IHS Markit: oil price collapse will change trajectory of North American gas supply

Green Car Congress

APRIL 8, 2020

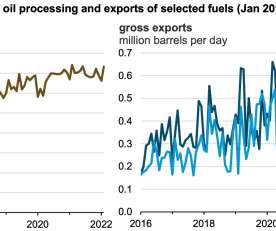

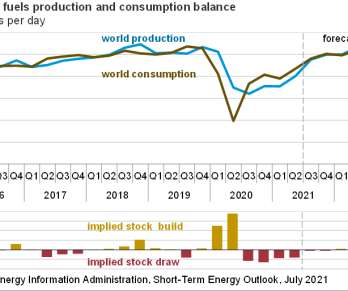

The trajectory of North American gas supply is set to change radically as a result of the fall in oil prices that has occurred due to COVID-19 and the breakdown in production cooperation between OPEC and Russia, according to IHS Markit. Combined, the Bakken and Eagle Ford are producing nearly 3 MMbbl/d of oil and 7.2

Let's personalize your content