Tesla (TSLA) is about to release Q4 2023 and full-year 2023 financial results on Wednesday, January 24, after the markets close. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll take a look at what both the street and retail investors are expecting for the quarterly results.

Tesla Q4 2023 deliveries

While Tesla is an “AI/robotics” company, according to CEO Elon Musk, its automotive deliveries remain the biggest drivers of financial performance.

Tesla already disclosed its Q4 vehicle delivery and production numbers:

| Production | Deliveries | Subject to operating lease accounting | |

| Model 3/Y | 476,777 | 461,538 | 2% |

| Other Models | 18,212 | 22,969 | 3% |

| Total | 494,989 | 484,507 | 2% |

And here are Tesla’s full-year 2023 production and delivery numbers:

| Production | Deliveries | |

| Model 3/Y | 1,775,159 | 1,739,707 |

| Other Models | 70,826 | 68,874 |

| Total | 1,845,985 | 1,808,581 |

Tesla had been aiming for 1.8 million deliveries for the whole year.

Delivery and production numbers are always slightly adjusted during earning results.

Tesla Q4 2023 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers.

However, Tesla’s average price per vehicle is changing a lot these days due to frequent price cuts and discounts across many markets, which makes things more difficult.

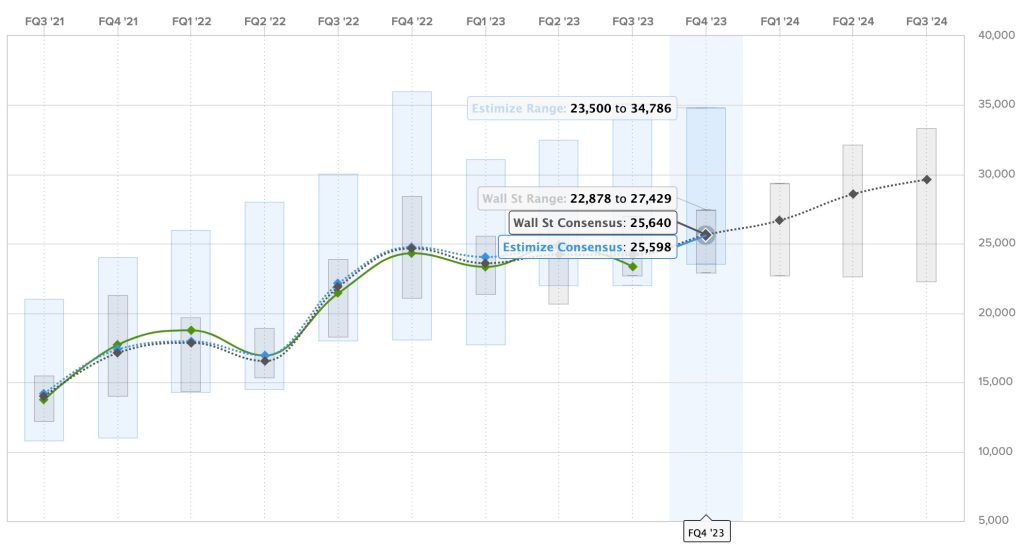

The Wall Street consensus for this quarter is $25.640 billion, and Estimize, the financial estimate crowdsourcing website, predicts a slightly lower revenue of $25.598 billion.

The crowdsourcing estimate is rarely lower than Wall Street consensus.

If Tesla can reach $25 billion in revenue, it would be a new quarterly record for the company.

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results are in green:

Tesla Q4 2023 earnings

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful in doing so over the last three years now.

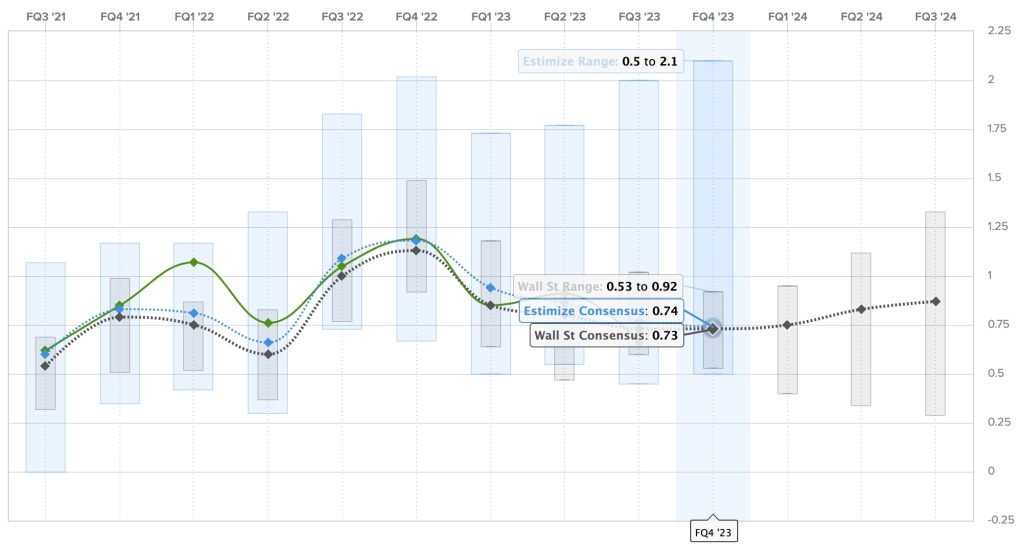

However, like revenues, it has been harder to estimate earnings this year with price cuts digging into Tesla’s industry-leading gross margins.

For Q4 2023, the Wall Street consensus is a gain of $0.73 per share, while Estimize’s prediction is slightly higher with a profit of $0.74 per share.

This would be significantly lower year-over-year amid price cuts.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

Other expectations for the TSLA shareholder’s letter and analyst call

Beyond the financial results, Tesla always gives broader updates and answers shareholder questions in its shareholder letter and conference call with management following the release of the results.

Tesla gathers questions from shareholders from the “Say Technologies” website.

The currently most upvoted question is about the next generation Tesla vehicles:

Given that you moved the start of the next generation compact vehicle production to Austin, has the timeline improved so that we might see next generation platform vehicles in 2025?

It’s a fairly simple question about getting an official timeline for the next-generation vehicle, which we will probably not get a straight answer on. Tesla doesn’t like to make product announcements on its earnings calls.

The second most upvoted question is a bit more interesting:

Should retail shareholders be concerned that Elon has stated he is uncomfortable expanding AI and robotics at Tesla if he doesn’t have 25% of voting?

This is in relation to Musk asking for a 25% voting control at Tesla, which would require the company to give him about $60 billion worth of shares, or he would prefer to build AI products at his new xAI startup.

We highlighted the conflict of interest problem and even possible breach of fiduciary duties that he is opening himself to with his statements.

This is probably the softest way to ask about this issue, but it is still going to be interesting to get a response from Musk or the rest of Tesla’s management.

The rest of the top questions are pretty straightforward, like the state of the Cybertruck backlog and the timelines for Gigafactory Nevada expansion and Gigafactory Mexico construction.

Finally, Tesla should also be sharing guidance for 2024, which should be interesting.

Join us on Electrek tomorrow for the best coverage of Tesla’s earnings.

FTC: We use income earning auto affiliate links. More.