Tesla Model Y Rules In Europe — Europe EV Sales Report

Approximately 288,000 plugin vehicles were registered in September in Europe, +15% year over year (YoY). Unfortunately, the overall market also grew by double digits, +11%, as it is finally recovering from a couple of bad years.

Last month’s plugin vehicle share of the overall European auto market was 25% (17% full electrics/BEVs). With that result, the 2023 plugin vehicle share remained at 23% (16% for BEVs alone).

Most of the plugin vehicle growth came from BEVs, which were up 18% YoY, while PHEVs were up by just 8%. This is visible in the BEV vs. PHEV sales breakdown as well, with pure electrics accounting for 68% of all plugin sales in September, against a 2023 average of 67%.

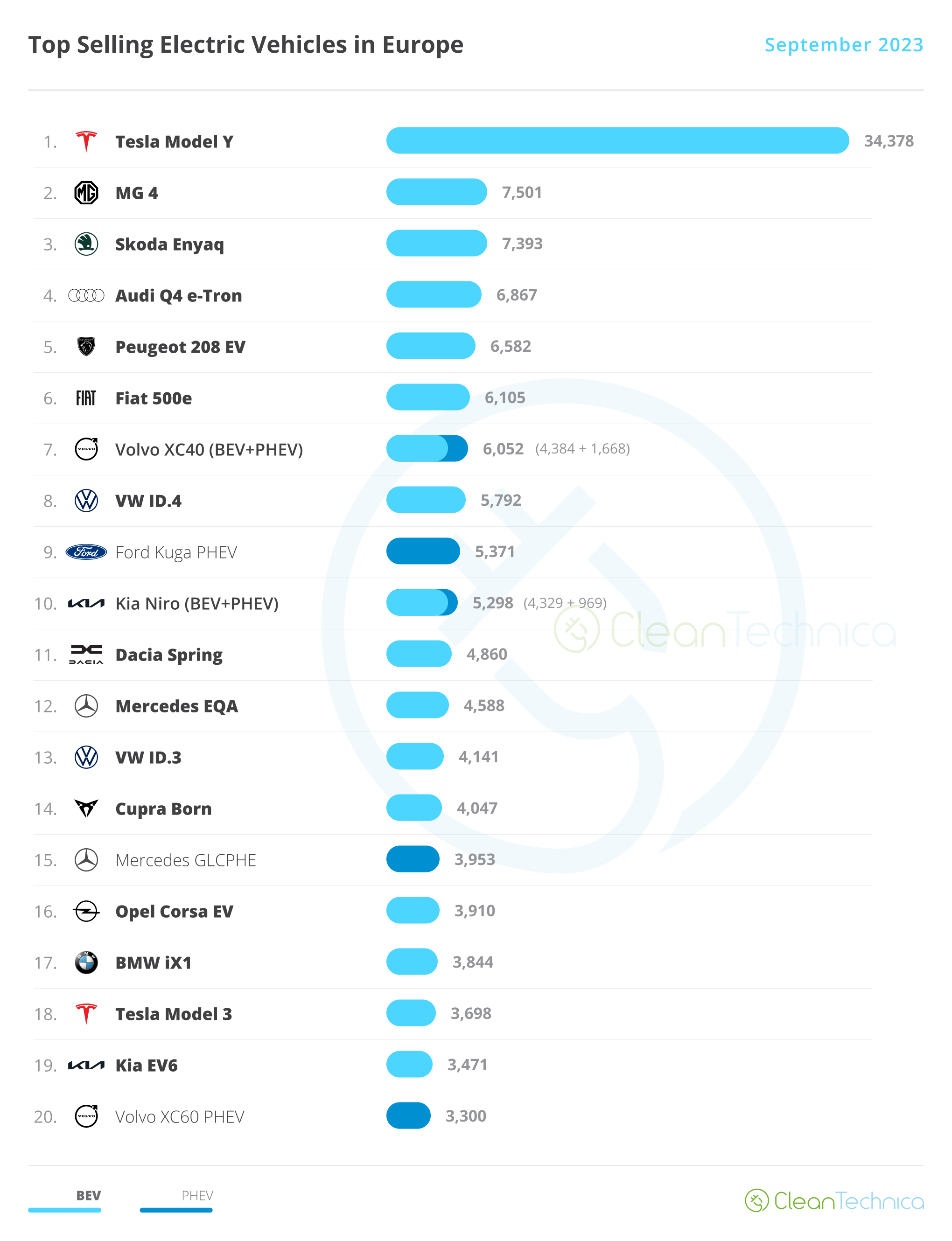

The highlight of the month was the Tesla Model Y selling four times more units than the runner-up MG4. Also, the Peugeot e-208 registered a record 6,582 units, allowing it to end the month in the 5th spot. But let’s look closer at September’s plugin top 5:

