Battery metals in South America are a crucial source of the green transition. Matt Brundrett of The Innovation Platform investigates several countries with access to these materials and their plans to accelerate development.

The climate crisis has increased the demand for sustainable energy and green technologies to unprecedented levels. Naturally, the demand for the materials critical to the construction of batteries is increasing with it. South America is known to possess a vast amount of these materials, including lithium, copper, and silver. Here, we investigate the current landscape of exploration and mining of battery metals in South America, and their plans to accommodate the rapidly rising demand.

The world market for batteries is growing and is set to continue doing so quickly. The world is grappling with climate change and is desperately seeking ways to cut down on CO2 and NO2 emissions. Obviously, this means a great shift to electric power for many things, especially in the rapidly evolving electric vehicle (EV) industry. In 2016, the Paris Agreement was put into action, meaning countries had to outline their plans to curb climate change, and the agreement’s overall goal is to keep global warming at 1.5C° or below by 2030. This is agreed to be our best bet to begin gradually reversing climate change.

With this gargantuan switch from fossil fuels to green energies being a necessity of the agreement, there is the issue of storage. As opposed to fossil fuels, batteries are crucial to storing green energies, such as solar or wind energy. As such, batteries and the metals required to make them are becoming more important than ever, and so many countries that contain such materials are looking to increase their mining and processing efforts as a result.

South America is a key focus in the battery metals space, particularly for lithium. The ‘Lithium Triangle’ – which comprises Argentina, Chile, and Bolivia – holds over 50% of the world’s identified lithium resources, according to the U.S Geological Survey. South America is also home to a large global supply of other key materials including silver, with Peru holding the top spot for silver production as of 2020, according to Global Data. With the rapidly accelerating demand for battery materials, it is no surprise that many countries in South America are setting forth plans and initiatives to increase the mining and processing of these materials.

Chile’s vast battery metals resources

Chile is the southernmost country on the planet and a key player in mining in South America. Between the years 1973 and 1990, Chile was under the control of the dictator General Augusto Pinochet. Unlike most countries when handing over from a dictatorship to a democracy, Chile remained relatively stable and continues to do so today. This has been of great benefit to the mining industry as businesses have been much more willing to invest, and capital is readily available, as well as the legal system providing protections to investors and mine workers themselves are receiving reasonable pay.

