Based on its latest plans, Nio has slowed down some of the equipment purchases for its battery factory, according to local media.

(Image credit: CnEVPost)

Nio's (NYSE: NIO) plans to develop its own power batteries have been delayed, as the electric vehicle (EV) startup becomes cautious about investing in new projects.

Nio has delayed plans to mass-produce its in-house developed batteries and will move forward with the project on a new timeline, local media outlet 36kr reported today.

Based on the latest plan, Nio has slowed down some of the equipment purchases for its battery factory, the report said, citing several industry chain sources familiar with the matter.

"Based on business needs, we have postponed the mass production of batteries. The program is progressing normally according to the new mass production schedule," Nio responded to 36kr.

Nio founder, chairman, and CEO William Li confirmed during an earnings call on June 9, 2022 that the company would develop its own batteries.

He said at the time that Nio had a battery team consisting of more than 400 people to research areas including battery materials, electric cells, and battery management systems, and to comprehensively establish battery system R&D and industrialization capabilities.

On February 24, Reuters reported that Nio plans to build its first battery factory to produce large cylindrical batteries similar to those used by Tesla.

The new plant will have an annual battery capacity of 40 GWh, which could power about 400,000 long-range EVs, the report said.

Beijing-based Cbea.com, which focuses on the battery industry, reported on February 27 that Nio held a battery partner forum in Hefei, Anhui province, where its two plants are located, on February 24, at which the company announced the start of construction of the first phase of its battery facility.

In the report today, 36kr said that construction of Nio's battery factory plant is still underway, but that equipment purchases have been put on hold.

The investment in the production line is divided into two parts, with the construction of the facilities, including the plant, mainly funded by the Hefei government, while the equipment is procured by Nio, according to 36kr.

Looking at Nio's sales performance in the first half of the year, the delay of the project is not unexpected, and the internal team is mostly voicing understanding, the report said.

"The project definitely needs to be delayed -- how many cars have only been sold? No sensible person would have invested in these immediately," said a source close to Nio.

Nio's sales have been weak over the past year due to model changeover and consumers becoming cautious about spending large sums of money in China's weak economy.