#1 Tesla Model Y — For the 11th month in a row, Tesla’s crossover was the best selling EV in Europe, and with the #2 model selling one fourth the number of vehicles, one cannot really imagine who could break the Model Y’s domination in Europe. In September, the midsizer had 34,378 registrations. However, this year could be considered “Peak Model Y” in Europe. The midsized crossover should continue to post similar results in the coming quarters in Europe, but do not expect sales to increase significantly over current volumes, as I am confident the Model Y has already reached the market’s natural limits. Also limiting its growth will be the refreshed Tesla Model 3, which could steal some sales from it, even if Europeans aren’t really into sedans these days. Regarding last month’s performance, the Model Y’s biggest European markets included France (5,035 units), the UK (4,035 units), and Germany (3,921 units), but other countries also posted strong results, like Sweden (3,050 units), Norway (2,476), Denmark (2,389), and the Netherlands (1,789), confirming the Model Y’s popularity in Scandinavia and Benelux.

#2 MG4 — The dragon slayer hatchback is fulfilling SAIC’s best expectations, with another podium presence thanks to 7,501 registrations. With almost unbeatable value for money, and the small detail of being 10,000 euros cheaper than its most direct competition (the VW ID.3 and Renault Megane EV), the Sino-British model is becoming the reference point among Europe’s compact hatchback class, a category that used to be the sheer definition of what a European car was, with examples like the VW Golf, Skoda Octavia, and Opel Astra. Back to the MG4’s September performance, its main markets were the UK (3,120 registrations), France (1,945 registrations), and Sweden (451 registrations).

#3 Skoda Enyaq — The Czech crossover is a sure value in the EV arena, and although the VW ID.4 is the MEB-platform best seller overall, the good looking crossover has managed to end September with a podium presence. The model had 7,393 sales, another great performance for the Skoda EV. Expect sales to continue strong in the coming months, especially now that production constraints have finally ended. Regarding the Enyaq’s September results, its biggest market was Germany (1,137 registrations), followed by the UK (1,080 registrations), Norway (717 registrations), and Sweden (708 registrations), confirming the Enyaq’s popularity in Scandinavia.

#4 Audi Q4 e-tron — Audi’s compact crossover won a top 5 presence in September, thanks to 6,867 registrations. With increased production availability, the compact Audi is now only dependent on demand to improve its performances. Interestingly, it seems compact crossovers are becoming the current specialty of the German Three Marys (BMW, Audi, Mercedes), with the best selling BEVs from these three brands all being precisely compact crossovers (Q4 e-tron, EQA, iX1). With upper segment sales suffering from the Tesla black-hole effect, it seems the three premium German sisters are taking solace from this category. Regarding the Q4’s September performance, its main market was the UK (2,310 registrations), followed by its domestic market of Germany (1,187 registrations) and then at a distance by Belgium (618 registrations), a known stronghold for the four-rings brand.

#5 Peugeot e-208 — Although going through the process of a long awaited refresh, the small French EV scored a record sales level in September, 6,582 units, winning its category in August. The French hatchback is currently one of Stellantis’ major cash cows in the EV arena, along with the Fiat 500e, confirming the auto group’s strong presence in the smallest categories in Europe. Looking at September’s performance, France (3,924 registrations) was its biggest market by far, followed at a distance by Germany (859 registrations) and the Netherlands (523 registrations), with this last market proving to be one where the Peugeot 208 is most popular.

Looking at the rest of the September table, the highlights are all in the second half of the table, while the lowlights all belong to Volkswagen.

Starting with this last one, in a month known for its sales peak, after the two holiday months of July and August, the German brand best sellers actually had their worst performances since January (ID.3) and February (ID.4). A small lapse, due to the upcoming specs refresh? Or is the demand drop starting to become visible?

