EVs Take 30% Share In Germany — Policy Chaos From Traffic Light Coalition

December saw plugin EVs take 30% share of the German auto market, down YoY from a huge pull-forward in December 2022. Full year 2023 BEV volumes were up 11.4% over 2022. December’s overall auto volume was 241,875 units, down 23% from the December 2022 pull-forward. December’s best selling full electric was the Volkswagen ID.4 / ID.5, and the Tesla Model Y took the win for full year 2023.

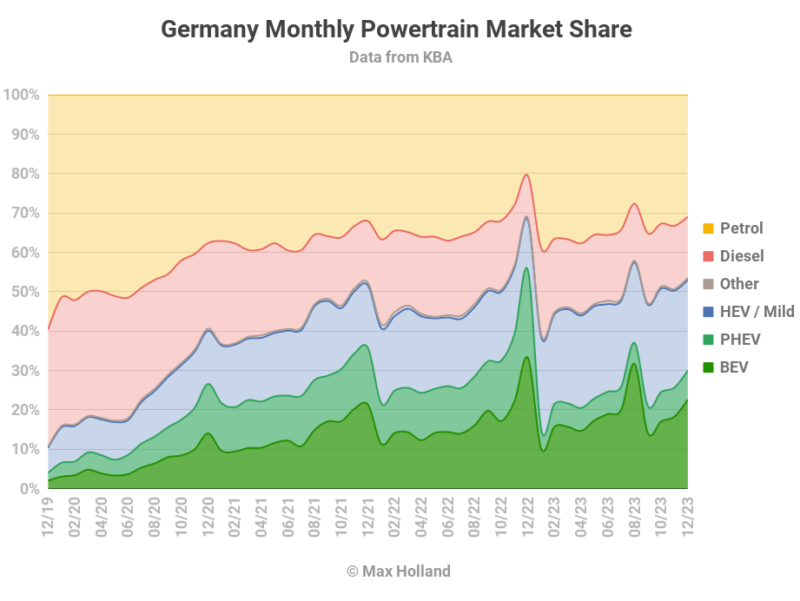

December’s combined plugin share of 30.0% comprised 22.6% full electrics (BEVs), and 7.4% plugin hybrids (PHEVs). These compare YoY with figures of 55.4%, with 33.2% BEV, and 22.2% PHEV.

December 2022 saw a huge pull-forward of plugin sales — taking over half of auto sales that month — ahead of the January 1st 2023 stopping of PHEV incentives, and significant cuts in BEV incentives. December 2023 wasn’t going to repeat that situation, but was due for a modest pull-forward for BEVs ahead of planned further incentive trimming from January 2024. However, things took a sharp and unexpected U-turn instead.

In mid-December 2023, the traffic light government summarily announced that all remaining BEV incentives, typically amounting to €3,000 per vehicle — previously slated to be available throughout 2024 — would be immediately cut from 17th December (with one day’s notice). We published a dedicated report on this debacle a couple of weeks ago.

This means that whatever modest pull-forward may have been gathering momentum across December was curtailed. Some manufacturers offered “in house” incentives to partly compensate customers for the government reversal, but the broad rush to make BEV purchases, ahead of January 1st, quickly disappeared. The result was that BEV sales volume in December ended up at a total of 54,654, little different from a “normal” end of quarter month, almost the same as they were back in June (52,988 units). This amounted to a market share of 22.6%

With policy volatility like that just witnessed in Germany, it is anyone’s guess how the auto market will respond over the coming few months. In the longer term, BEVs will continue to grow share, but consumer sentiment and demand for BEVs, after this “incredibly big breach of trust for tens of thousands of customers” (as the ZDK president put it), will presumably take some time to resettle over the coming months.

PHEV share has remained fairly stable in the range of 5% to 7.5% throughout 2023, and the 7.4% seen in December was unexceptional.

Combined combustion-only share remained below 50% for the third consecutive month, at 46.4% in December.

BEV Best Sellers

December saw the Volkswagen ID.4/ID.5 again take the monthly top spot, as it previously did in August, July, and in April.