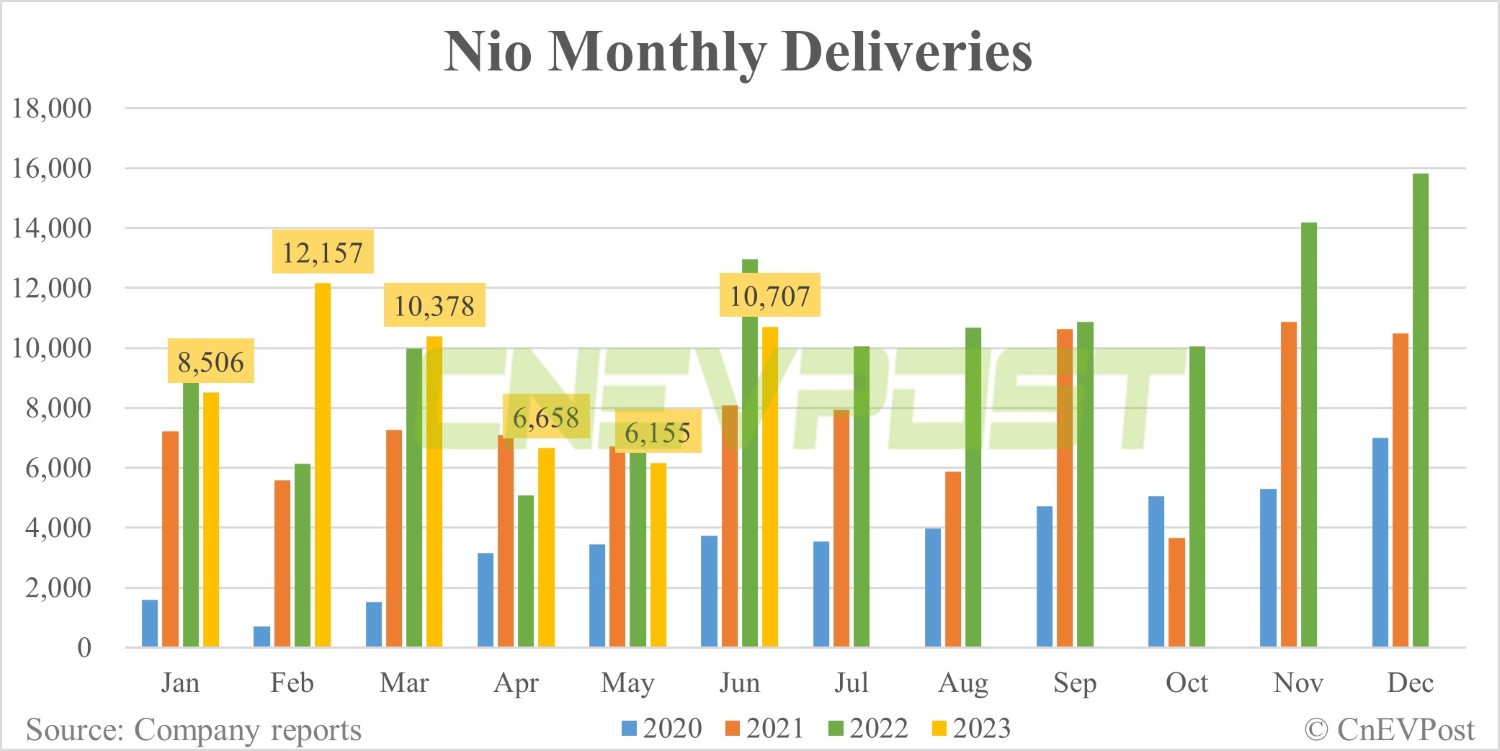

In the second half of last year, monthly deliveries of the Nio were at just over 10,000 units for most months. In May this year, Nio deliveries fell to 6,155 units, the lowest since April last year.

The company's deliveries bounced back to 10,707 units in June as deliveries of several new models began. However, the weak deliveries, along with the weak financial performance, are forcing Nio to become cautious in its spending.

Nio will manage its cash flow carefully, with some fixed-asset investments postponed, Li said on a June 9 analyst call after the company reported first-quarter results.

Li didn't explicitly mention which investments would be delayed at the time, but the low-priority but expensive battery project could be one of them.

Battery production lines need extremely high investment, requiring the introduction of high-volume, fully automated production lines, with investment budgets that can reach billions or even tens of billions of RMB, 36kr's report noted.

For a battery production line, typically around RMB 200 million ($27.8 million) is needed to produce 1 GWh of battery cells, while the large cylindrical production line Nio is seeking could cost even more, the report said, citing an industry source.

Nio started to set up its battery R&D team in 2021, with related planning taking place in early 2022. With battery prices skyrocketing, its battery development team has even vowed to ensure that in-house developed batteries will be used in production cars starting in 2024, according to the report.

Nio's production lines for the battery aren't moving full speed ahead, and it's focusing on 150-kWh semi-solid-state battery pack this year, the report said.

A large number of Nio's R&D and industrialization staff are put on the semi-solid-state battery pack project, and other cell and battery pack projects have been delayed to varying degrees, and the in-house battery production lines are apparently no longer urgent, the report said.

Nio recently updated the owner's manuals for its vehicles to begin to include the 150-kWh battery pack, which Li said at the launch of the new ES6 in May that the new pack would be in service in July.

On June 30, Beijing WeLion New Energy Technology, the supplier of the batteries, began delivering 360 Wh/kg lithium cells to Nio and held a delivery ceremony in Huzhou, Zhejiang province, where its production base is located.