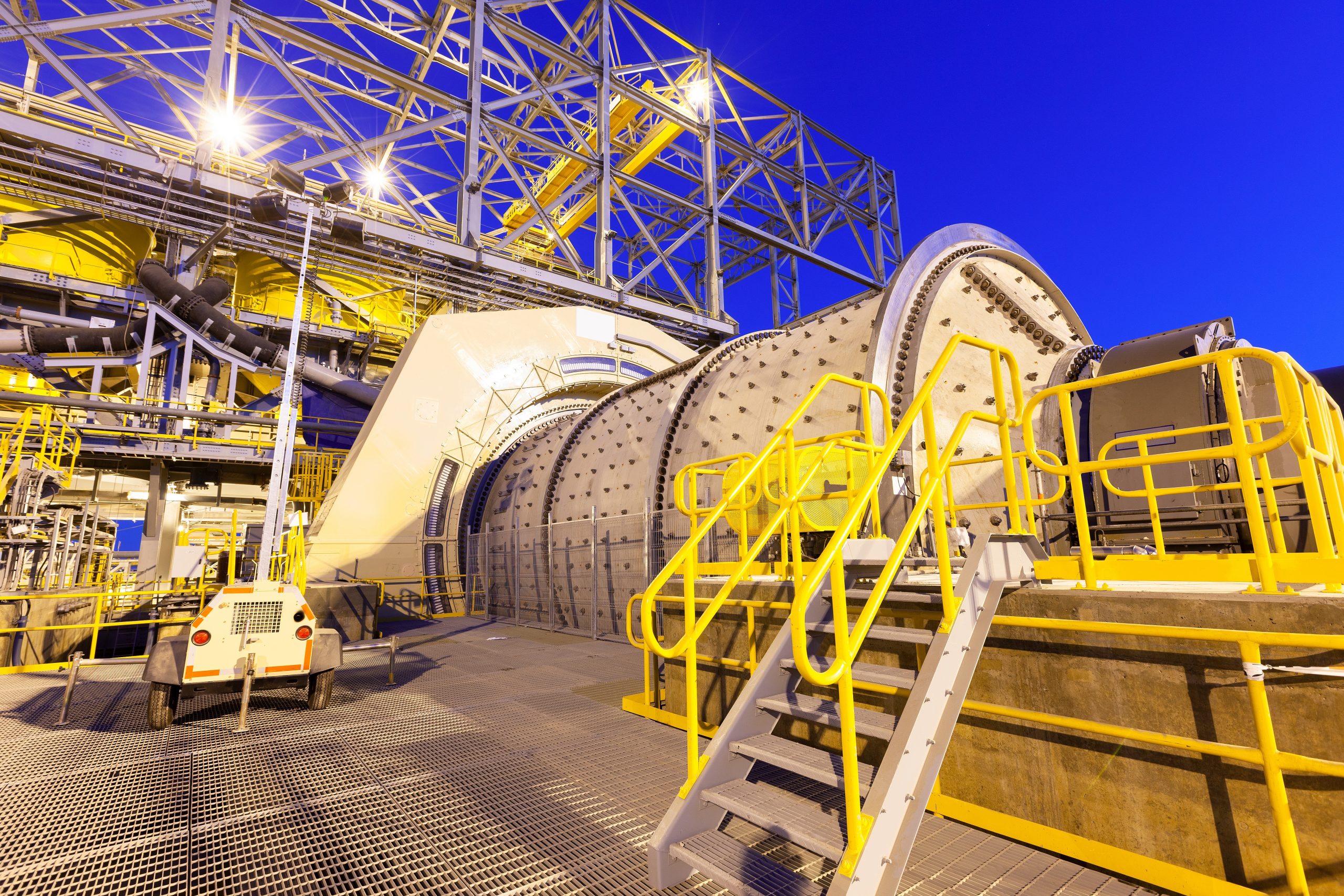

One of the main battery metals in South America is copper. Copper is used in the current collector within batteries, essentially regulating the flow of electricity within the battery. Therefore, copper mining is set to become a bigger industry than ever before, and two of the top spots in copper production globally are already held by Chile and Peru.1

In Chile, copper mining was a nationalised industry until the 1970s; however, it appears there have been recent attempts to gradually ease into some state control of mining once again. In 2021, Chile produced roughly 25% of the world’s copper, and a new national constitution was proposed and then put to the vote in 2022. The constitution would essentially give the government power to seize privately owned copper and lithium mines, imposing a severe risk of sky-high tax rates and rock-bottom profit margins.

It was identified by many Chileans as the first step towards another nationalised mining industry and even as communism by some.2,3 The results of the vote ended with a 62% rejection of the constitution, and the government was tasked with writing up another one. The vote for the second one is due in December of this year but means that, for now, the profit margins of copper are relatively safe.

Additionally, Chile is implementing a tax reform that will affect copper mining by increasing the royalties on companies that produce more than 50,000MT of copper per year. This aims to increase the country’s GDP by 4.1% and is likely to do so, as well as ensuring that the copper mining industry has a lot of room for further investment. This policy, however, does not directly increase the actual production and processing of copper as opening more copper mines would, for example. In this regard, Chile is more focused on lithium.

Chile already has a distinct advantage over the other two countries in the Lithium Triangle, as due to its victory in the War of the Pacific in 1884, they have a monopoly on the ports that offer quicker access to exporting the lithium once it is mined. More recently, Chile has outlined plans to bring governmental power into the lithium industry, essentially giving the state more power in the process of lithium extraction than just the current two authorised companies for mining in Chile: SQM and Albemarle. This essentially means that, rather than the state claiming and retaining control of lithium mining, there is an agreement between the state and private companies.

