EVs At 19.3% Share In Germany — Tesla Model Y Leads

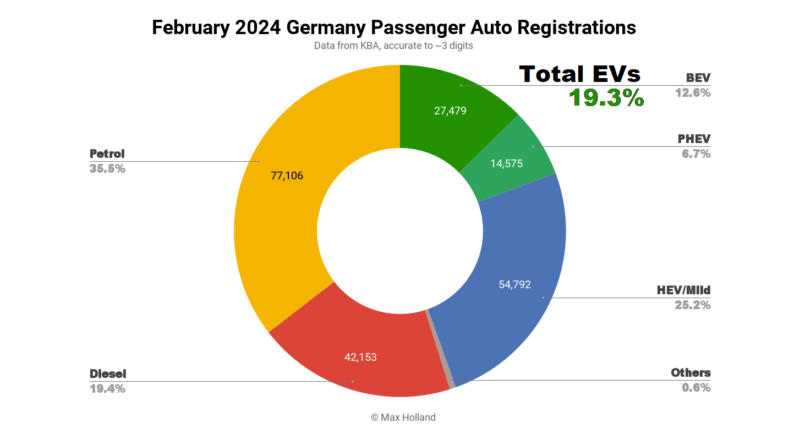

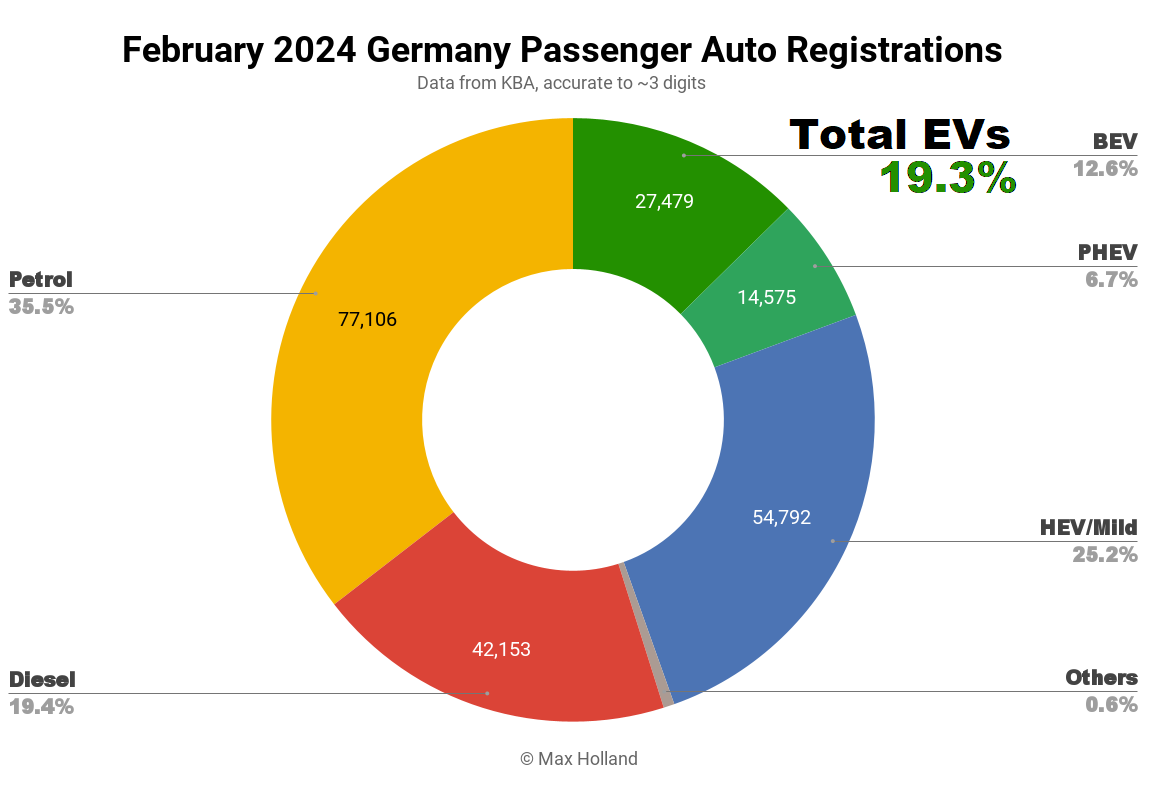

February saw plugin EVs at 19.3% share of the German auto market, still in a hangover from sudden incentive changes in late December. BEVs were down some 15% in YoY volume, while PHEVs were up some 22%. Overall auto volume was 217,383 units, down some 13% from pre-2020 seasonal norms (~250,000 units). The best selling BEV was the Tesla Model Y.

