Blue Sky Uranium Corp. is addressing surging demand in the uranium market by advancing its Amarillo Grande project in Argentina.

The spot price of uranium is up 180% in the last three years, from $25/lb to $70/lb in early October. In 2021, 440 nuclear plants globally used 74,000 tonnes of uranium oxide. 57,000 tonnes were mined and processed in 2021, with shrinking inventories providing the 17,000-tonne difference, according to the World Nuclear Association.1

Uranium is used to make the fuel to run nuclear power plants that generate electricity. It is first mined and processed into yellowcake (uranium oxide in powdered form), which is then enriched to become nuclear fuel.

Why is nuclear power increasing in use?

Today’s world demands both drastic decarbonisation and much more electricity. Nuclear power is being embraced globally because it is safe, carbon free, and very reliable, which means more demand for uranium fuel.

To generate electricity, one enriched uranium fuel pellet – about the size of your fingertip, weighing ten grams – replaces one tonne of coal, 149 gallons of oil, or 17,000 cubic feet of natural gas, as well as having zero emissions, according to the Nuclear Energy Institute.2

Therefore, more nuclear reactors are being constructed and commissioned globally. In August this year, 436 reactors were operable. Sixty-seven have come online in the last ten years, four thus far in 2023. Sixty are being built, and 120 more have gotten through the planning phase, according to the WNA. This means more uranium is being used every year.

Importantly, fundamentals in the uranium market indicate that the bull market is likely to continue. It takes ten or more years to get a uranium mine into production, according to Sprott Asset Management.

Russia’s supply currently off-limits to many

With Russia’s invasion of Ukraine in February last year, western utilities are continuing, but not extending, contractual imports of enriched uranium/nuclear fuel from Rozatom, the Russian state uranium monopoly. At some point, Russia may stop all supplies from its uranium market to the West.

And pending Western legislation – for example, in the US, HR1042 in the House and ROS23164 in the Senate, together referred to as the Nuclear Fuel Security Act – could end it all as well.

Uranium is a strategic mineral. Nuclear provides 20% of the US power grid – communications, homes, businesses, factories, and now cars and trucks. Will US political leaders let the grid collapse? Unlikely.

With Russian supply waning, the uranium market has changed. Kazakhstan, Russia, and Uzbekistan produce 50-55% of the world’s uranium today, and Russia enriches 45% of the world’s nuclear fuel, per the WNA. The global uranium market, this year and last year, is divided into two markets, approximately 50% each between the Western world and Russia and its allies. This is demonstrated in the rising price of uranium.

A genuine opportunity

The situation is dire. The opportunity is real. The last time the price of uranium surged strongly, in 2004–2007, the price peaked above $140/lb, or above $200/lb when adjusted for inflation. The time before that, in 1976–1977, it peaked at $173/lb, inflation-adjusted to compare with today’s prices.

Western-world producers are gradually increasing uranium production, and the hunt is on for developers with the potential for scale and low-cost, relatively near-term production.

Few investors are aware that Argentina has ambitions to be the South American nuclear sector leader. It already is in many regards.

