EVs At 23.0% Share In UK – BMW Leading BEV Brand

January saw plugin EVs at 23.0% share of the UK auto market, up YoY from 20.0%. Full electric volume increased by 1.21x YoY, and plugin hybrids by 1.31x. January’s overall auto volume was 142,876 units, up 8% YoY. BMW was the UK’s leading BEV brand in January.

January’s data recorded combined plugin EVs at 23.0% share, with full electrics (BEVs) taking 14.7%, and plugin hybrids (PHEVs) taking 8.4%. These compare with shares of 20.0% combined, with 13.1% BEV, and 6.9% PHEV, a year ago.

Recall that from January 1st, the UK has a zero emissions vehicle (ZEV) mandate in place for the first time. Zero emission vehicles must account for ~22% of each auto brands’ total UK sales in 2024 (with a few temporary accounting fudges allowed, to ease the adoption of the new policy), or face up to £15,000 (€17,420) in fines for every non-BEV that they sell. That 22% target will ratchet up over the coming years.

In last month’s report, I estimated that some brands would hold-back Q4 2023 deliveries, and release them in Q1 2024, to help get a jump-start on meeting the 2024 ZEV mandate. We can now confirm this was indeed a strategy followed by many of the weaker BEV brands, those which may otherwise struggle to meet the 2024 target. More details on this in the brand analysis below.

In volume terms, January saw BEV grow sales by 1.21x year on year, whilst PHEV grew 1.31x. HEVs lost 1% volume YoY, “Petrol” (now with mild-hybrid petrol included) grew 7.5% volume, and “Diesel” (including mild-hybrid) lost 10% volume. See the appendix‡ at the foot of this report for a discussion of what trends underlie the SMMT’s new method of combining the combustion-only numbers with mild-hybrid numbers, which will likely be the norm, going forwards.

Recombining the categories and summing their numbers doesn’t ultimately change the shrinking fate of diesel powered vehicles. The newly combined category saw volume drop over 10% year on year, down to 9,348 units in January. Market share also dropped YoY, from 7.9% to 6.5%.

Petrol sales look more impressive now that combustion-only and MHEV are combined, but we can still expect this newly combined category to fall under 50% share in Q4 2024, and under 50% over full year 2025.

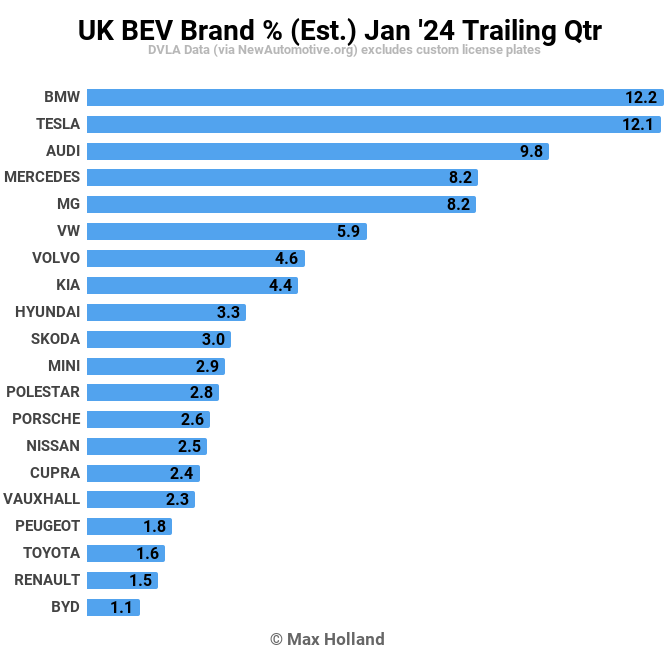

Best Selling BEV Brands

January saw BMW once again take the top spot for BEV market share in the UK. MG took second place, just ahead of Tesla in third.

BMW had been in a close second place for the previous two months, so taking the lead is not a huge surprise. However, given that Tesla has dominated this market every consecutive quarter since Q3 2019 (!) this is a great result for BMW.