The monthly totals saw combined EVs at 19.3% share, with full electrics (BEVs) at 12.6% and plugin hybrids (PHEVs) at 6.7% share. These compare with 21.5% overall, 15.7% BEV, and 5.8% PHEV year on year.

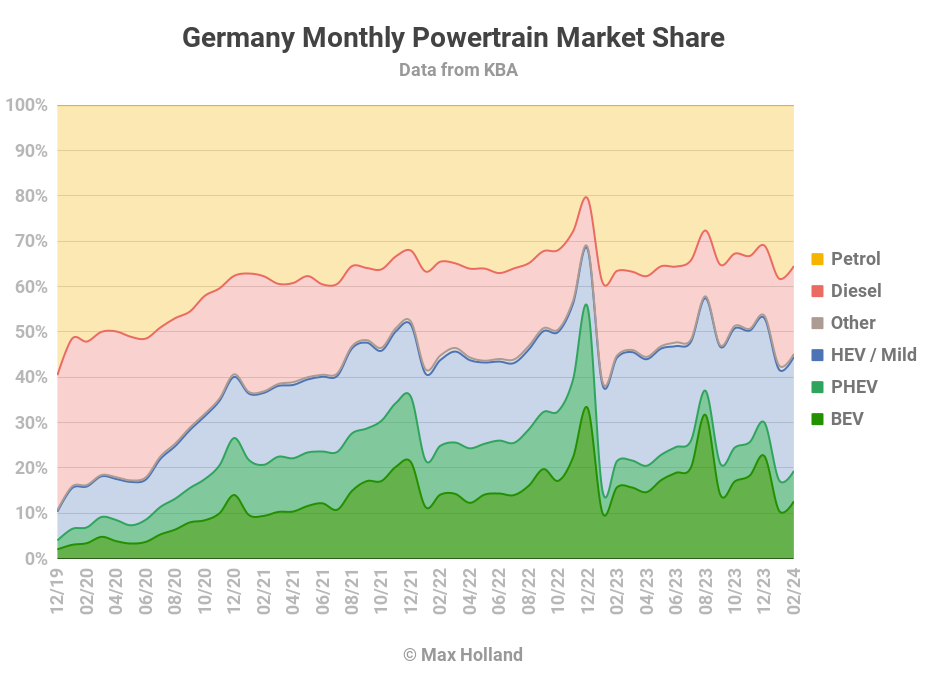

BEV sales are still in turmoil after late December’s sudden surprise government cancellation of purchase incentives. It will be several more months before the BEV market finds a new equilibrium after this upset.

PHEVs, on the other hand, already faced their incentive cuts in January 2023, and their monthly volumes found a new equilibrium in H2 2023. Their share has hovered around 7% of the market since September. Before the incentive cuts, the PHEV share was around 11.5% of the market.

See last month’s report to get more details on the change in incentives and its market effects. Other than disruption itself, there’s not a coherent trend to analyse in the current situation. We will have to wait until H2 to see where the dust settles on powertrain shares.

