World EV Sales Now 13% Of World Auto Sales

Global plugin vehicle registrations were up 3% in February 2024 compared to February 2023. There were 830,000 registrations, making it possibly the last month with fewer than one million sales per month ever for plugin electric vehicles. BEVs were down by 6% YoY, but there’s no reason to sound the alarm, as this had more to do with the Chinese New Year celebrations happening in February, thus slowing down the largest EV market in the world, than anything else.

In the end, plugins represented 13% share of the overall auto market (8% BEV share alone). This means that the global automotive market remains in the Electric Disruption Zone.

Year to date, plugin electric vehicle market share was at 14% (9% BEV).

Full electric vehicles (BEVs) represented 64% of plugin registrations in February, pulling up its year-to-date tally to 63% share.

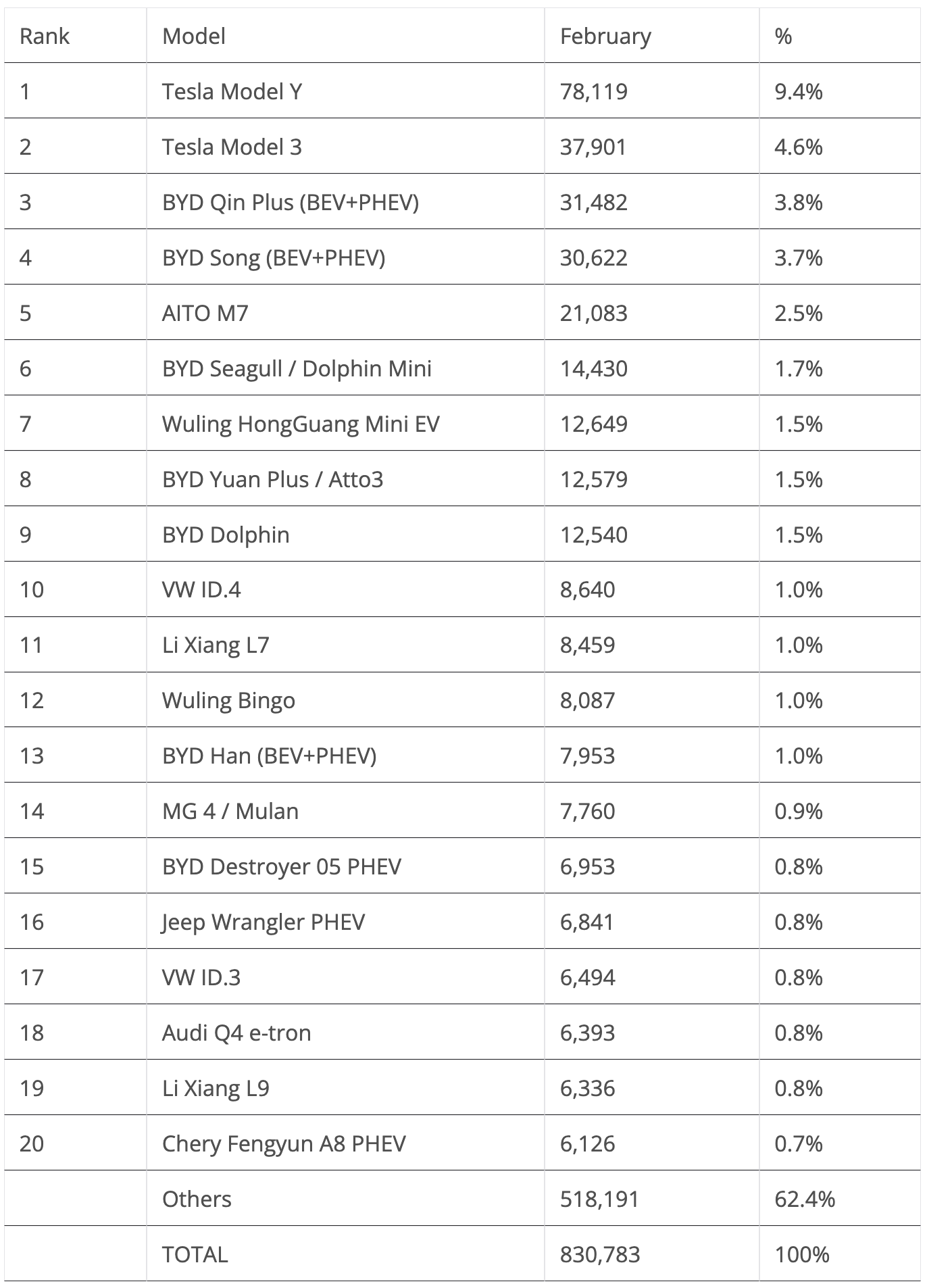

20 Best Selling EV Models in the World in February

Looking at February best sellers, Tesla benefitted from the slow month of the Chinese EV market to get a #1 and #2 win in February, with the Model Y taking the usual lead role while the Model 3 this time managed to beat BYD’s best sellers, the Song and Qin Plus. The BYD sedan did close the podium after the two Teslas.