What a long way BMW has come since I excoriated them back in mid 2019 for foot dragging on BEVs. And thank goodness that Zipse took over as CEO, rather than Fröhlich!

Nevertheless, we can expect Tesla to be back in the lead in February. BMW’s relative strength is that the brand already has 7 BEV models selling in the UK (the iX1, iX2, iX3, iX, i4, i5, and i7). Apart from the i7, most of these models have the potential to sell hundreds (or thousands) of units per month in the UK market.

BMW’s top two BEV models appear to be the i4 and iX1, though the iX and iX3 sometimes register strong numbers also. The iX2 has just arrived in the UK market in January, so that’s another one to keep an eye on.

ZEV Mandate – Jumping the Start

Outside the top 3, there were strong signs of some brands strategising to meet the ZEV mandate, by having lowered their delivery volumes in Q4 2023, only to now release an anomalously large number in January.

Bear in mind that, in all past years, January typically sees less than half of the previous month’s volume (December). Now consider the following:

Toyota, having delivered under 300 BEV units throughout the whole of 2023 (and almost none in Q4), suddenly delivered over a thousand BZ4X units in January alone! Group sibling Lexus followed a similar pattern (though at much lower volumes).

Honda likewise delivered just over 400 vehicles throughout the whole of 2023, but suddenly managed to deliver 235 in January alone, mostly the e:NY1.

Stellantis’ main UK BEV brands, Peugeot, Vauxhall (Opel), and Citroen, together delivered over 2,000 units in January, more than they delivered throughout the whole of Q4.

Mazda delivered around 100 units in January, over twice its monthly average during Q4.

Most other brands, especially those which will comfortably meet the mandate in 2024, didn’t see these anomalous volumes in January.

Here’s a view of the past 3 months:

At the top, BMW takes the win from Tesla, a rare but welcome event, as we noted above. Audi took third, and Mercedes and MG had a close race for 4th place.

With the playing out of the ZEV strategy shenanigans that we discussed above, there’s not necessarily any strong insights to be gleaned from January’s trailing 3 data alone. In two months’ time, we will be able to look at the January-to-March data, and contrast it with the Q4 2023 data, to get more insights into which brands are playing insincere box-ticking games, in regard to the ZEV mandate.

Outlook

The UK’s overall economy was weak throughout 2023, with YoY GDP growth figures for consecutive quarters of 0.6%, 0.4%, 0.3%, and 0.3%. The inflation rate increased in December (latest data) to 4% from 3.9% in November. Interest rates again remained steady at 5.25%. Manufacturing PMI increased to 47 points in January, from 46.2 points in December, though still negative (below 50 points).

The SMMT is calling on the UK Government to half the VAT on private consumer BEV purchases from March. I get the impression that they are doing this mainly at the command of those of their members (hint, Toyota) who will struggle to find enough demand for their BEVs to meet the ZEV target.

On the other hand, a VAT halving would effectively reduce the price of BEVs by 10%, which would also be a boon to BEV buyers. However, this is probably too much to expect, given that the UK cut BEV incentives a couple of years ago already. I could get behind sales tax cuts if they targeted the most affordable BEVs (perhaps setting a £20,000 or £25,000 threshold), but that’s not the suggestion. Calling for tax cuts, to include expensive new BEVs that list for over £40,000 is simply not going to happen in the context of a stagnant economy and high inflation, whilst many folks struggle to pay their rent and bills.

Either way, with the new ZEV mandate in force, we can confidently predict that BEVs will grab roughly 22% market share in 2024 (with some small margins for accounting manipulation by the laggards)!

What are your thoughts on the UK’s EV transition? Please join in the conversation below.