Back to the highlights, the main news was the record performance of the #12 EQA, with 4,588 registrations, leading a great month for Mercedes, and the new Mercedes GLC PHEV returning to the table in #15 with 3,953 registrations, the nameplate’s best result since December 2021. Below the top 20, other Mercedes also hit record scores, like the EQB (2,519 registrations) and EQE sedan (2,112 registrations), and even the veteran EQC had a year-best result, 2,860 registrations.

Below the top 20, we had several models with positive performances, like the BMW iX3 reaching 3,142 registrations, a new year best, and the BMW i4 getting 2,979 deliveries. In the full size category, the Audi Q8 e-tron continued to remain in charge, thanks to September’s 2,544 registrations, but we have a surprise in the second spot, providing evidence once again of the effectiveness of doing slooooow ramp-ups. The Mercedes EQE sedan is finally starting to live up to expectations, thanks to its aforementioned 2,112 deliveries. Will we still see Mercedes fancy (and streamlined) sedan steal the category leadership spot?

There was also good news in the Stellantis stable, with the Opel Mokka EV (2,714 units) getting closer to the top 20, and the German brand hoping to place its two best sellers in the table at the same time.

Finally, in MG’s lineup, it isn’t just the MG4 hatchback shining. Despite being based in an older platform, the ZS EV crossover had 2,854 deliveries, contributing for MG’s 92% YoY growth rate in September.