The Aito M7 continues to shine, with the full size SUV ending in 5th in February. The Huawei-backed model is the unlikely hit of 2024, being the rare model able to run at the same pace as the galactics of Tesla and BYD. It is also the current leader of the full size category, beating the BYD Han and Li Xiang L7 by a wide margin.

Volkswagen Group benefitted from the slowdown of the Chinese OEMs, allowing the German OEM to place three models in the top 20. The VW ID.4 ended the month in 10th, the VW ID.3 in 17th, immediately followed by the Audi Q4 e-tron in #18.

Another legacy OEM showing up on the table was Stellantis(!), with its Jeep Wrangler PHEV ending the month in #16, with 6,841 units, while the Sino-British MG4/Mulan was 14th, once again benefitting from the slowdown of sales of most Chinese EVs.

As the exception confirming the rule, there was a Chinese EV coming out of nowhere and right into the top 20. The Chery Fengyun A8 PHEV showed up in 20th on the global table in only its 2nd month on the market. This is a surprising result for Chery, as the Chinese OEM is not known for its EV sedans, so it will be interesting to see if this performance can be replicated regularly.

Top 20 EV Models YTD

In the year-to-date (YTD) table, there was nothing new on the podium, with the Tesla Model Y ruling supreme above the BYD Song. With that said, the #3 Tesla Model 3 reduced the distance from the #2 BYD Song, so the race for silver could be one of the interesting points to follow in March.

Just outside the podium positions, the #4 BYD Qin Plus surpassed the AITO M7. Its crossover sibling, the BYD Yuan Plus/Atto 3, climbed to 7th, in this case at the expense of the BYD Dolphin.

The little Wuling Mini EV was up one spot, to #9, while Li Auto saw two of its models climb positions. The L7 climbed to 10th, while the flagship L9 re-joined the table in February in the 19th spot.

Thanks to the slow month of most Chinese EVs, VW’s ID.4 and ID.3 took the opportunity to climb positions, with the hatchback jumping two positions, to #16, while the crossover was also up two spots, in this case to #14.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

