After pushing a massive economic stimulus bill through Congress, Obama aimed to pass a comprehensive climate bill with ambitious (for the time) 2020 GHG goals. We all remember how that ended – in disappointment.

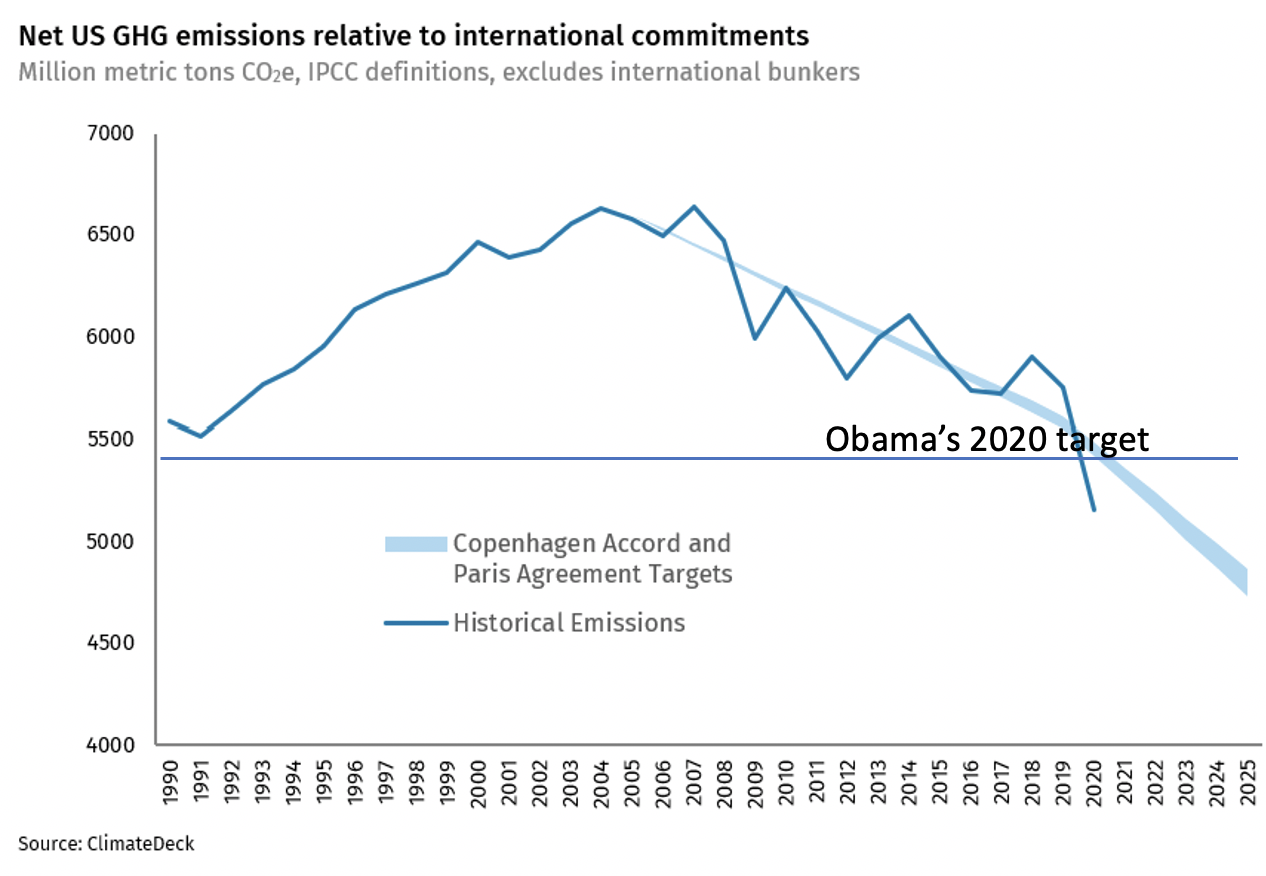

This failure of federal climate policy notwithstanding, the US ended up outperforming Obama’s 2020 GHG emissions targets. So it’s tempting to think/hope that the forces that have been driving down GHG emissions over the past decade will just keep on driving (twice as fast to hit Biden’s more ambitious goal of 80-100% clean energy by 2035).