Other parts of the Chilean plan include implementing a cap on lithium revenue expenditure, limiting the cost of mining and production of lithium, as well as increasing the transparency and availability of information in negotiations and contracts. Presumably, the increased state participation in the industry is intended to help this point along as well. There are also intentions to establish an institute of lithium and new technologies in Antofagasta. Companies will fund this to deepen the knowledge and research into the location, extraction, and processing of lithium in tandem with the other institutions in Chile that deal with this topic. Chile clearly means to ramp up the supply of lithium both for the world’s benefit and its own.

Peru’s mining expertise

Peru has a long history of mining, with silver mining especially making its way towards being a part of the Peruvian national identity. The use of silver as ornaments in the country dates as far back as the first millennium,4 but major significant advancements really took hold with the Spanish conquest of South America beginning in 1492. From there, Peru’s silver production and trade increased, along with that of Bolivia and Mexico, to account for 85% of the world’s silver.5

Peru is clearly planning on expanding its production of copper, hoping to produce 15% more copper in 2023 than the 2.44 million MT produced in 2022. It expects $7bn in investments in order to achieve this, along with new mining operations such as the $5.5bn Quellaveco mine. This follows mass mining protests in 2022 which disrupted much of the copper mining process and slowed many copper mines to a halt. As such, the Peruvian government is seeking to revive the copper industry and claim back some of the missed profits from the previous year, as well as cover the current year.

Peru is also a top-three producer of silver,6 another critical battery metal. In 2020, Peru produced 109.7 million oz, which is forecast to increase to 140 million oz by 2024, and silver mining currently accounts for 50% of Peru’s export revenue. Peru is evidently on track to keep this output up, as mining companies continue on as normal. Hochschild Mining, for example, announced in 2019 that their Inmaculada mining project would increase its lifespan by a decade after discovering another 1.3 million oz within its project border. This cements Peru’s position to become an important player in the copper and silver industries.

Argentina’s role in the battery revolution

Argentina is a leader of battery metals in South America, with over a century of mining metals such as gold, silver, and copper,7 and the mining industry is one of the most important industries in the country, with it accounting for 5% of Argentinian foreign sales, making it the country’s fourth largest exporter.8 Argentina has had an unstable few decades in terms of politics, with a somewhat paradoxical situation of having stable politics, but an unstable economy. In the years 2016-2020, Argentina’s GDP dropped by 4.8%.9 However, mining is an important tradition in Argentina,10 and as such, the country may be presented with opportunities to boost its economy by further enhancing their mining operations and output, as well as keeping the mining industry more secure.

And so, Argentina has put in place no fewer than six projects to increase its production of lithium, targeting an annual production of 200,000MT by 2025, a sharp rise from its 33,000MT in 2022. By 2030, Argentina is hoping to have 11 lithium mines in operation. Dozens more are under consideration as Argentina makes one of the biggest moves to increase lithium mining the world has ever seen to accommodate the skyrocketing demand for lithium. By 2040, the demand for lithium is expected to have increased 40-fold.11 The price of lithium has also been volatile in the past few years, rising to sky-high levels at the end of 2021 and for most of 2022 and then crashing substantially at the start of 2023 due to a drop in demand for electric vehicles in the predominantly Chinese market. However, the price is steadily rising again, and Argentina clearly intends to take advantage of this.

One of the projects that will be implemented is from a company named Lilac Solutions which is opening a mine named Kachi. The company claims to have a Direct Lithium Extraction (DLE) method that is both far quicker and more efficient than the traditional brine method of extracting lithium, which can take up to two years and allows most of the water involved to evaporate. Lilac’s technology is designed to produce more than twice the amount that traditional methods do in as little as a few weeks, and return most of the water to its tanks as salt water. If needed, this water can then presumably be cleansed and returned to the land as fresh water. If so, this indeed may be a landmark victory in the march for more environmentally friendly and sustainable lithium mining. Argentina may well lead the way in sustainable battery metals in South America in the next few years.