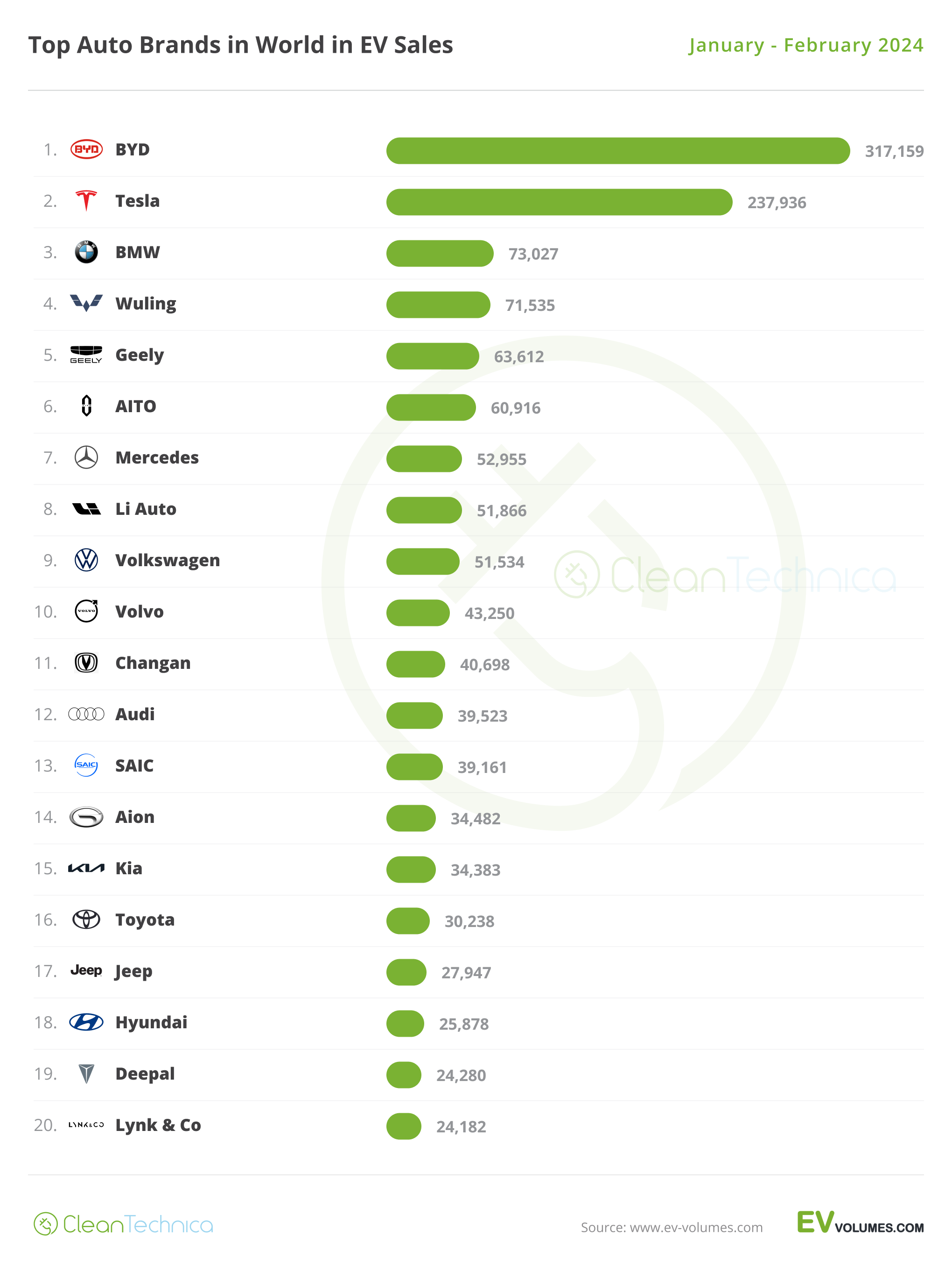

Top Selling Brands

In February, BYD failed to impress, barely beating Tesla in an off-peak month. While the slow month could be explained by the Chinese New Year, we should see how the folllowing months go. Now that BYD is deep into pricing out the ICE competition, a surge in sales should be expected. If that surge does not materialize, then BYD wasted its profit margins for nothing.

Below the top two galactics, Wuling and BMW were battling for the last position on the podium, with the advantage going to the Chinese make. Volkswagen ended in 8th, benefitting from the slow month of Chinese brands.

The second half of the table saw Kia end the month in 12th, but the Korean brand wasn’t the only legacy brand to improve their standings, as Jeep ended the month in #14, ahead of #17 Ford and #15 Toyota. The US adventure brand is basing its current strength on the Wrangler PHEV and Grand Cherokee PHEV dynamic duo, allowing it to run at the same pace as the almighty (in the overall market) Toyota. The Japanese brand is so far failing to create a best selling model.

With Toyota currently the 3rd largest brand in China (it was 2nd before the rise of BYD), it needs to ramp up its EV operations fast — or else it could say bye bye to the million-plus units it sells in that market. In February, Toyota was down by 38% YoY in China, making it one of the worst performers in that market. Interestingly, in that same month, Honda and Buick were also down 38% YoY in China….

In the YTD table, there wasn’t much to report regarding the top. BYD is ahead of Tesla, with the two makes together being responsible for almost a third of the global plugin vehicle market.

Far below these two, which are really in a league of their own, BMW and Wuling benefitted from Geely’s slow month to climb one position each, with the German make climbing to 3rd while the Chinese brand was up to 4th.

AITO’s rise also continued, climbing to 6th, and it could climb higher in March, especially considering the current production ramp-up of its flagship M9. Mercedes was also up, in this case to 7th, while Volvo and Audi also climbed positions, in this case to #10 and #12, respectively.

The legacy brand recovery is also visible in the second half of the table, with Kia rising to #15, immediately followed by Toyota (#16), Jeep (#17), and Hyundai (#18). #LegacyOEMsfightingfortheirlives