Some recent work by Harvard economists Jim Stock and Daniel Stuart puts this hopeful idea into stark relief. Jim and Daniel are focused on modeling emissions in the power sector which is expected to deliver an outsized share of total emission reductions over the next decade. Their work is summarized in two recent papers (here and here).

One thing I really like about their approach is that they illustrate emissions trajectories across a range of plausible energy market worlds that we might find ourselves living in. These scenarios differ in terms of clean technology cost assumptions, natural gas price trajectories, and electricity demand projections. Details can be found in the paper.

The graph below summarizes GHG projections under a federal climate policy strike-out scenario. This assumes that no new federal policy makes it out of Congress and tax credits phase out according to current law.

Different lines in the graph track different GHG emissions trajectories under different assumptions about future technology costs, electricity demand, etc. Scenarios in the legend are: low/high electricity demand (D); low/reference/high natural gas prices (G); low/reference/high renewable energy costs (R).

You can see that these GHG projections are particularly sensitive to assumptions about renewable energy costs going forward. But even in the best-case scenario (where wind, solar, and battery storage costs fall faster than expected and efficiencies improve significantly), a federal climate policy strike-out leaves us pretty far short of our decarbonization goals.

Can we green the grid with tax credits?

The figure above underlines the need for policy intervention. But what form should this policy intervention take? What form can it take given the gale force headwinds?

In addition to modeling some home-run policy scenarios, Jim and Daniel have been analyzing a range of possible second-best policies. This includes a scenario in which the only part of BBB that makes the political cut is the material expansion and extension of the $24/MWh production tax credit (indexed to inflation), the 30% investment tax credit, and a tax credit for CCS.

Their modeling results are summarized below. Comparing these GHG trajectories to the strike-out case above, you can see that tax incentives reduce GHGs across a range of energy market scenarios:

In “HiR” scenarios, where renewable energy and storage technology costs fall by only 20-30% between now and 2035, tax credits have a pretty small impact. What’s going on?

The problem is that tax credits are not directly targeted at GHG emissions. These tax incentives subsidize clean technologies at the same rate, regardless of whether these resources displace hydro or coal. And fossil generators can pollute without penalty, no matter how carbon intensive they might be. All carrot and no stick amounts to fighting climate change with one hand tied behind our back.

A modest proposal

I am not a carbon-tax-or-bust economist. But I am climate-anxious and looking for the most effective policy response possible. So let’s just suppose that savvy politicos could finagle enough votes to support not only the expanded tax credits, but also a modest carbon price of $20/ton.

A carbon price of $20/ton is much lower than the social cost of carbon. It is much lower than the prevailing carbon price in Europe ($90 USD) or Canada ($40 USD). But it is higher than the current carbon price across much of the U.S ($0/ton).

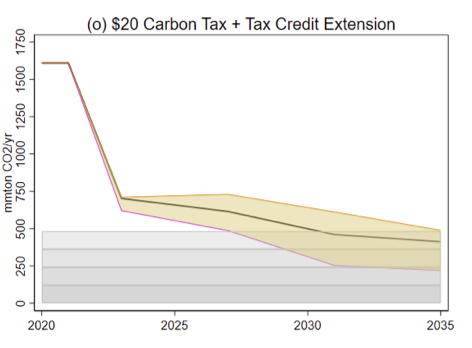

The figure below projects GHG emissions under the BBB tax credit extension + $20 carbon price (increasing at 3% annually in real terms):

This figure illustrates two key points. First, even a modest carbon price can make a big difference. A $20/ton carbon price increases the operating costs at an average coal plant by about $20/MWh (assuming 2.23 lbs/kWh for coal generation). This cost increase is sufficient to drive coal out of the market given the range of natural gas prices considered. And this helps explain the steep drop in GHGs when the carbon price takes effect.

Another take-away: tax incentives and carbon pricing are true complements. The emissions reductions achieved with the combination of the tax credit subsidy and the modest carbon price exceeds the reductions we’d get under either policy acting alone.