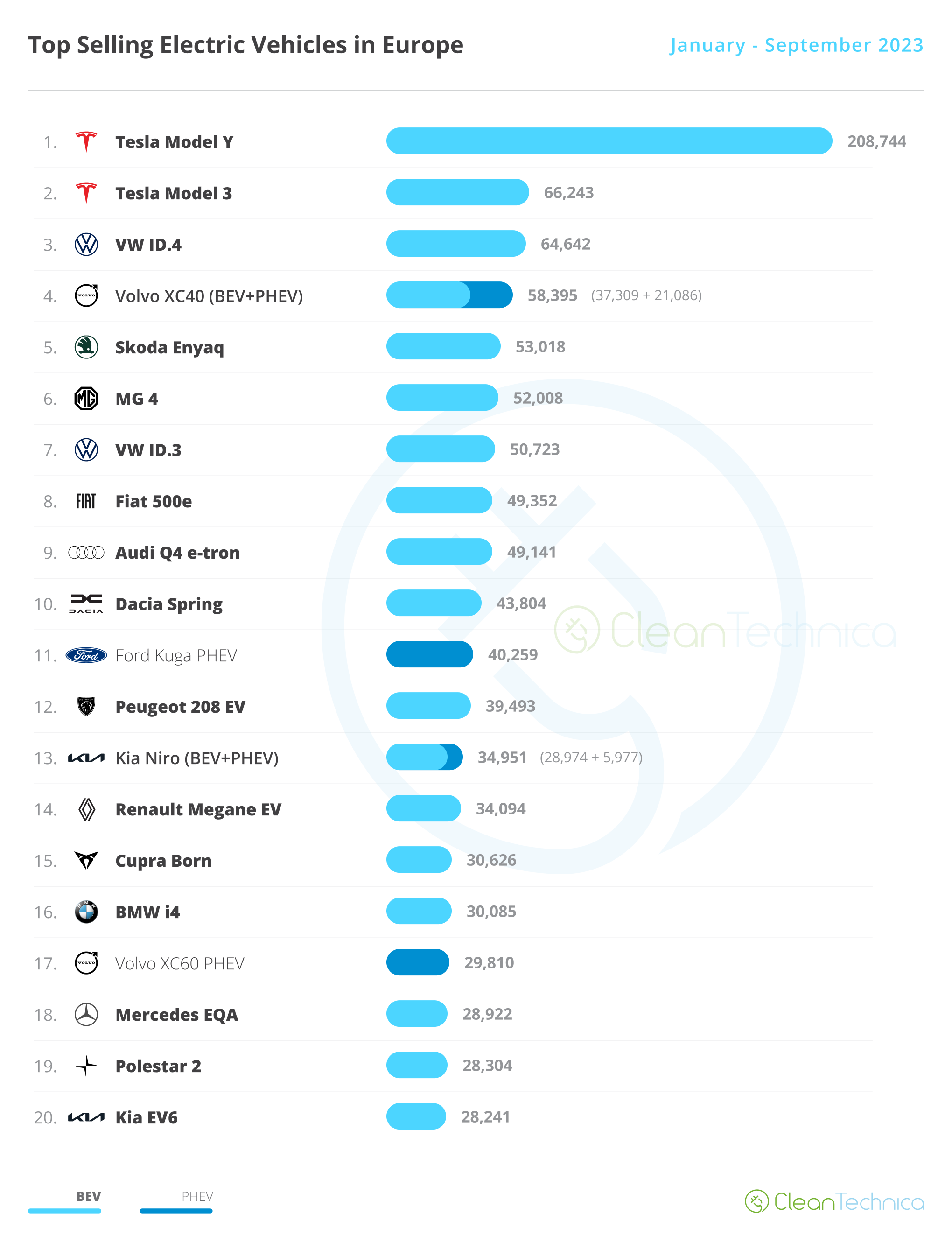

Looking at the 2023 ranking, with the Tesla Model Y having three times as many deliveries as the new runner-up Tesla Model 3, the attention is now focused on the remaining podium positions.

On that topic, there are really only two candidates remaining in competition for the silver medal. And if the production ramp-up of the refreshed Model 3 goes smoothly, the VW ID.4 shouldn’t have a chance to compete for the runner-up spot, as the Model 3 should have a BIG December.

Regarding the #4 Volvo XC40, it is probably already suffering from the comparison with Volvo’s newborn EX30. That might be good news for a number of models behind it, namely the #5 Skoda Enyaq and #6 MG4, which could end the year ahead of the Belgian-built Swede.

Speaking of these models, the Skoda Enyaq and MG4 continue to climb up the table, having risen one position in September — at the cost of the VW ID.3, which dropped to #7.

This signals a symbolic, but important change: the MG4 is now Europe’s best selling electric compact hatchback, ahead of such stalwarts as the VW ID.3 and Renault Megane EV. With the midsize category already in the hands of Tesla, thanks to both the Model Y and Model 3, it is now time for the compact hatchback category, something of a European specialty, to fall in the hands of foreign newcomers. For now, the smaller A and B segments are in the hands of Stellantis, through the hands of the Peugeot e-208 (B-segment) and Fiat 500e (A-segment), but the question remains: “For how long?”

The remaining position changes happened in the second half of the table, with the Kia Niro climbing to #13 at the cost of the Renault Megane EV (another symbolic change) and the Cupra Born moving up to #15.

In the last positions on the table, the highlight is the two-position rise of the Mercedes EQA, to #18. The compact crossover is currently on top of its game and looking to climb a couple more positions by the end of the year.

The last position on the table signaled the return of the Kia EV6 to the top 20, allowing the Korean make to have two models on the table. Kia was thus one of just four brands to have more than one model on the table. The others were Tesla, Volkswagen, and Volvo.

In the auto brand ranking, Tesla is leading with a comfortable 12.7% share of the plugin market, having increased its share in September by 0.4% share. Volkswagen is in the runner-up position with 8.4%, down 0.3% compared to the previous month due to a slow month from its ID.3 and ID.4 best sellers.

3rd placed BMW (8.1%) remained stable, but #4 Mercedes (7.6%, up from 7.4%) is getting closer, with only 0.5% share separating these two. With three months to go, a lot can still happen between these two in 2023.

Finally, Volvo (5.6%, down from 5.7%) is still in 5th, but it is losing share by the day. So, we might see #6 Audi (5.4%, up 0.1%) surpass it sometime in the future.