The BMW i4 was the runner up in December, with the Skoda Enyaq in third. The top 3 places were tightly contested — separated by a less than 8% gap.

In the previous 2 years, December was a massive month for Tesla in Germany, taking the top BEV sales spot in 2021, and the top two spots in 2022. Tesla often pushes its own incentives and discounts at the end of the year, to try to meet internal sales targets. December 2022 scored the brand almost 17,000 combined sales for the Model Y and Model 3, partly thanks to the pull-forward discussed earlier.

With the out-of-the-blue cut in the government incentives from 17th December, however, Tesla was left high and dry this time around. The Tesla Model Y, by far the biggest seller in Germany over 2023, was only in sixth spot last month. The combined Model Y and Model 3 sales amounted to just 3,852 units. No doubt they will return in strength in the coming months.

Relatively strong performances were shown by the BMW iX, at almost 4x its recent monthly volumes, grabbing 15th spot. Just behind in 16th place, the Jeep Avenger saw almost 5x its recent volumes.

In terms of newcomers, the BYD Seal made its German debut in December, with 21 initial units. I summarized the Seal in the Sweden report if you are not familiar with this model. The short version is that the Seal competes with the Tesla Model 3.

The new Volvo EX30, which debuted in November, saw a big step up in sales, from 6 units, to 98 units. A decent value compact SUV, let’s see how high it can climb in the German market. The BYD Dolphin also saw a stronger second month, with 51 units, from its debut 17 units in November.

There will no doubt be more new BEV models on the German market throughout 2024, and we will be tracking their arrival and ramp up.

Let’s now turn to the 3 month chart:

Thanks to leading in both November and in October, the Skoda Enyaq takes the top spot over the trailing 3 month period. Its July to September rank was 4th, so this is a strong step up, thanks to 1.47x higher volume.

Despite taking the December crown, in the trailing 3 months chart the Volkswagen ID.4/ID.5 was on a downturn from the prior period, losing 36% of its previous volume, and dropping from 1st to 3rd.

The BMW i4 had its strongest ever 3 month run, with 6,927 units, over 3.3x its prior volume, climbing from 31st to 4th.

Further down the ranks, two others which were on the slide were the Dacia Spring in 14th (37% less volume than prior), and the Mercedes EQA, in 18th (48% less volume). The EQA is getting a technical refresh, with more range, early in 2024, so this is likely just a short-term downturn.

Let’s now look at the full year model rankings:

The Tesla Model Y’s strong lead is visible here, with the second place ID.4/ID.5 also at a good margin away from the followers. For more detailed full year data, see my charts elsewhere.

Finally let’s take a look at the trailing 3 month manufacturing group performance:

Here, Volkswagen Group’s strong domination of the home market is unmistakable. BMW has climbed an impressive 4 ranks, from 6th in Q3, and increased volume 1.62x over the prior period.

Hyundai Group fell three spots to 6th, with volume down at just 0.53x what it was previously. All other groups stayed the same or shuffled by just a single place.

For full year group performance, see my more detailed charts elsewhere.

Outlook

Germany’s overall economy saw the first 3 quarters of 2023 register YoY growth of -0.1%, +0.1%, and -0.4% respectively (Q4 numbers still pending). Interest rates remained at 4.5% in December, flat since September. Inflation, which had been on a lowering trend since the summer, took a turn upwards again in December, to 3.7%. Manufacturing PMI improved slightly, to 43.3 points in December, from 42.6 points in November, though this is still negative territory (below the 50 point neutral line).

What this will mean for BEV and plugin sales throughout 2024 is anyone’s guess. It is looking like the politicians who presided over the “incredibly big breach of trust” of December 2023 may anyway soon become so unpopular they may have to resign, and this should (eventually) lead to more stable policies, for BEVs amongst other things.

The long term cost of ownership advantages of BEVs are now well known, and their market share will continue to rise over time, but the pace of this rise in Germany will depend on the policy landscape, and the health of the broader economy.

What are your thoughts on Germany’s EV transition in the months and years ahead? Please join in the conversation in the comments below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.