Toyota is securing substantial funding as it looks to catch up in the EV race. Sources close to the matter say Toyota and its affiliates will sell a stake of around $4.7B in Denso, the second-largest global auto supplier.

Toyota plans to sell around 10% (roughly $4.7 billion) of its stake in the supplier by the end of the year. The move comes as Toyota looks to accelerate next-gen EV tech development.

The sources told Reuters Toyota Motor’s portion will be about half of the 10% while Toyota Industries and Aisin will make up the other half. Denso plans to buy back some of the shares to soften the impact it may have on market prices. The supplier’s shares were down 6% in pre-market trading.

At $4.7B (700 billion yen), the sale would be the biggest the auto industry has seen in over a decade.

According to LSEG data, the sale would be the second largest behind the $9B share sale in Japan Post Bank in March. The move underscores the significance of funding in the transition to EVs.

A Toyota spokesperson said it was “not in a position to comment on Denso.” Denso declined to comment.

Toyota to unload $4.7B in top supplier for EV funding

Toyota unveiled several innovations over the past several months designed to help it catch up with EV leaders like Tesla.

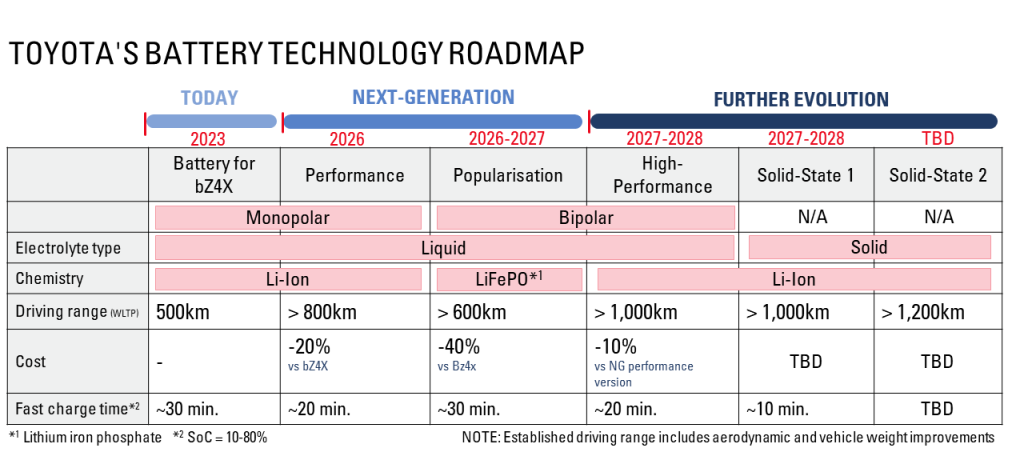

At a workshop in June, Toyota highlighted new tech, including next-gen EV batteries, designs, and manufacturing upgrades to improve efficiency.

Toyota is promising its next-gen EVs, due out in 2026, will feature nearly 500 miles (800 km) of range.

The automaker is also taking a page from Tesla’s playbook (like most of the industry) with plans to introduce Giga casting for production.

The fundraising comes after Toyota said it would sell a 250 billion yen ($1.7B) stake in KDDI Corp in July, shortly after revealing the new tech.

Toyota is expected to remain Denso’s top investor. The automaker held around a 24% stake at the end of September.

Electrek’s Take

As one of the world’s largest automakers, Toyota has the resources and network to compete in the EV era.

Top comment by Ian Ollmann

Toyota has crushing debt and needs to spend billions to catch up. Selling off unneeded assets makes a lot of sense when interest rates are high.

However, its initial hesitation has set it far behind the pack. As buyers switch to EVs, Toyota is losing market share in key markets like China and Thailand.

The company has claimed to accelerate EV production for several years with little to show. Perhaps $4 billion in funding will help charge up the transition.

Toyota’s new EV tech is due out in 2026. With the transition to EVs proving costly for many legacy automakers, Toyota is bolstering its funds now.

A rapid transition from Toyota is unlikely anytime soon. Toyota has said it will lean on its hybrid tech for the foreseeable future.

FTC: We use income earning auto affiliate links. More.

Comments