Volkswagen Group released its financial numbers for Q1 2024 today, following similar trends from other EU-based automakers. The numbers detail a slowing of sales and a drop in profits. Despite a 20% decrease, the Group remains optimistic that it will end the year at its financial targets.

Today’s Q1 2024 report from Volkswagen Group comes with little surprise, as the German automaker already gave the public an idea of its sales woes earlier this month when it shared its delivery numbers.

Deliveries for Q1 were up 3% overall year-over-year, but BEV sales fell. EV sales were up in China (+91% YOY) but stumbled in Volkswagen’s native Europe (-24%) and the US (-16%). It’s top-selling models in the first quarter were the ID.4/ID.5 (34,600 units), ID.3 (26,100), Audi Q4 e-tron (22,800), Skoda Enyaq (14,000), Audi Q8 e-tron (9,600), and VW ID.Buzz (7,000).

At the same time, Volkswagen Group shared that deliveries of Porsche’s lone EV, the Taycan, also fell by 54% in Q1 2024. Still, a bolstered 2025 model year Taycan is on the way alongside several new BEV models from Volkswagen that the auto conglomerate hopes will help it bounce back in 2024.

Today, we got a better idea of VW Group’s Q1 numbers beyond mere deliveries, which includes a 20% drop in profits.

Volkswagen’s sales and revenues dropped in Q1 2024

Per a detailed Q1 2024 report released by Volkswagen Group today, it is off to a slower start this year, although the German automaker states it anticipated this dip and relayed confidence going forward. Per VW Group CFO and COO Arno Antlitz:

As expected, our first quarter results show a slow start to the year. We remain confident of achieving our financial targets for 2024. A strong March, the solid order bank and the improving order intake in the past months are encouraging and should already have a positive impact in the second quarter. We expect additional momentum over the course of the year from the launch of more than 30 new models across all brands. At the same time the effects our efficiency programs will gradually unfold as the year progresses. In this context, it will be particularly important to vigorously counteract the increase in fixed costs and exercise investment discipline.

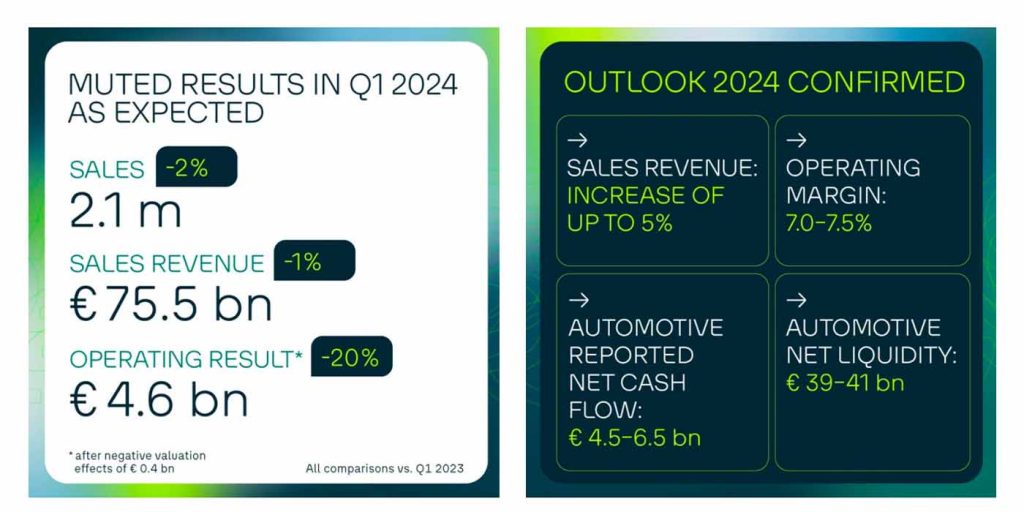

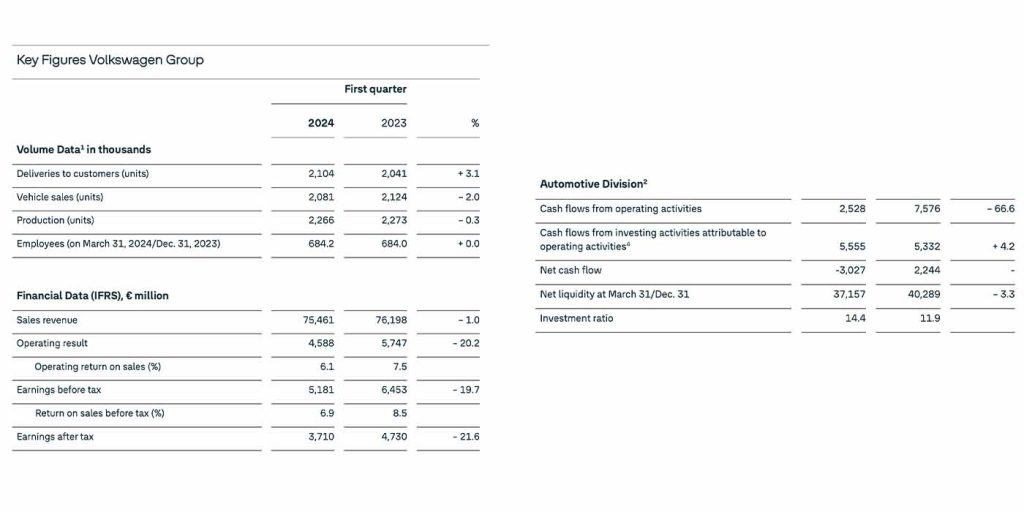

Notable figures include 75.5 billion euros in sales revenue, down from 76.2 billion in Q1 2023. Furthermore, VW Group reports EUR 4.6 billion in operating results, down 20% compared to a year ago with an operating margin of 6.1%. Volkswagen cites “lower sales volumes, an unfavorable country, brand and model mix as well as an increase in fixed costs” as the reasoning behind its negative Q1 2024 results.

In terms of overall sales, Asia-Pacific saw 2% growth while South America recorded record numbers, up 19% year over year. That said, sales in North America were down 10%, followed by the rest of the world at 5%, for a grand total of 2.1 million vehicles sold globally in Q1.

Despite many minuses on its Q1 2024 spreadsheet, Volkswagen Group anticipates a sales revenue increase of up to 5% and an operating margin between 7 and 7.5%, clearing the way for a clean 2024 outlook it remains confident in. Per the release:

In the Automotive Division, the Group assumes an investment ratio of between 13.5 percent and 14.5 percent in 2024. The automotive net cash flow for 2024 is expected to be between EUR 4.5 and EUR 6.5 billion. This will include in particular investments for the future and cash outflows from mergers and acquisitions for the battery business, which are a vital pillar of the Volkswagen Group’s transformation. Net liquidity in the Automotive Division is expected to be between EUR 39 billion and EUR 41 billion in 2024. It remains the Group’s goal to continue its solid financing and liquidity policy.

Challenges will arise in particular from the economic situation, the increasing intensity of competition, volatile commodity, energy and foreign exchange markets, and more stringent emissions-related requirements.

FTC: We use income earning auto affiliate links. More.