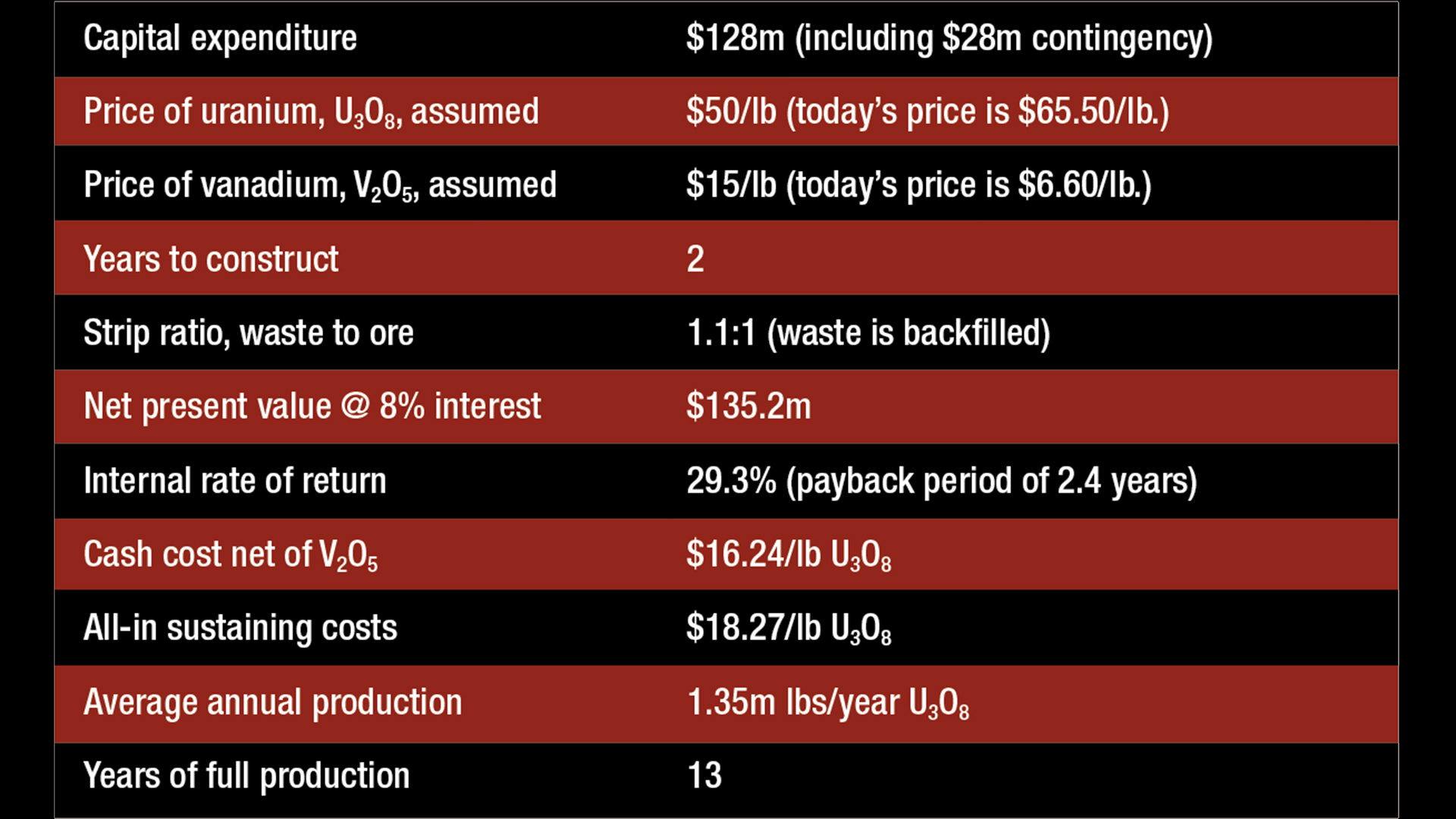

Blue Sky Uranium Corp.(BSK.V; BKUCF.OTC) has already completed a Preliminary Economic Assessment (PEA) on its first uranium resource at Amarillo Grande, as stated in company news on 27 February 2019. The study demonstrates that the current deposit has the potential to produce uranium over a thirteen-year period, with an overall internal rate of return of 29%.

