FY2025 has a tough ask on its hands, given that FY2024 has registered sales of an estimated 4.23 to 4.25 million passenger vehicles, up 8.75% on FY2023’s 3.89 million units. The utility vehicle (UV) segment which comprises SUVs and MPVs, unabashedly continues to do the heavy lifting for India PV Inc. This sub-segment has proven to be the bulwark of the PV industry and its sustained double-digit growth has helped buffer the sharp decline in mass-market entry-level cars and the slowdown in demand for other vehicle categories like hatchbacks and sedans.

Of the overall UV segment, SUVs (sports utility vehicles) are estimated to account for 50% of overall PV wholesales, which translates into 2.11 million units. In FY2023, total UV sales were 20,03,718 units accounting for 51% of PV sales. In FY2024, the UV share of PV sales is expected to jump to nearly 60 percent. That will be know for sure when apex body SIAM releases the final data around mid-April.

Surging demand for SUVs has powered best-ever fiscal year sales for Maruti Suzuki, Hyundai, Tata Motors, M&M and Toyota Kirloskar, while the Elevate midsize SUV has brought Honda Cars India ‘back into the game’.

Of the 16 PV manufacturers and SIAM members, seven released their FY2024 wholesales numbers, with all but one witnessing strong YoY growth. Of these seven OEMs, Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra and Toyota Kirloskar Motor have each recorded their best-ever fiscal year sales, thereby contributing to the industry’s sterling performance. Let’s take a closer look at the top players’ performance

MARUTI SUZUKI INDIA: 1,759,881 units, up 10% YoY

Maruti Suzuki India, the bellwether of the industry, has reported its best-ever fiscal year dispatches of 1,759,881 or 1.75 million units, up 10% on the 1.60 million units it sold in the domestic market in FY2023.

Providing the sales charge, as it has been for the entire fiscal, has been the company’s SUV and MPV range. The eight-model utility vehicle (UV) portfolio, comprising the Brezza, Grand Vitara, Fronx, Jimny, S-Cross, XL6, Ertiga and the new Invicto, has helped buffer the decline in overall sales of hatchbacks and sedans.

Nexa models have sold 561,000 units, up 52% (FY2023: 369,000 units and account for 87% of Maruti Suzuki’s total UV sales of 642,296 units in FY2024.

Nexa models have sold 561,000 units, up 52% (FY2023: 369,000 units and account for 87% of Maruti Suzuki’s total UV sales of 642,296 units in FY2024.

For the past year or so, utility vehicles – SUVs and MPVs – have transformed into the firm growth driver for Maruti Suzuki, offsetting the sharp 39% sales decline in Alto-S-Presso sales as well as the 4% YoY decline in demand for the seven-car group of the Baleno, Wagon R, Swift, Dzire, Tour S and Ignis. The company’s total UV sales of 642,296 units in FY2024 are a handsome 75% increase – an additional 276,167 units YoY – over FY2023’s UV sales of 366,129 units.

Proof of demand for Maruti Suzuki’s UVs comes from dispatches from its premium Nexa channel, which retails the popular Grand Vitara, Fronx, XL6, Invicto and Jimny. Nexa models have sold 561,000 units, up 52% (FY2023: 369,000 units and account for 87% of the company’s total UV sales in FY2024.

Maruti’s supremacy in the UV segment is reflected in the fact that they are more than the entire FY2024 PV sales of Hyundai Motor India (614,721 units), Tata Motors (570,955 units), Mahindra & Mahindra (459,877 units) and Toyota Kirloskar Motor (244,940 units).

The increasing weightage of UVs in Maruti Suzuki’s overall passenger vehicle sales is clearly seen in the numbers. Between FY2023 to FY2024, there is a 13-percentage basis point increase in UV penetration level – from the 23% in FY2023 (366,129 UVs in 1.60 million PVs), the UV share of PV sales has jumped to 36.49% in FY2024 (642,296 UVs in 1.75 million PVs).

