According to a joint report by Ernst & Young and the European power industry trade association, there will be 130 million electric vehicles on the road in Europe by 2035.

The report’s projections show that by 2030, the number of electric vehicles in Europe will grow from less than 5 million today to 65 million, before doubling over the next five years.

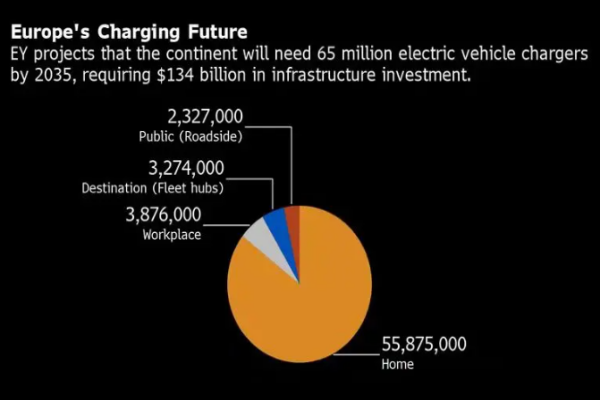

Ernst & Young estimates that continental Europe is expected to need 65 million charging points to service these electric vehicles, of which 85% will be installed in private homes.

The rapid adoption of electric vehicles in the European market has brought two major tasks to infrastructure development.

First of all, it is necessary to establish an infrastructure network consisting of 9 million outdoor charging piles in public places such as roads and office buildings.

According to the latest statistics from Bloomberg, about 445,000 public charging piles have been installed in Europe in the past ten years. Serge Colle, EY’s global head of energy and resources, said that by 2030, about 500,000 new units will need to be built each year, and by 2030 to 2035, an average of 1 million will need to be built each year.

Ernst & Young estimates that infrastructure expansion over the next decade will cost about $62 billion, with an additional $72 billion needed to install 56 million home chargers.

The increased production capacity of electric vehicles will be matched with batteries, renewable energy reserves, and infrastructure design and construction. In addition to overseeing and managing the installation of millions of charging piles, the European automotive industry will also require additional load on the grid.

According to Ernst & Young’s calculations, the number of electric vehicles on the road in the next few years could directly increase the peak load of the grid by 90% if the extended range near the highway is to meet the fast on-demand charging that drivers expect.

Managing these surges will require more solar and energy storage systems to be installed near the network of charging stations, Serge Colle said.

In an urban residential setting, EY expects charging demand to surge overnight when drivers leave work, leading to a possible 86% increase in peak load.

To better flatten the peaks, electricity providers will need to provide incentives for car owners to let more people charge during off-peak hours.