February Best Selling BEVs

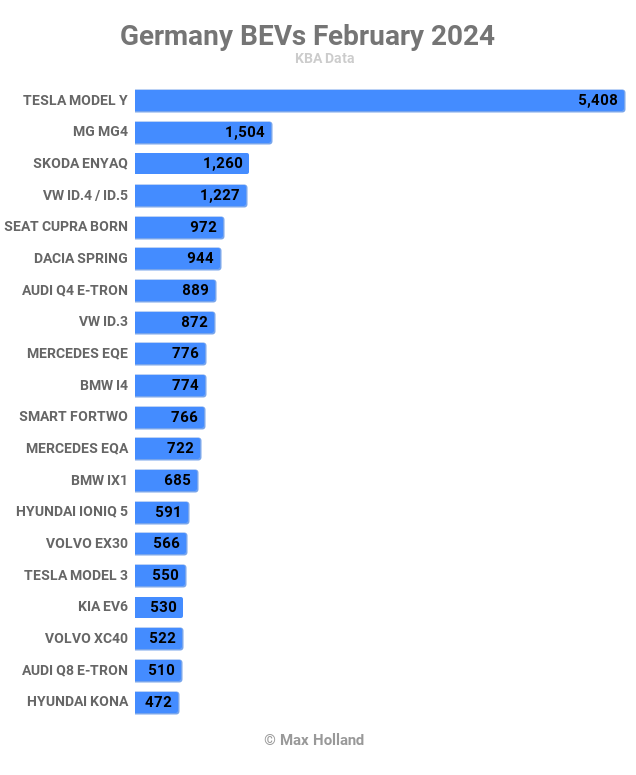

The Tesla Model Y was the top selling BEV in February, with 5,408 units delivered, more than the next four models combined. The MG4, 2023 CleanTechnica Car of the Year in Europe, took second place, with the Skoda Enyaq in third.

Beyond monthly logistics variables, there are no big surprises in the top 20. The volumes of most models returned closer to recent averages after January’s increased volatility (following the surprise policy change).

The Dacia Spring came in 6th, above its typical 15th spot, thanks to a temporary discount price of 12,750€ (to counteract the recent incentive cancellation). This is a rare example in Europe of a simple BEV with a reasonable sticker price (only set to last until April).

Let’s see how Dacia prices it after that. Recall that battery cells now only cost 44€ per kWh. The Spring’s pack is ~27 kWh, a simple design with modest power and no active cooling, so should cost under 1,600€. The motor and inverters are also modest power (33 kW), so similarly inexpensive. The Renault-Dongfeng badged “Fengshen EX1” version (same battery and power) had a pre-sales tax price of under €6,000 in China.

The new Volvo EX30 is again comfortably inside the top 20 ranks (as it first was in January), having only just launched in November. Let’s see how far the EX30 can climb.

The new Audi increased its registrations to 50 units in February, from 22 in January, its debut month. It will continue to ramp up from here.

One new model appeared in February, the Vinfast VF8, with a 10 unit debut. The Vinfast may struggle to reach notable volumes in the competitive German market, but we will keep an eye on it.

Let’s check the trailing 3 month performance:

The Tesla Model Y is still very dominant, well ahead of the Skoda Enyaq in second and Volkswagen ID.4/ID.5 in third.

The top 10 saw only minor movements in ranking, and even the top 20 was fairly stable. If the Volvo EX30 continues its growth path, it should appear in the top 20 by the end of Q2.

Now let’s check the manufacturing groups’ rankings:

Volkswagen Group remains in a strong lead with 26.8% market share, only slightly down on the 27.5% share from 3 months prior.

Stellantis fell two spots to 4th, dropping share from 15.4% to 1.8%. This allowed both BMW and Tesla to climb a spot, to second and third respectively. Both saw their share climb.

All the lower ranks remained unchanged, with little movement in market share. With the new Volvo EX30 ramping, Geely (currently in 9th) may have a chance to climb into the top 8 spots in the coming months.

Outlook

The broader German economy remains in recession, with Q3 and Q4 2023 (latest data) seeing YoY GDP scores of -0.3% and -0.2%. Inflation cooled to 2.5% in February, from 2.9% in January. Interest rates remained at 4.5%. Manufacturing PMI took a steep dive to 42.5 points in February, from 45.5 points in January.

Obviously, in this economic climate, we can expect the auto market to continue to be weak in 2024, including for BEV volumes. Their share of the market should continue to slowly increase, however, due to the long-term cost of ownership advantages.

What do you think about Germany’s EV transition. Please join in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.