With UVs estimated to account for nearly 60% of PV sales in FY2024, MSIL’s total UV market share would have increased from 11% in FY2023 to 22% in FY2024. “This is a healthy sign for us, and a resultant of the company’s growing market share, which was pegged at nearly 42% by end-FY2024,” said Shashank Srivastava, Executive Committee Member, MSIL, at a press briefing in New Delhi yesterday.

HYUNDAI MOTOR INDIA: 614,721 units, up 8.31% YoY

Hyundai Motor India has recorded its best-ever domestic market sales of 614,721 units in FY2024, an increase of 8.31% over FY2023’s 567,546 units. This is the best performance by the Korean auto major since it entered the Indian market in 1998.

Demand for the company’s overall passenger vehicle range continues to be powered by the Creta midsize SUV and the recently launched Exter compact SUV. Like the other leading PV makers in India, SUVs are the key growth drivers for Hyundai whose SUV line-up comprises the Creta, Venue, Alcazar, Exter and the Tucson along with the Ioniq 5 and Kona electric SUVs.

Hyundai surpassed the 600,000 sales mark for the first time, powered by its best-seller, the Creta midsized SUV, Venue and Exter compact SUVs.

Hyundai surpassed the 600,000 sales mark for the first time, powered by its best-seller, the Creta midsized SUV, Venue and Exter compact SUVs.

According to the company, the Creta, Exter, Ioniq 5 SUVs and the Aura sedan registered their highest ever annual numbers. As per industry data for the April 2023-February 2024 period, Hyundai’s top selling SUVs were the Creta (146,315 units), Venue (119,281 units), Exter (62,826 units in 8 months since launch) and the Alcazar (19,333 units). Their numbers will increase with the March 2024 wholesales. This performance has meant that the Creta, Venue and Exter were ranked fourth, seventh and 15th in the Top 20 UVs chart for the first 11 months of FY2024.

Hyundai has also gained from strong demand for the Exter compact SUV, which has received over 100,000 bookings, creditable given that this new model is part of an ultra-competitive sub-segment.

A look at the company’s performance over the past 12 months reveals that Hyundai surpassed the 50,000-unit sales mark for eight months, and averaged monthly sales of 51,226 units compared to 47,295 units in FY2023. Hyundai opened 2024 with best-ever monthly sales of 57,115 units, which could be put down to the launch of the new Creta that month.

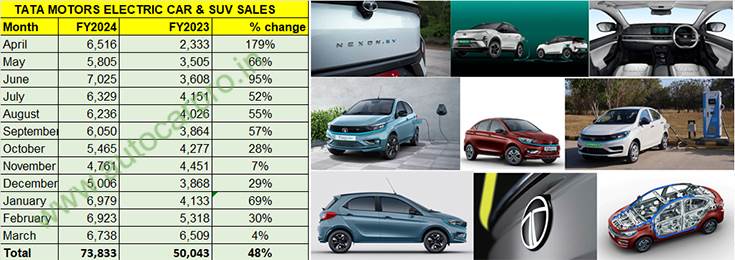

TATA MOTORS: 570,955 units, up 6% YoY

Tata Motors, which surpassed sales of half-a-million passenger vehicles for the first time in FY2023, has bettered that with its FY2024 performance. The car and SUV manufacturer has reported total dispatches of 570,955 units in FY2024, improving upon its year-ago sales by six percent (FY2023: 538,640 units).

March 2024’s 50,110 units made it the third month in a row that the company clocked sales of over 50,000 units. This demand, according to the company, is led by new launches in CNG and EVs and the continued strong customer response for the recently launched new Nexon, Harrier and Safari SUVs.

Tata Motors recorded its best-ever PV sales of 570,955 units and best-ever EV sales of 73,833 units, with EV penetration increasing to 13% of PC sales.