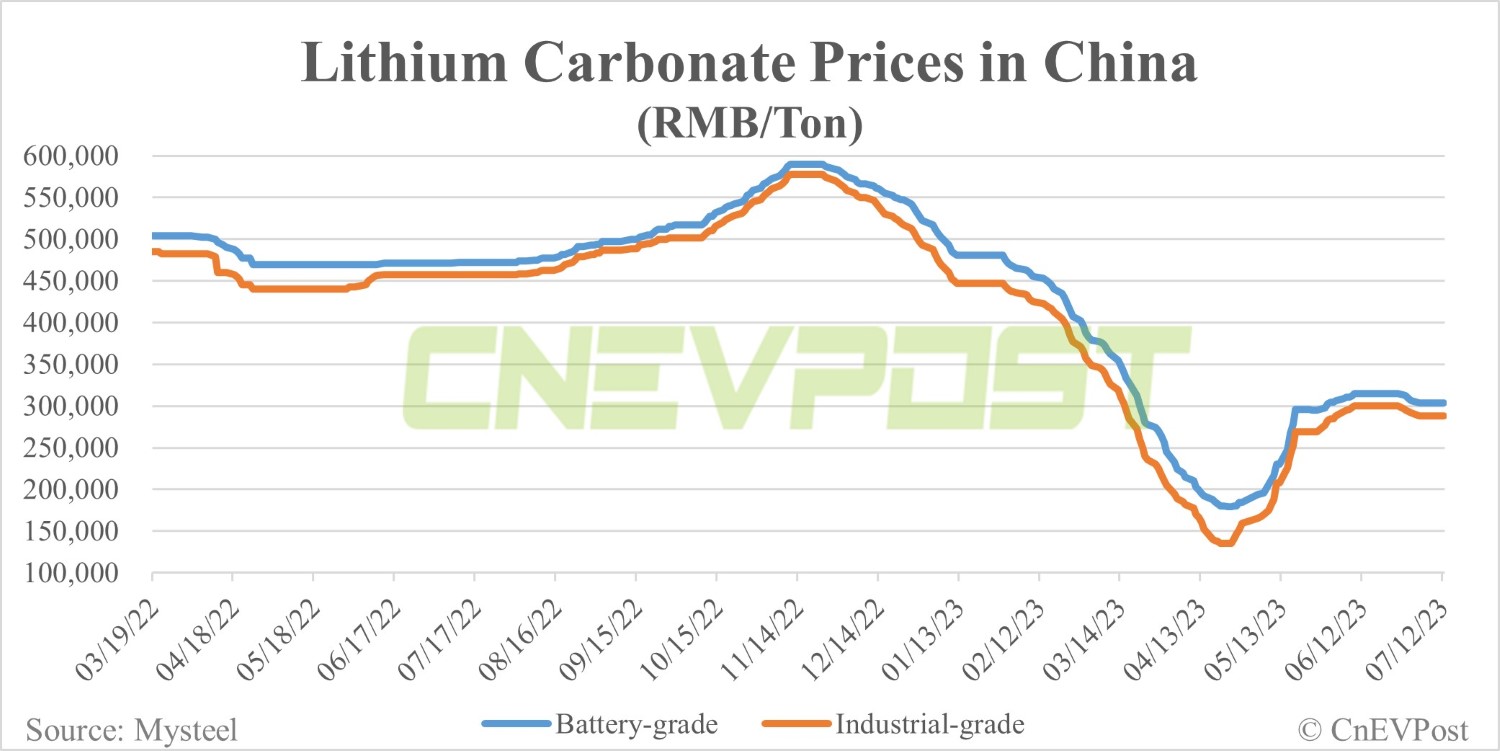

In addition, lithium prices have plummeted and battery supply is no longer an issue threatening the company, 36kr said, citing a person familiar with the matter.

The price of lithium carbonate, a key raw material for power batteries, rose to about RMB 600,000 per ton in China at one point in November 2022, about 14 times the June 2020 average price of RMB 41,000 per ton.

After that, however, lithium carbonate prices began to slide and only stopped falling by April.

Until April 21, lithium carbonate prices hadn't seen a single one-day increase in China this year, down about 65 percent since the beginning of the year.

Prices for lithium carbonate have remained largely stable over the past month, with battery-grade lithium carbonate currently priced at around RMB 300,000 and industrial-grade at about RMB 290,000, according to data from Mysteel.

($1 = RMB 7.1903)