Building better tax incentives

Tax credits will work to accelerate needed clean tech investments. This will reduce GHG emissions at home, and help to drive down costs for the rest of the world. Financing clean tech investments with federal tax dollars, versus utility bills, will also mitigate impacts on retail electricity prices. This is important, because a clean energy transition funded by higher electric rates will undermine efforts to electrify other sectors.

In other words, there’s a lot to like about clean energy tax credits. And the BBB proposal adds more. The House-passed plan includes design changes that reduce investment uncertainty and add a direct-pay option. These refinements will help grease the wheels of needed clean energy investments. But they will not address a core problem: GHG polluters can keep polluting for free.

If Democrats could tie a modest carbon tax bow around this tax credit package, we would see much deeper GHG reductions. But if a carbon price is not in the cards at the moment, slow progress on good climate policy is better than no progress. Let’s work to pass the best passable clean energy tax incentives. And then look for every opportunity to sharpen the carbon focus of our policy tools.

Keep up with Energy Institute blog posts, research, and events on Twitter @energyathaas.

Suggested citation: Fowlie, Meredith. “Fighting Climate Change With Tax Credits” Energy Institute Blog, UC Berkeley, January 24, 2022, https://energyathaas.wordpress.com/2022/01/24/fighting-climate-change-with-tax-credits/

Categories

I would rather see fossil fuels subsidies etc be eliminated rather than subsidise solar . etc. Preferential land leases, even have them pay a portion of the cost of the naval protection of sea-lanes. A snowball’s chance of that happening!! But philosophically better than the subsidy for renewable. EVERYTHING should pay its way!!

Assuming that there is a flow of cash from Tax Credits or Carbon Tax, Where is the money going to go in terms of reducing GHG to, and in, the atmosphere? Should they go to the expansion of the present inventory of carbon free renewables. Where should the dollars go to produce the least expensive reliable energy and the lowest cost of bringing GHG in the atmosphere to sustainable levels?. The transportation folks have been quite up front on their environmental impacts with their well-to-wheel calculations (more work needed here on Lithium batteries). The present nuclear generation system has been well documented on it’s environmental impact. The solar, and wind folks are much less inclined to show their environmental ‘well-to-wheel’ impacts in a similar fashion. I have not seen any similar analysis for collecting carbon out of the atmosphere or off shore wave systems .We need to define these answers before we start the program to allocate tax credits or assign a carbon tax.

Meredith, the failure of Build Back Better (BBB) could be blamed on its gargantuan proportions. Or maybe, on a lack of credible tax incentives. Or maybe blame for its death should be placed squarely where it belongs: the obstinacy of anti-nuclear Senate democrats preventing them from coming to the bargaining table with Joe Manchin. The West Virginia senator, two weeks ago, gave them a clear path to supporting BBB: an extension of the proposed $15/megawatthour nuclear tax credit in BBB from six to ten years. Since, neither Biden nor Senate democrats have either supported or rejected the proposal. Worse, it’s been ignored.

https://www.bloomberg.com/news/articles/2022-01-13/manchin-offers-path-for-biden-green-goals-i-m-big-on-nuclear

There is no credible path to decarbonizing U.S. electricity with wind, water, and sunlight. None. Notwithstanding the magical, affordable, long-term storage which will supposedly both power the grid today and tomorrow, for a price of less than thirteen figures. The time for U.S. policymakers and their constituents to get over their hysterical, irrational fear of radiation, of “nuclear waste”, that nuclear fuel can be used to make nuclear weapons, is long overdue. As “The Big Climate Short”, an open letter written by acclaimed climate scientists James Hansen, Makiko Sato and Pushker Kharecha two weeks ago, unequivocally explains:

“The Big Climate Short will dwarf Wall Street’s 2007-2008 Big Short. Perpetrators of the Big Climate Short stretch well beyond the usual suspects – people in search of power and money – and include many who will profess innocence or falsely claim hero status. Such protestations of innocence or ignorance will ring hollow to young people as the consequences of global climate change grow and the story of how it came about is illuminated.