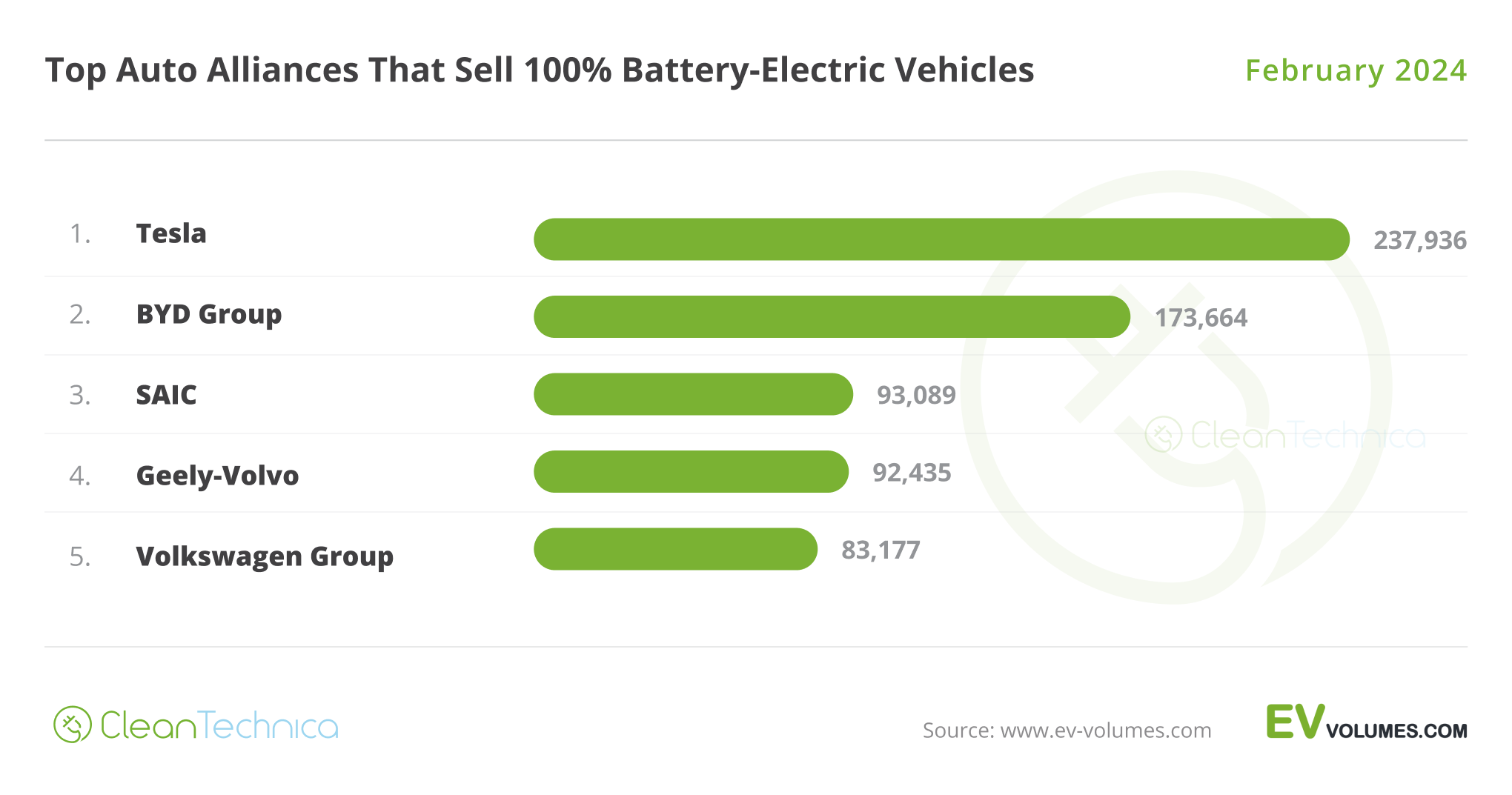

Top Selling OEMs for EV Sales

Looking at registrations by OEM, leader BYD lost share, going from 19.8% to its current 17.3%, while Tesla was up, as expected, to 12.4% share (it had 10.7 % a month ago).

3rd place is still in the hands of Geely–Volvo, with the OEM losing 1.4% on the way (9.7% a month ago, 8.3% now). Meanwhile, both #4 Volkswagen Group (6.5%, up from 6.2%) and #5 SAIC (6.4%, up from 6.1%) were up.

Below SAIC, Stellantis (4.4%, up from 3.7%) recovered its 6th spot, with a comfortable distance over #7 BMW Group (4%), with the German OEM surpassing Changan in February and thus recovering its usual 7th position.

Looking just at BEVs, Tesla remained in the lead with 19.8%, up from 17.6% in January. The US make has a comfortable lead over BYD (14.5%), making it unlikely the Chinese automaker will be able to remove Tesla from the BEV throne in the near future.

The last place on the podium saw a position change, with SAIC (7.7%) surpassing Geely–Volvo (7.7%, down from 8.3%).

In 5th we have Volkswagen Group, with 6.9%. The German OEM is looking to reach the two players ahead of it, but still has a ways to climb. Still, with #6 BMW Group (4.4%) at a safe distance, the German conglomerate could try to recover on the lost time in the coming months.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.