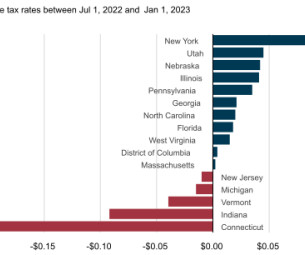

EIA: State tax rates for retail gasoline and diesel increased in 13 states in 2023

Green Car Congress

FEBRUARY 24, 2023

Data source: US Energy Information Administration, federal and state motor fuels taxes table. Note: Tax rates increased by $0.001/gal in Arkansas and by $0.0005/gal in Missouri. gal), although that low tax rate will gradually increase through May 2023. These Superfund taxes include a $0.09 in fiscal year 2021.

Let's personalize your content