“The underlying reason for the great overshoot of the 2°C scenario is failure of the world to develop a clean energy system for electricity. Instead, the West – or at least the liberal West – has adopted the fantasy of 100% renewable energy within decades, in which both nuclear power and fossil fuels are eliminated. Further, the West has instructed the developing world that it, too, must follow this fantasy. Consequently, President Clinton terminated research and development on nuclear power in the United States after his election in 1992. Germany, as the host nation for COP6 in Bonn in 2001, excluded nuclear power as a clean development mechanism under the Kyoto Protocol. Now, financing for fossil fuel or nuclear power plants is being denied to developing countries, even though the West used those energies to raise its own standards of living and continues to use those energies as needed to maintain living standards.

“The 100% renewables vision was spurred mainly by Amory Lovins, who correctly projected in the 1970s that energy efficiency would allow less energy use than predicted by the Energy Information Agency. However, his expectation that all fossil fuels, nuclear power and large hydro could be replaced by soft renewables is debunked by real world data. Real world utility experts conclude that renewable energies must be complemented by reliable baseload electricity generation available 24/7 – either fossil fuels or nuclear. For the sake of climate, the partner of renewables had better be nuclear power, not fossil fuels.

“The Big Climate Short has been handed to young people. They are inheriting an energy and climate system in which large climate change is now unavoidable. The United Nations and government leaders pretend that global warming, now at 1.2°C, can be curtailed with little additional warming. Capable scientists with an understanding of climate and energy know that this is pure, unadulterated bulls**t. Politicians who claim paltry successes while ignoring the elephants in the room must be called out. We have sold our young people short.”

Click to access NovemberTUpdate+BigClimateShort.23December2021.pdf

You state: “Financing clean tech investments with federal tax dollars, versus utility bills, will also mitigate impacts on retail electricity prices.”

The problem with this is that it does not encourage the most efficient use of energy. The most cost-effective way of reduction carbon emissions is frequently improved energy efficiency, such as better home insulation, see for example https://www.mckinsey.com/about-us/new-at-mckinsey-blog/a-revolutionary-tool-for-cutting-emissions-ten-years-on:

I am skeptical that politicians will resist spending money on politically popular projects that claim to reduce greenhouse gas emissions but are just pork barrel projects. For example, using carbon cap and trade funds to balance the California budget or fund high speed rail, neither of which is a cost-effective way of reducing carbon emissions. A better way that may be politically more appealing is the carbon fee and dividend (search terms “carbon fee and dividend.”) This proposal would result in the lowest income residents getting more back in a dividend than the increase in their energy use bills, while encouraging energy efficiency and the lowest cost per tonne carbon reduction technology. Unless society rigorously funds the cheapest method of carbon reduction, long-term climate goals will fail.

These models are nice, but some questions need to be raised:

1. Do these models account for the physical constraints of operating an electric grid or do they simply assume that renewables generate all the time as they replace steady forms of power? How is back-up/reliability for intermittency provided?

2. Renewables are claimed to be the cheapest form of electricity at this point. Why do they still need subsidies? There seems to be a logical inconsistency.

3. What does all this cost?

The papers referenced discuss storage, so that implies that they are considering variability of renewable output. The cost of mitigating variability appears to be trivial, on the order of 2-3% of total operating costs (which in turn are only a portion of total generation costs): https://www.sciencedirect.com/science/article/pii/S0038092X21010616?via%3Dihub

First, conventional plants are also subsidized through other channels. There is dispute over the relative magnitude of the subsidies, but its important to acknowledge that is not just renewables. Second, the important thrust of renewable subsidies is to accelerate the retirement of conventional plants. That means overcoming the existing financial commitments to those existing plants. Third, there have been many studies published on the range of costs for these policies, many of them referenced already on this blog site. No paper can cover the full range of issues. This paper appears to be an interesting contribution to one aspect of these issues. If you want to acknowledge that they successfully showed that these policies have these effects, then we can move on to what the potential costs and/or benefits might be.

“The cost of mitigating variability appears to be trivial, on the order of 2-3% of total operating costs….”

Nowhere in your source, Richard, is there support for this statement. Your source addresses the costs of day ahead errors in solar forecasting – it makes makes no mention of variability or the cost of mitigating it. Yet somehow you would have readers believe that the support from natural gas peaker plants required to run in spinning reserve, whenever solar or wind are online, is only 2-3% of total operating costs?

Excellent. I agree with your analysis. Thanks for your efforts.