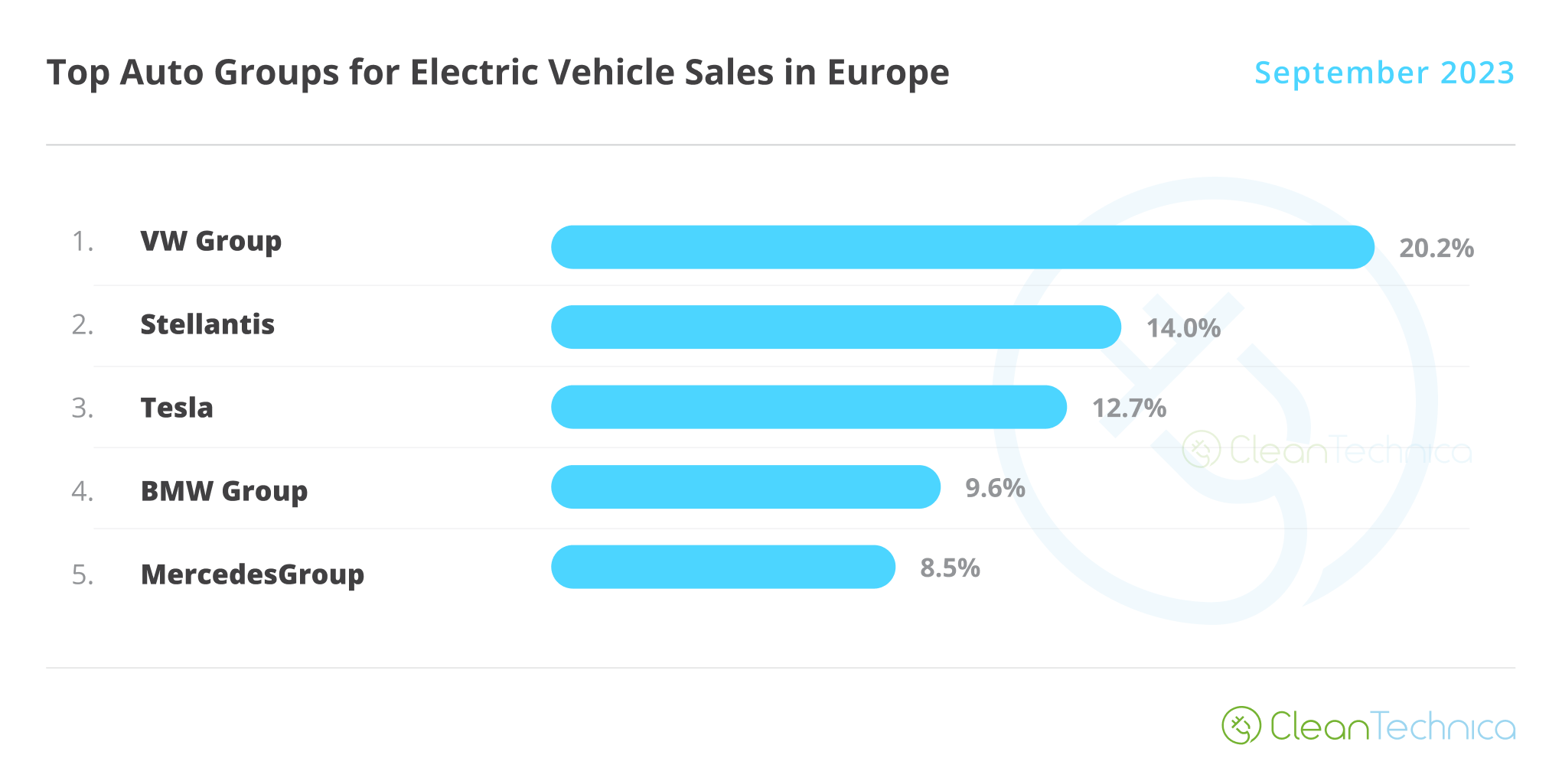

Arranging things by automotive group, Volkswagen Group was down to 20.2%, from 20.4% in August. Nonetheless, it kept a comfortable lead over runner-up Stellantis (14%).

#3 Tesla was up to 12.7%, and expect the U.S. automaker to try and go after the #2 position in December. It could profit from an eventual slip from Stellantis.

Off the podium, #4 BMW Group was down to 9.6%, while we have a new #5 in the form of Mercedes-Benz Group. Previously, in August, Hyundai–Kia removed Geely–Volvo from the top 5. Now, Mercedes Group (8.5%, up from 8.3% in August) has removed the Korean OEMs from the last position on the table. Hyundai–Kia dropped by 0.1% share to 8.4%.

#7 Geely–Volvo continues to drop, this time by 0.3% to 7.8%. So, even the #8 Renault–Nissan Alliance (6.8%) is now looking likely to surpass them by year end.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.