Amarillo Grande project: Potential scale with a low-capital, low-cost profile

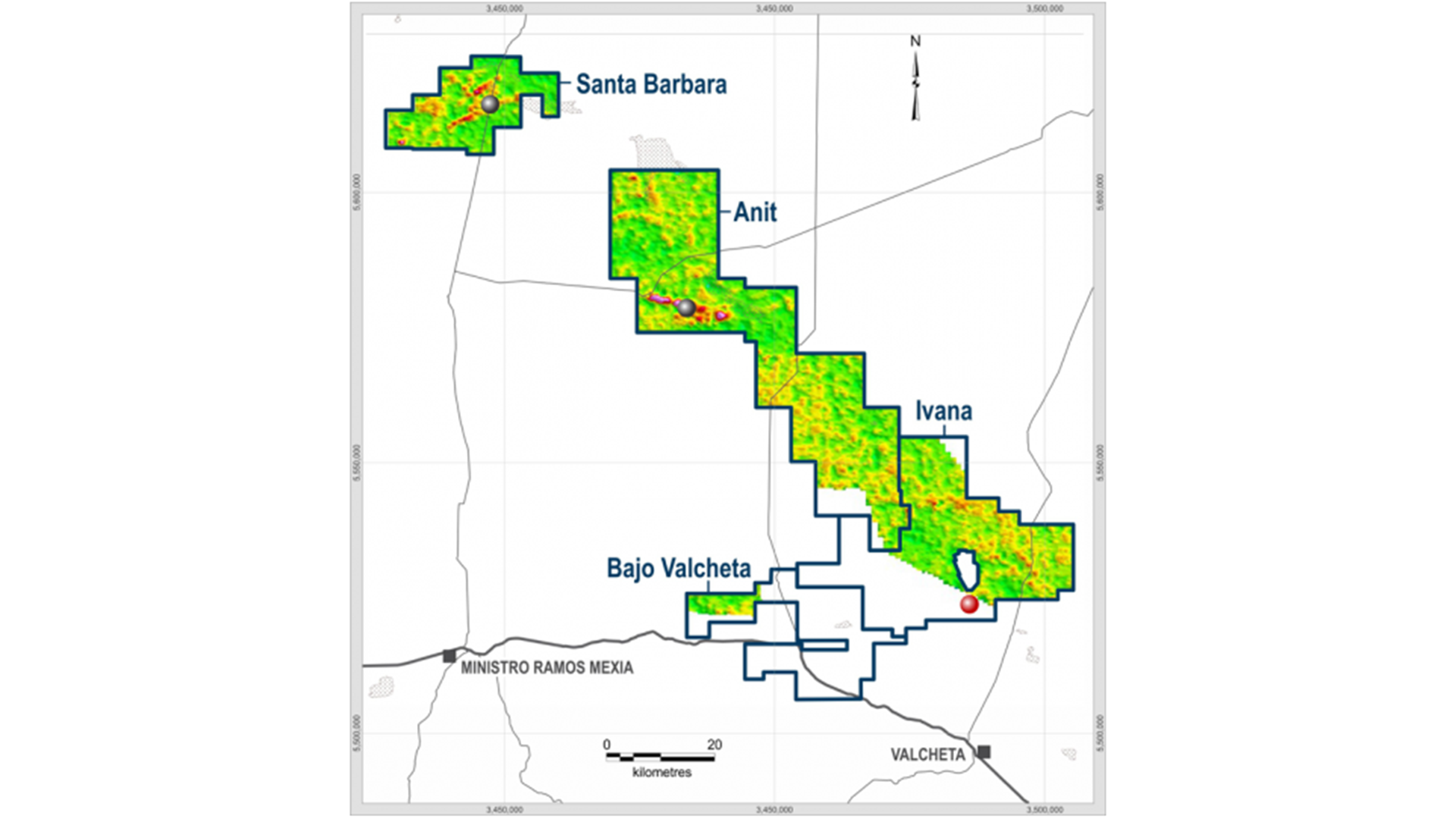

The project consists of a series of new uranium-vanadium discoveries made by BSK over 15 years along a 145km by 50km trend, or 90 miles long by 31 miles wide (1.5 times the size of Delaware) and covered by nearly 300,000 hectares of mineral rights. Blue Sky controls 100% of the project.

The area is semi-desert, with very little population and low environmental risk in the pro-mining, pro-nuclear Rio Negro Province. The project is road-accessible all year, shallow groundwater is plentiful, and power and rail are accessible.

Argentina and Rio Negro Province are nuclear-savvy

Argentina is a leading centre of nuclear understanding and progress in South America, with an advanced nuclear industry, including:

• Three nuclear power plants in operation (three of the total five in South America);

• Six research reactors;

• Four particle accelerators;

• A uranium purification plant;

• One nuclear power plant under construction; and

• Two additional plants are in planning, with two more under proposal.

Yet, there is no uranium production in Argentina; all uranium is imported from Asia. Argentina has its own enrichment facilities processing the imported uranium into nuclear fuel for their operating plants.

The legal framework guarantees the purchase of uranium by any producer in Argentina, and exports of both uranium and vanadium are legal. The Ivana deposit within the Amarillo Grande project is the largest and most advanced uranium mineral resource in Argentina.

Rio Negro Province is itself a strong nuclear jurisdiction

Rio Negro Province, where Blue Sky’s Amarillo Grande project is located, has a broad local nuclear experience. A research nuclear reactor, hydro-metallurgical lab and the country’s pilot uranium-enrichment plant are in Rio Negro Province.

If uranium production commences at Amarillo Grande, it could potentially be enriched directly in the same province for sale and use by Argentina’s nuclear plants. By comparison, the US has no enrichment facilities.

Initial Resource Statement

Blue Sky Uranium had its first resource estimate completed by independent consultants and reported in 2018, and then updated and reported in 2019 along with the company’s first PEA.

This estimate establishes a good place to start. Note that since it is an inferred resource, it does not have demonstrated economic viability.