Bolivia’s staggering potential

Bolivia is one of the smaller South American countries with its own history of mining, starting with the Incan Empire in the 15th century as they created vast underground mines to extract silver, copper, and gold.12 Today, after the War of the Pacific, Bolivia’s main critical raw material (CRM) mining focus is silver, with a very small amount of mining dedicated to copper.13

In January, Bolivia announced a partnership with a Chinese consortium to extract lithium in its vast salt flats. Like Argentina, the country is set to adopt new technologies to somewhat replace the traditional method of lithium mining, as that method is less suited to the Bolivian climate and the impurities associated with Bolivian lithium. This new method of lithium mining is another form of DLE, which would directly take the lithium from the brine and means that little to no evaporation is required in the process.

Bolivia is hoping to improve the previous results it has seen from the traditional method, especially as the salt flats that the lithium is contained in see rain for months at a time during certain times of the year. Bolivia is also currently in discussions to open further mining agreements with China, the US and Russia. While still early days, this is set to see around $1bn (€916.3m) in investment.

Brazil: A leading graphite hub

Brazil also has a long history of mining spanning from the late 1600s, seeing gold rushes, diamond rushes, and huge operations to extract iron lasting hundreds of years each. Today, Brazil is a key producer of an important CRM: graphite.

Brazil is currently the fourth largest producer of graphite in the world at 87,000MT and is seeking to up its production further, with China at the top, but an ever-increasing need for graphite is giving non-Chinese graphite production a boost. Brazil has taken advantage of this with the Santa Cruz Graphite Project (SCGP). The SCGP is estimated to have a life of mine of 19 years and 12 million MT of mineable resources, producing around 25,000MT per year. The project is being put in place with an estimated capital expenditure of £26.5m (€31.05m) and, combined with Brazil’s existing output of graphite, could boost the country’s production to around 112,000MT per year.

This would place Brazil third in the top producers of graphite on the globe, taking over Mozambique’s 110,000MT. As graphite is another extremely important material in the production of batteries, this is an ample opportunity for Brazil to step forward into the spotlight.

Becoming a global supplier of battery metals

As mentioned previously, the demand for battery metals in South America is only going to go up. With world politics as they are, the US, the EU, and other European countries have policies in place to diversify the sources of their material in an attempt to remove the leverage that certain countries have over them, especially China and Russia.

This means that South America is being presented with a prosperous opportunity to trade with various countries as they possess vast amounts of these critical materials. Mostly, there are plans in place to ramp up the extraction and production of these materials in an attempt to accommodate demand, but in some instances, such as Chile, they are also looking to increase their own use of these materials with research and production of batteries.

References

- Ranked: The World’s Largest Copper Producers (visualcapitalist.com)

- Chile constitution: Voters overwhelmingly reject radical change – BBC News

- Chile’s constitutional assembly rejects plans to nationalise parts of mining sector | Chile | The Guardian

- Mining in Peru — A Brief History of Peru’s Silver Mining Industry – (agmr.ca)

- Silver Mining in History | (silverinstitute.org)

- Top 10 Silver-producing Countries (Updated 2023) (investingnews.com)

- Mining in Argentina (kpmg.com)

- Mining in Argentina: overview | Practical Law (thomsonreuters.com)

- (PDF) Peronism Back in Power in Argentina: Economic Crisis and Political Stability (researchgate.net)

- Mining in Argentina (kpmg.com)

- Why 2023 is a pivotal year for lithium prices (australianresourcesandinvestment.com.au)

- Mining in Bolivia Industry: From Pre-Columbian Times to the Present – anglocanex.com

- Minerals of Bolivia – South America to the World