‡ Some notes on the SMMT data methodology change this month: the UK’s auto industry association, the SMMT, had previously split off mild-hybrid (MHEV) sales data from other powertrain categories, and reported their sales numbers separately (both as petrol MHEV and diesel MHEV), but this is no longer the case. MHEV sales numbers are now undifferentiated, folded back into “petrol” and “diesel” numbers. The charts in this report have larger segments of yellow and red as a result.

Why did the SMMT make this change? Probably for a couple of reasons. Even in this “least-electrified” end of the auto market, combustion-only sales (with zero electrical propulsion assist) are steadily fading out, and MHEVs (with 48 volt starter motors and batteries which can do mild assist and mild regen) are becoming the new normal, as emissions rules tighten. Diesel mild-hybrids, for example, started to become significant in the UK (and much of Europe) in 2020, and drew equal with diesel-only sales in 2023. Petrol mild-hybrids sales have been slower to catch up with petrol-only sales, currently with only around half as many sales as the latter, but are steadily increasing. With diesel sales soon “mostly” MHEVs (and petrols in the next couple of years), perhaps the SMMT is simply getting ahead of the curve.

An additional possible reason is that even the most simple “combustion-only” vehicles are having to quickly adopt new methods of becoming more efficient and lower their emissions. Stop-start engines (which save 5% to 10% fuel on average) have been in the majority of new cars sold in Europe since the mid 2010s. These have a more robust starter motor and battery compared to previous cars, though these components can still be 12 volt. However, the basic 12 volt stop-start systems don’t have the capacity to maintain the HVAC when the engine is in stop mode, which is a comfort issue in many climates.

A 48 volt system doesn’t have this limitation, and potentially allows other auxiliary components to be more energy efficient also (power steering, adaptive suspension, water pumps, radiator fans, infotainment, etc), Many of these have traditionally been belt-driven, inefficient, and a constant load on the ICE. They can also potentially reduce the thickness and cost of the wiring harness, compared to a 12 volt alternative, and increase efficiency. As the power levels of many auxiliary components (e.g. infotainment, HVAC) have increased over the years, efficiency becomes more important.

48 volt systems can also make the combustion powertrain more efficient in other ways, beyond simply starter-motor propulsion assistance, and mild regen. Such systems can turn the ICE off completely when cruising (in some models), and can use electric powered turbos and superchargers, to increase combustion efficiency.

All in all, tightening efficiency and emissions requirements made 48 volt mild-hybrids, focused on propulsion assistance and regen, an economically rational pathway for auto makers over the past 5 years or so. This in turn has had the consequence of establishing mass manufacturing of 48 volt systems components, and R&D, which have opened up further efficiency opportunities in many other sub-systems of vehicles (of all powertrains, including BEVs). For more information, see this summary on the transition to 48 volt systems, and this white paper from the ICCT.

The reducing cost of having a 48 volt system in autos, combined with tightening efficiency requirements on new ICE vehicles will effectively kill-off the sale of new vehicles that have zero electric assist. Even if for mainly low-speed manoeuvring (e.g. parking), implementing some level of mild propulsion assist and regen will be cost effective, given tightening emissions regulations.

At some point, every remaining auto on sale in Europe that has an ICE will effectively be some kind of “mild” hybrid (if not HEV, PHEV or EREV). Because this blurring of category lines between the “combustion-only” and “MHEV” is already starting to happen, the SMMT may have decided to simply start counting these categories together.

In my UK market summary reports, I had previously lumped MHEVs in with traditional hybrids (HEVs), given that both provide some degree of propulsion assistance. After this SMMT data methodology change, that previously combined HEV+MHEV category will now shrink to just HEVs, and the “petrol” and “diesel” categories will correspondingly inflate, due to including MHEVs.

Bear in mind that, in the long run, these will anyway all turn out to be temporary and residual categories — fast on their way to being replaced by mostly BEVs within the coming few years, certainly in most of Eurasia. For now, just bear in mind that for every “diesel” number you see quoted in the UK charts and reports, already at least half of them are MHEVs, and for every “petrol” number, at least one third. That proportion will grow quickly over the next couple of years.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.