Blue Sky’s Ivana deposit hosts an inferred resource of 22.7 million lbs of U308 and 11.5 million lbs of V2O5 (28.0 million tonnes averaging 0.037% U308 & 0.019% V2O5 at a 100 ppm uranium cut-off).

Please refer to the company’s news release dated 27 February 2019 for more information.

The vanadium may add value. Argentina uses a tremendous amount of vanadium in their steel factories. The vanadium does not involve increases in processes, equipment, or capital. The same processing steps free both the uranium and vanadium.

Preliminary Economic Assessment

Refer to Blue Sky’s news release dated 27 February 2019 for more information.

At Amarillo Grande, the Ivana deposit starts just below surface level and the host gravel, sand, and sandstone are amenable to shovelling, hauling, wet scrubbing and screening, and leaching of the uranium and vanadium using alkaline leach (sodium carbonate/bicarbonate) to produce a uranium-vanadium bearing solution that can be used to produce yellowcake. No blasting, no drilling, no crushing, no monitor wells, no production wells are anticipated.

These details are described in the Company’s PEA:

While this information is preliminary, the all-in-sustaining costs are easily within the lowest quarter of uranium production globally, comparing favourably with the top producers in Kazakhstan. Based on estimates generated by SRK Consulting at approximately the same time as this PEA was reported, the lowest one-quarter of AISC costs to produce a pound of uranium ended just below $21/lb.

Costs have changed somewhat since this report was completed, but so have prices across the uranium market.

Next actions

Now, with another 8,000 metres of drilling completed at Amarillo Grande over the past three years — both in-fill and step-out drilling at Ivana, plus initial drilling at Ivana Central and Ivana North targets — the Company has been working on resource upgrading and engineering to maximise the project’s uranium potential.

Note that 8,000 metres of drilling covers a large footprint when each hole is just ten to 40 metres in depth. Each hole was preceded by careful and thorough geophysical and geochemical workups.

Near-surface uranium, being modestly radioactive, can be targeted prior to drilling. Each drill hole includes radiometric monitors that survey the area below and surrounding the hole for nearby uraniferous zones.

Drilling Ivana North, Ivana Central, Ivana East and Cateo Cuarto targets

Ivana North and Ivana Central targets are so large – each approx. 4x7km – that initial drilling is a starting touch. The first 40 holes into Ivana North have been reported. Anomalous uranium was detected in several of the completed holes, confirming the area’s potential for a new discovery. The first 1,500 metres of drilling at Ivana Central have been completed, with initial results showing potential.

The first drill programme at Ivana East (10km east of Ivana) will be the next to be completed. Geophysical and geochemical programs at Cateo Cuarto (32km southwest of Ivana) have set targets for its first drill testing, which will be subsequent to the Ivana East program.

The discoveries at Santa Barbara, 130km to the northwest of Ivana, and Anit, 70km to the northwest, also need to be addressed and further explored.

The ongoing exploration drilling will accompany the engineering studies that are underway, potentially leading to an updated economic study with a new resource estimate as early as 2024.

Management readiness

The company has a strategic advantage over competing explorers in Argentina. Blue Sky is a member of the Grosso Group, a management team that pioneered the mineral exploration industry in Argentina. Started in 1993, it has been involved with four exceptional mineral deposit discoveries, all of which are in Argentina.

Blue Sky management, headed by long-term industry professional Nikolaos Cacos, is proud to have strong relationships built over the decades with local, provincial, and federal officials, as well as strong community and cultural ties.

In addition to the Amarillo Grande uranium deposit, Grosso Group’s precious and base metal explorer Golden Arrow Resources Corp (TSX-V: GRG) discovered the Chinchillas silver/lead/zinc deposit, which was sold to and is now in production by SSR Mining. It had involvement with two additional discoveries in Argentina: Gualcamayo gold, in production by Mineros SA and Navidad silver, controlled by Pan American Silver.

Grosso Group lithium explorer Argentina Lithium and Energy Corp (TSX-V: LIT) recently announced a $90m investment by Stellantis, one of the world’s leading automakers and mobility providers.

Uranium market valuation

Market awareness of the uranium market – and the few development companies with potentially large scale – is on the rise. Serious uranium resources in the Americas within a low-cost profile and in a supportive jurisdiction are what investors in this sector need to see. This does not come easily.

The Ivana deposit has the potential to check all those boxes, plus a host of nearby exploration potential. Clearly, Blue Sky Uranium’s Amarillo Grande project has a big sky to grow into in the near term.

References

Please note, this article will also appear in the sixteenth edition of our quarterly publication.