Nio maintains its previously mentioned goal of doubling sales, despite greater challenges to meet the goal, said William Li.

(William Li (left), founder, chairman and CEO of Nio, and Qin Lihong, co-founder and president of the company, participate in a media group interview. Photo taken by CnEVPost.)

Nio (NYSE: NIO) is confident it will see sales double this year, despite a rare price war that disrupted the Chinese auto industry in the first quarter.

Nio maintains its previously mentioned goal of doubling sales, though the challenge to meet that goal is greater, William Li, the electric vehicle (EV) maker's founder, chairman and CEO, said in an interview in response to questions from CnEVPost.

The price war has had a big impact on the auto industry, and Nio will not follow suit. Instead, it adjusted the benefits offered to consumers, which can be seen as a price increase, Li mentioned in the group interview on April 17 on the eve of the Shanghai auto show.

What Nio really cares about is creating value for users, not simply lowering prices, Li said, adding that companies that start price wars usually don't get the results they want because it leads to damage to the interests of existing vehicle owners and won't win the future.

In the short term, Nio will face some pressure as a result, he said.

Nio delivered a total of 122,486 vehicles in 2022, up 34 percent from 91,429 in 2021. The doubling of sales means that Nio is expected to deliver about 240,000 vehicles this year.

Li said in a March 1 analyst call following Nio's fourth-quarter earnings announcement that the company is aiming to see sales double this year compared to last year.

"Our team is very confident in that," Li said at the time.

In a March 22 interview with Bloomberg TV, Nio CFO Steven Feng said the company is very confident it will meet its sales target in 2023.

Nio delivered 31,041 vehicles in the first quarter, which means it needs to deliver more than 23,000 vehicles each month on average for the rest of the year to meet its full-year goal.

At the time Li mentioned the target on March 1, only a handful of NEV makers had cut prices in China.

However, some internal combustion engine automakers then began offering steep discounts, and a wave of price cuts quickly swept through the industry.

Rather than boosting vehicle sales significantly, the rare price war has led to increased consumer's wait-and-see sentiment.

On March 22, the China Association of Automobile Manufacturers (CAAM) called for the hype about this round of price cuts in China's auto industry to cool down as soon as possible, so that the industry can return to normal operation and ensure healthy and stable development throughout the year.

In March, retail sales of new energy passenger vehicles in China were 543,000 units, up a modest 21.9 percent year-on-year and 23.6 percent from February, according to data released by the China Passenger Car Association (CPCA) on April 10.

This is lower than the CPCA's preliminary figure of 549,000 units released on April 6, and lower than the 560,000 units it had forecast in its March 25 report.

The price cuts by some NEV companies may have triggered a wait-and-see mood among consumers, the CPCA said at the time.

For the overall passenger car market, retail sales in March were 1.587 million units, up 0.3 percent from a year earlier and up 14.3 percent from February. In the January-March period, retail sales in China's auto industry were 4.261 million units, down 13.4 percent from a year earlier.

Li also said in the interview that the decline in Chinese auto sales in the first quarter reflected a strong consumer wait-and-see sentiment.

He also mentioned that the company maintained its target of achieving profitability for its core Nio brand in the fourth quarter of this year, excluding investment in innovative businesses.

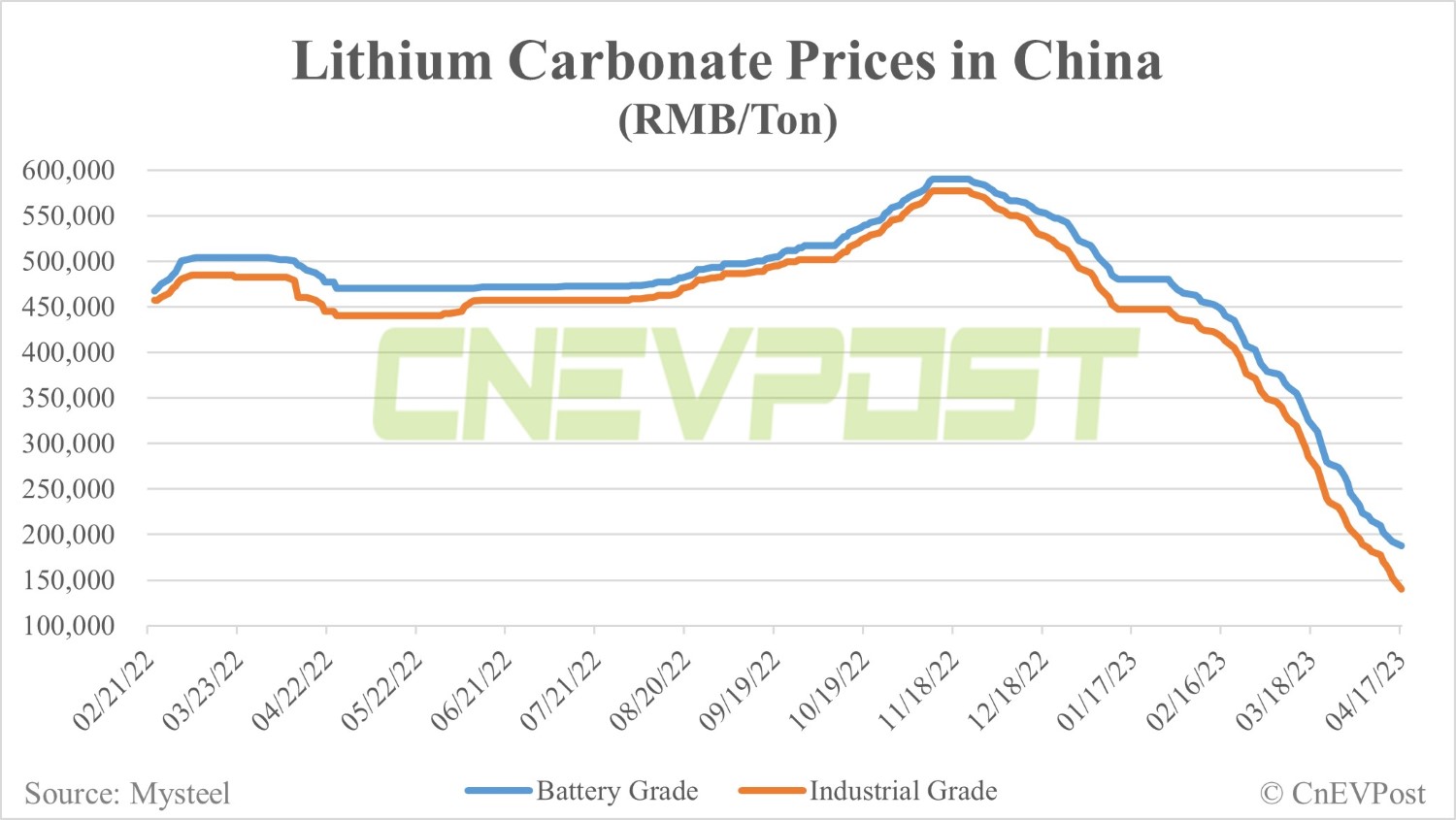

Lithium prices are falling faster than expected, and Nio's costs will fall as future deliveries rise, Li said.

As of April 17, the average price of battery-grade lithium carbonate had fallen to RMB 187,500 per ton in China, and the average price of industrial-grade lithium carbonate fell to RMB 140,000 per ton, according to data from Mysteel.

NIO ET5 ranks 7th in top-selling premium sedan list in China with 6,437 Mar sales