Tesla Service Was Not Going To Be A Profit Center … But Is It Now?

Some years ago, Tesla CEO Elon Musk noted that Tesla service centers would never be a profit center for the company. Counter to how dealerships make a lot of their money on service, Musk contended it wasn’t the right thing to do and Tesla service centers would never be focused on making a profit, but would just break even.

So, I found it interesting when reading Tesla’s Q4 and 2023 shareholder letter that Tesla highlighted gross profits of around $500 million in its “services and other” business. “Gross profit of our Services & Other business increased from a ~$500M loss in 2019 to a ~$500M profit in 2023,” the company noted.

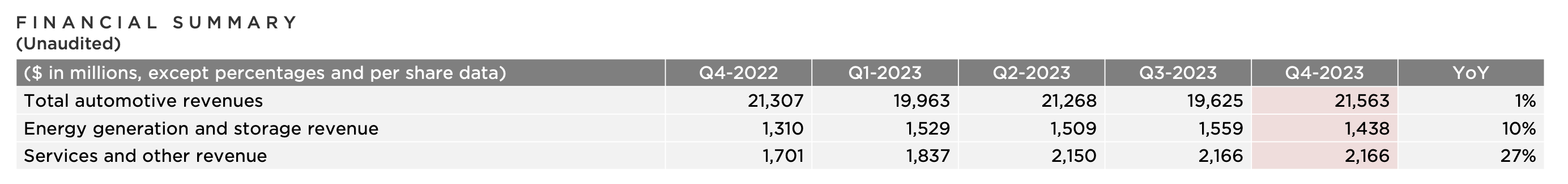

If you look at the section of the report above, you can see that “services and other” revenue grew gradually quarter over quarter from Q4 2022 to Q4 2023, with year-over-year growth of 27% in that quarter.

If you look at full-year trends (above), you can similarly see that “services and other” revenue grew year over year since 2019. The biggest jump occurred from 2021 to 2022, but there was also a big jump from 2022 to 2023 — 37% growth.

Revenue is not profits. Naturally, with a massively growing fleet, services revenue tied to total vehicle fleet size is going to go up. But what is driving profits, and is it over-priced service work that Elon Musk said would never be part of the business? (Side note: The cost of at least one basic service, an air filter change, has gone up a lot in the past couple of years. However, the cost to have Tesla change my Model 3’s tires would be similar to what it was a couple of years ago — but still far more than going to an independent tire place.)

Going deeper into the report, I then found a better explanation of what “services and other” is capturing. “The Services and Other business continued to grow alongside our fleet in 2023, achieving record revenue and gross profit generation. The biggest drivers of profit generation in 2023 were part sales, used vehicle sales, merchandise sales and pay-per-use supercharging. As our fleet continues to expand in the coming years, there is an opportunity for fleet-related services to become a more meaningful driver of profit generation.”

Let’s just take a moment on each of these. Also, unfortunately, Tesla is lumping revenue and gross profit generation together for all of these here, so we don’t really know which ones are bringing in more gross profits versus which ones are seeing revenue growth but not necessarily profit growth.

Part sales is the first thing Tesla mentions. Naturally, a larger fleet and an older fleet is going to require more part sales. The question is whether Tesla is marking up prices on parts in order to make more profits, on the backs of loyal Tesla owners. We don’t really know. All we know is what Tesla wrote above. (Drop a comment down below if you know more.)

Used vehicle sales is an interesting one. Tesla pulls in tons of used vehicles, as many owners decide to trade their Teslas (or other cars) in when they buy new Teslas. Tesla is logically selling more and more of those as it sees increasing sales, and perhaps shifts in the market are also helping the company to make more profit on those vehicles when reselling them.

Merchandise sales is something I imagine Tesla doesn’t make huge revenue or profits on. Though, I’ve long contended that the company could milk far more money out of its fans by putting more goodies in stores, in service centers (which are often barren and depressing), and at big Supercharger stations.

Pay-per-use supercharging is an intriguing one. So far, Tesla is basically just making money on this from its growing owner fleet and the growing number of Superchargers out there. However, in the coming years, as more electric vehicles can use Tesla’s Superchargers — via adapters and then via their built-in charging equipment — you could see this really booming. In fact, while Tesla’s vehicles have had other advantages over the years, access to the Supercharger network has been the biggest advantage for many buyers. I think Tesla risks losing auto sales by opening up the network to other EVs, but at the same time, it could lock down a semi-monopoly on fast charging in North America, could indeed help EV adoption to grow much faster, and could end up making a great deal more revenue and profits from charging services. Actually, I’ve also argued for years that Tesla should build better facilities and services around these Superchargers, to make them nicer for travelers, and also to make a great deal more revenue. Many drivers would spend more money on snacks, coffee, or other goodies from a Tesla store at a Supercharger station than they would on the charging. And bonus: I don’t think Elon ever said that Tesla would never make a profit on its charging services.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.