The company, which retails seven PVs – Altroz, Tigor, Tiago, Nexon, Punch, Harrier and the Safari – in the domestic market, has capitalised on surging demand for its SUVs, particularly the Nexon and the Punch compact SUVs. What has benefited the company’s growth over the past couple of years is that Tata Motors’ PV ‘New Forever’ portfolio covers petrol, diesel, CNG and electric powerplants, thereby considerably expanding its consumer reach compared to most of its rivals.

A key factor that acts as a catalyst to Tata Motors’ accelerated growth is its first-mover advantage in India’s fast-growing electric vehicle market, where it has an over 70% market share. The company’s EV portfolio comprises the Nexon EV, Tigor EV and Xpres-T (for fleet buyers), Tiago EV and the recently launched Punch EV. As per Vahan, of the 90,012 EVs retailed in India in FY2024 (up 90%), Tata Motors accounted for an estimated 63,545 units and maintained its lead with a 70.59% share in a dynamic market which is seeing rivals roll out new competitive products at regular intervals.

There is growing demand for CNG-powered Tata cars. Combined sales of CNG variants and EV accounted for nearly 29% or 165,576 units. Given that EVs accounted for 13% (73,833 units), it can be surmised that CNG car and SUV sales were around 91,352 units.

MAHINDRA & MAHINDRA: 459,877 units, up 28% YoY

Mahindra & Mahindra has wrapped up FY2024 with its best-ever sales: 459,877 units. This constitutes strong 28% year-on-year growth (FY2023: 359,253 units) with the company selling an additional 100,624 units in FY2024. What’s more, the rapid rate of demand for most of its SUVs meant that M&M has doubled its FY2022 sales of 225,895 units in just two years.

With SUVs accounting for over 55% of total passenger vehicle sales in India in the first 11 months of FY2024, M&M clearly made the most of the sustained and surging wave of consumer demand for this vehicle type.

Mahindra has maintained a strong growth trajectory in an extremely competitive marketplace bristling with over 100 UVs and 800 variants.

Mahindra has maintained a strong growth trajectory in an extremely competitive marketplace bristling with over 100 UVs and 800 variants.

In what is an extremely competitive market for utility vehicles bristling with models and variants aplenty, Mahindra & Mahindra, which has eight SUVs (Bolero, Bolero Neo, Scorpio, Scorpio N, Scorpio Classic, Thar, XUV300, XUV400 and XUV700), has maintained high double-digit YoY growth throughout this fiscal (see data table above).

In March 2024, the company dispatched 40,631 units, up 13% YoY. In the past 12 months, the SUV manufacturer surpassed the 40,000-units mark on five occasions, with the festive month of October 2023 (43,708 units) delivering the highest number.

Five Mahindra models are already in the Top 20 best-selling UVs listing for the April 2023-February 2024 period. The Scorpio is ranked sixth with 126,311 units, Bolero is No. 10 (100,494 units), flagship XUV700 No. 13 (72,787 units), Thar at No. 17 (58,430 units) and the XUV300 at 18th position with 51,890 units. Their total FY2024 will swell even more when model-wise March 2024 dispatches are added.

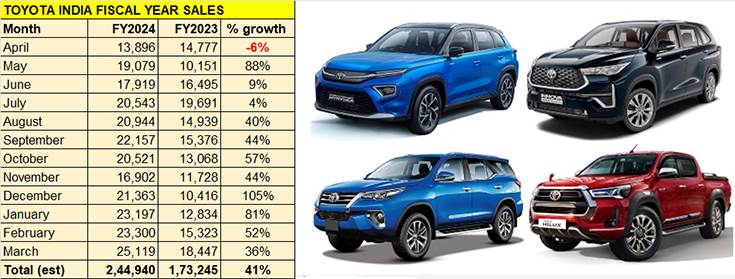

TOYOTA KIRLOSKAR MOTOR: 244,940 units, up 41% YoY

Toyota Kirloskar Motor (TKM) has also recorded its best-ever domestic market sales in a fiscal year. At an estimated 244,940 units, TKM has posted strong 41% year-on-year growth (FY2023: 173,245 units).

