Building cars and trucks is hard.

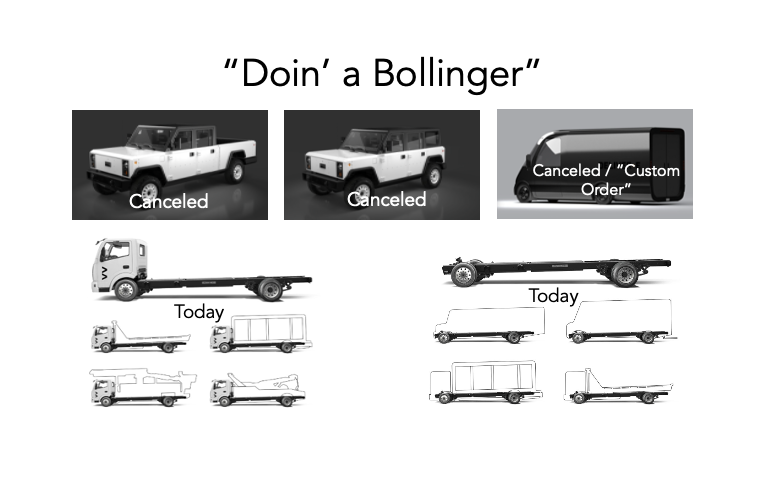

For every successful Tesla, dozens of EV startups will fail, get acquired, re-organize, or with companies like Bollinger — keep pivoting until they can hopefully find a sustainable business. (Hence my proposed new business slang term: “Doin’ a Bollinger” = Companies that can’t scale a product or service and eventually morph into building custom products or services.)

A little historical perspective: from Wikipedia:

“Starting with Duryea in 1895, at least 1900 different companies were formed, producing over 3,000 makes of American automobiles.[9] World War I (1917–1918) and the Great Depression in the United States (1929–1939) combined to drastically reduce the number of both major and minor producers. During World War II, all the auto companies switched to making military equipment and weapons. However, by the end of the next decade the remaining smaller producers disappeared or merged into amalgamated corporations. The industry was dominated by three large companies: General Motors, Ford, and Chrysler, all based in Metro Detroit.”

Source: Wikipedia

On this Labor Day it is a good reminder that building cars and trucks is just that — it isn’t about design, technology, or platforms — but actually building them at scale. And it is also about access to capital and billions of dollars. But we’ve seen that even well run and well capitalized start-ups like Lucid Motors and Rivian have struggled with production and scale. A lot of capital is a pre-requisite for success, but it takes much more than that to survive and succeed.

So the next time someone makes fun of GM, Ford, Toyota, Honda, and other legacy automakers and suggests they will be the next “Blockbuster” or “Kodak” because they aren’t transitioning fast enough — who other than Tesla has the ability to steal significant market share?

Which leads to one of the biggest threats for old-guard legacy OEMs and that is the new-guard legacy OEMs, mainly Hyundai and Kia (along with the Genesis brand). These Korean companies have a greater focus on technology than the old-guard, most of the battery companies are Korean (except for CATL and BYD), and their culture, and being younger companies enables them to move more quickly.

Honda is getting crushed in California by Tesla, but Kia and Hyundai are the sleeping giants that pose just as a big of a threat. And in addition to the Korean companies, Chinese backed (Geely) Polestar and Vinfast, the auto division of the Vietnamese industrial company VinGroup are some of the other up and comers.

There is going to be a lot of OEM roadkill the rest of this decade, but most of carnage will be among the start-up companies. Though there will clearly be consolidation (Mazda, Subaru?) and a reduction in brands (does Chrysler survive?) among the legacy automakers.

Which EV start-ups are most likely to succeed and which legacy OEMs or brands are most at risk? Let me know your thoughts in the comments?

2 Responses

Thanks for your perspectives on the EV market.

In future articles, I ask that you please define your abbreviations. Had to look up OEM. Best not to assume your wide audience is in the know.

Sally, yes I receive the comment about acronyms occasionally – which I understand. That said my site is targeting people in the EV and EV charging industry, it is a B2B site so those readers know these terms and explaining them would be unnecessary. The site does also attract consumers, which are not my target – so I write for the core audience I target who I hope will purchase my EV data or consulting services.