Li Auto's fourth-quarter delivery guidance of 45,000 to 48,000 vehicles means it expects to deliver 19,914 to 22,914 vehicles in December.

Li Auto (NASDAQ: LI) today reported weaker-than-expected third-quarter revenue and a decline in gross margin to a more than two-year low, but its delivery guidance for the fourth quarter implies a strong uptick in December vehicle deliveries.

The company reported third-quarter revenue of RMB 9.34 billion ($1.31 billion), below market expectations of RMB 9.6 billion, according to unaudited financial results it released today.

This was up 20.05 percent from RMB 7.78 billion in the same quarter last year and up 6.99 percent from RMB 8.73 billion in the second quarter.

The company's gross margin in the third quarter was 12.7 percent, a new low since the first quarter of 2020 when the figure was 8.0 percent.

In a research note sent to investors on December 8, Deutsche Bank analyst Edison Yu's team said Li Auto's accelerated phase-out of its first model, the Li ONE, in the third quarter severely hurt margins.

The company offered significant incentives, such as insurance subsidies and a RMB 20,000 discount, to sell inventory before the Li L8 changeover, the team said.

Yu's team estimated Li Auto's revenue at RMB 9.2 billion in the third quarter, with a gross margin of 16.0 percent and adjusted earnings per share of RMB -0.75.

The gross margin numbers posted by Li Auto were worse than Yu's team had expected.

The company reported a vehicle margin of 12 percent in the third quarter, down from 21.1 percent in the year-ago quarter and 21.2 percent in the second quarter.

Li Auto reported a net loss of RMB 1.65 billion in the third quarter, compared with RMB 21.5 million in the same quarter last year and RMB 641 million in the second quarter.

This was due to the loss of inventory and supplier contracts that Li Auto had originally prepared for the Li ONE model as it accelerated its phase-out, resulting in it taking an inventory impairment and contract loss of RMB 803 million.

It reported a non-GAAP net loss of RMB 1.24 billion for the third quarter. As a comparison, it saw net income of RMB 335.7 million in the same period last year and a net loss of RMB 183.4 million in the second quarter.

Li Auto guided for fourth-quarter deliveries of 45,000 to 48,000 units, representing year-on-year growth of 27.8 percent to 36.3 percent. It guided for fourth-quarter revenue of RMB16.51 billion to RMB17.61 billion.

Li Auto delivered 10,052 and 15,034 units in October and November, respectively, for a total of 25,086 units in the two months. The latest guidance means that it expects to deliver between 19,914 and 22,914 vehicles in December.

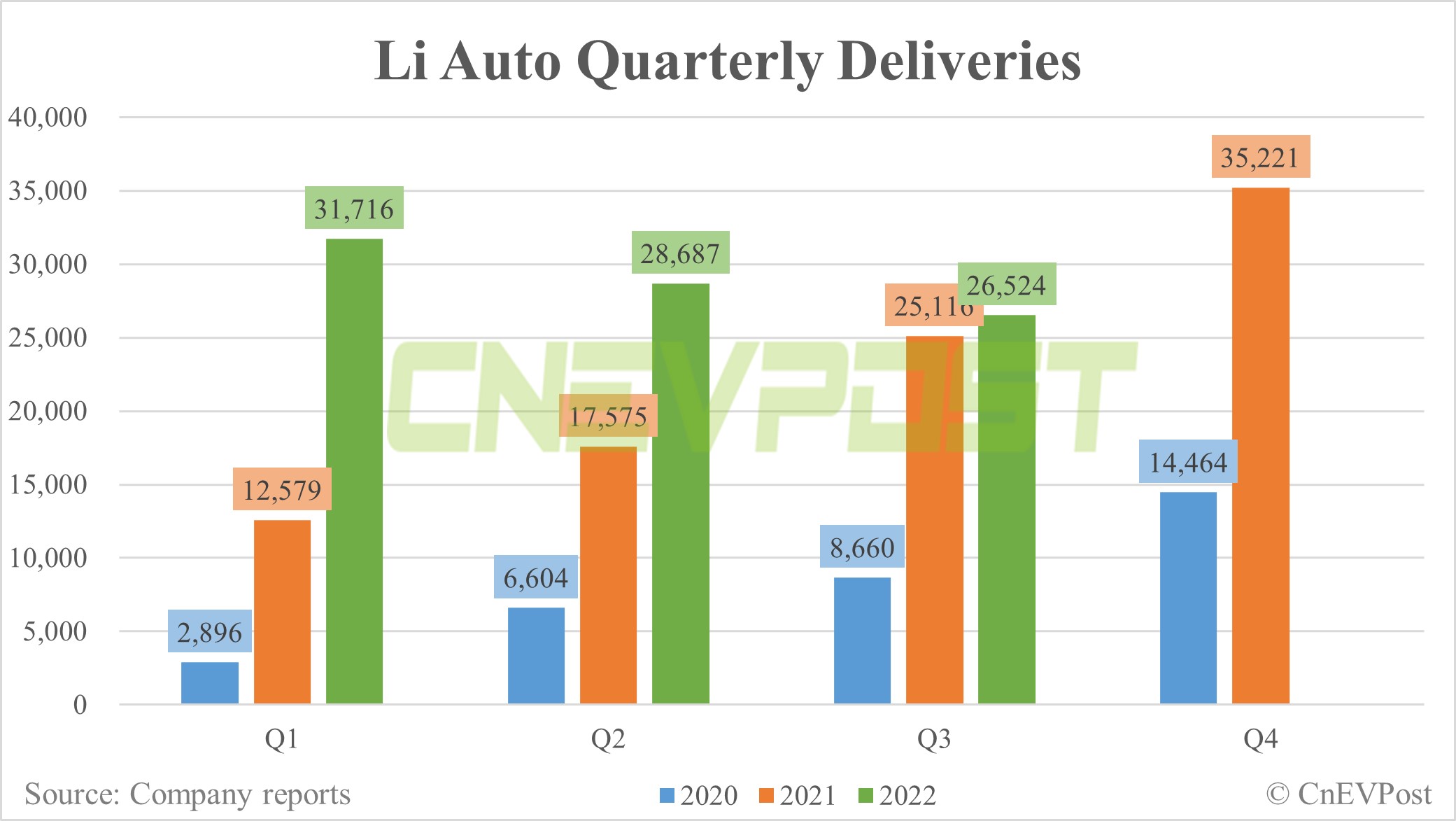

Previously published figures have shown that Li Auto delivered 26,524 vehicles in the third quarter, up 5.61 percent from 25,116 vehicles in the same period last year and down 7.54 percent from 28,687 vehicles in the second quarter.

When Li Auto announced its second-quarter earnings on August 15, it provided guidance for third-quarter deliveries of 27,000 to 29,000 vehicles and revenue guidance of RMB 8.96 billion to RMB 9.56 billion for the third quarter.

However, on September 26, Li Auto lowered its guidance for third-quarter deliveries to about 25,500 vehicles, saying this was a direct result of supply chain constraints while underlying demand for the company's vehicles remained strong.

The company will continue to work closely with supply chain partners to address bottlenecks and accelerate production, Li Auto said in late September.

On November 1, Li Auto founder, chairman and CEO Li Xiang said on Weibo that the company will aim to achieve single-month revenue of more than RMB 10 billion in 2022.