This performance over the past 12 months (April 2023-March 2024) betters the company’s wholesales in calendar year 2023 and reflects the sustained demand for most of its products. In CY2023, TKM registered its best-ever annual sales – 221,356 units – as a result of sustained demand for its MPVs and SUVs as also the rebadged models like the Glanza, Urban Cruiser Hyryder and Rumion, ramped-up production and a number of customer-friendly initiatives.

With 244,940 units and 41% YoY growth, Toyota India capped off its best-ever fiscal year with best-ever monthly sales of 25,119 units in March 2024.

In FY2024, the top two models for TKM are the Innova Crysta / Hycross MPV and the Urban Cruiser Hyryder SUV. Between April 2023 and end-February 2024, the Innova models had sold an estimated 88,281 units and the Hyryder, 42,951 units. The third best-selling UV is the Fortuner with 28,050 units in the first 11 months of FY2024. All these three models are among the Top 25 UVs in the April 2023-February 24 period: the Innova in 12th position, Hyryder 19th and the Fortuner at No. 21.

Commenting on the company’s performance, Sabari Manohar – Vice-President, Sales-Service-Used Car Business, Toyota Kirloskar Motor said: “We are thrilled to close both our wholesales for 2023-24 fiscal year and March 2024 by recording the highest ever units. Instrumental to our growth has been our strong product portfolio, tailormade value-added services such as enhanced digitalization, financial tie-ups, high value proposition, easy accessibility to our products/services. Notably, the SUV and MUV segments were our biggest contributors with models like the Innova Crysta, Innova HyCross, Fortuner, Legender, Urban Cruiser Hyryder, Hilux and LC300. Other product offerings such as the Camry Hybrid, Glanza, Vellfire and the Rumion too have fuelled the company’s upward sales trend.”

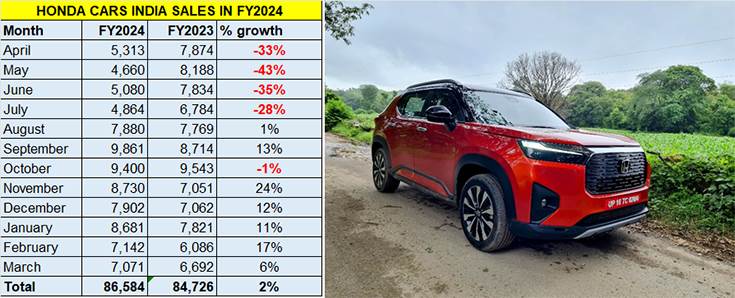

HONDA CARS INDIA: 86,584 units, up 2%

Honda Cars India has registered total wholesales of 86,584 units in FY2024, up 2% YoY (FY2023: 84,726 units). The Japanese car and SUV maker’s performance has been energised by the launch of the Elevate midsized SUV in August 2023. Between August 2023 and February 2024, the Elevate had sold 30,365 units and was Honda’s second best-selling model after the Amaze. March 2024 would have added another 4,300-odd units to its tally, taking the Elevate’s total sales in FY2024 to around 34,665 units.

The Elevate, which is also exported to Japan, has also revved up overseas shipments for the company. The Elevate would have contributed a little over 7,000 units to Honda Cars India’s exports of around 37,589 units in FY2024, up 66% on FY2023’s 22,710 units.

Kunal Behl, Vice President, Marketing & Sales, Honda Cars India said: “FY2023-24 has been an important year for HCIL as we marked a strong entry into the booming SUV segment with the Honda Elevate, which has received an overwhelming response from customers nationwide. The Elevate has become a strong business pillar contributing significantly to our domestic sales and strengthening our exports by addition of new destination Japan.”

ALSO READ:

Passenger vehicle sales in FY2024 up by 8.5% to best-ever 4.23 million, SUV share at 50 percent