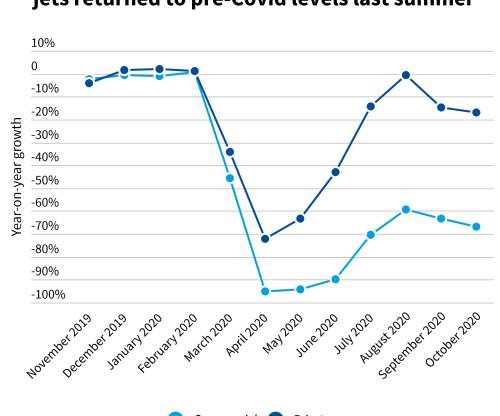

US COVID-19 mitigation efforts resulting in significant decline in traffic, emissions and fuel-tax revenues

Green Car Congress

MAY 2, 2020

The authors used the VMT data to calculate that emissions of US greenhouse gas (GHG) emissions were reduced by 4% in total and by 13% from transportation in the almost 8 weeks since many stay-at-home orders went into effect. Fuel use dropped from 4.6 It also resulted in fuel-tax revenue reductions, which vary by state.

Let's personalize your content