If you’ve seen the light with electric cars, chances are you’re at least curious about home solar.

Solar can help contribute to vehicle charging, and it can reduce the load from the electrical grid during peak charging times. That, in turn, means even fewer carbon emissions from your public utility. And as part of energy management systems, electric cars themselves (their traction batteries) could potentially help serve as flexible energy-storage buffers and pinch-hitters.

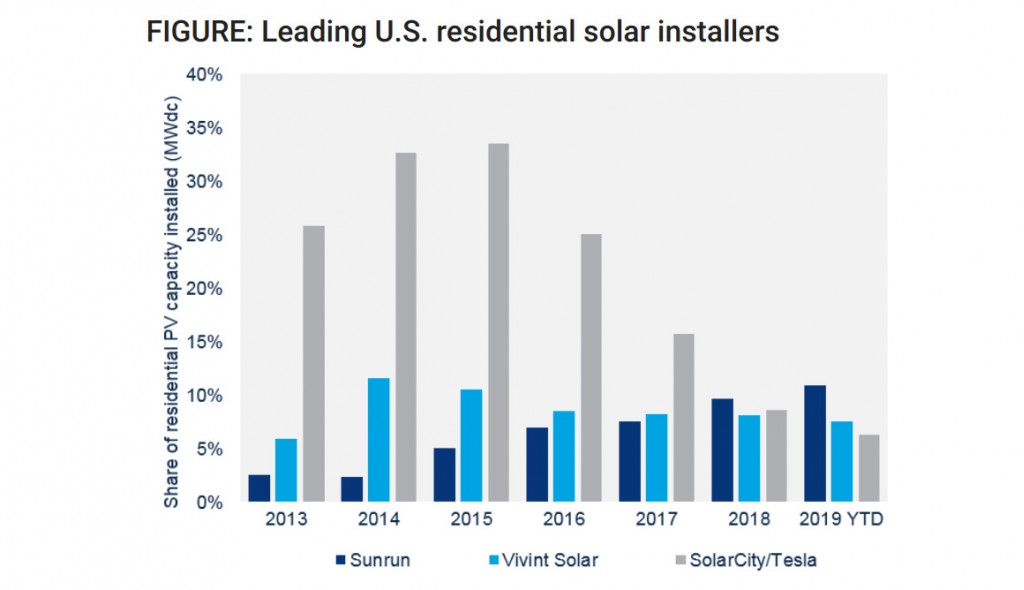

Considering Tesla’s acquisition of the much-hyped SolarCity in 2016, you might think that the electric carmaker would have quite the command of the market.

SolarCity

It’s quite the opposite, and a new report from the consultancy Wood Mackenzie lends some context to the slide. Looking at the first quarter of 2019, Sunrun has an 11-percent market share while Vivint Solar has 7.6 percent and Tesla (SolarCity) is in third place, at 6.3 percent. It’s quite a turn from three years ago, when Tesla held a first place lead with more market share than the other two combined.

Wood MacKenzie expects the entire U.S. residential solar market to grow just three percent by the end of this year. In 2018 Tesla’s installations dropped 41 percent despite modest growth across the market as a whole.

Market share for home solar through Q1 - June 2019, Wood MacKenzie

SolarCity reached a high of about 33 percent of the residential solar market in late 2015, the result of aggressive leasing programs and partnerships, such as with Home Depot.

The home-solar market hasn’t experienced much growth over the past several years. Another obstacle on the horizon is the Federal Investment Tax Credit for residential solar, which will sunset in 2022. And Wood MacKenzie says that it’s evidence that the market itself is segmenting.

![George Parrott's home solar installation [Credit: George Parrott] George Parrott's home solar installation [Credit: George Parrott]](https://images.hgmsites.net/lrg/george-parrots-home-solar-installation-credit-george-parrot_100689848_l.jpg)

George Parrott's home solar installation [Credit: George Parrott]

In Q1, Tesla’s total solar sales slumped by 36 percent versus the previous quarter and 38 percent versus year-ago levels.

Tesla cut prices of its solar systems late last year, and it announced another repositioning of its offerings in April. The company has said that its energy storage production was limited in 2018 by cell supplies, but it’s not clear whether this was related to the dip in solar sales.

In Tesla’s Q1 letter to its shareholders the company reported customers could now purchase solar and energy storage from its website “in standardized increments of capacity.”

It also said in the letter: “We aim to put customers in a position of cash generation after deployment with only a $99 deposit upfront. That way, there should be no reason for anyone not to have solar generation on their roof.”

Tesla bought SolarCity in 2016, at a cost of $2.6 billion, not counting the $3 billion of SolarCity debt it assumed. The original intent was to sell solar in its stores as well—something that hasn’t been a focus amid the push to deliver Model 3 sedans.

“Tesla stepping away from being a growth driver for solar reaffirms our hypothesis that long-term national growth will continue to be driven by smaller local and regional players and less reliant on national players,” said the recent consultancy report.

Tesla Solar Roof

The pièce de résistance, Tesla’s long-awaited solar roof, has run into issues with manufacturing and cost. But in the company’s last quarterly financial call, CEO Elon Musk said that the company has a shot at the product costing the same as an existing roof. “This is actually quite a hard technology problem to have an integrated solar cell with a roof tile and have it look good and last 30 years,” he said.

Even with a long list of products in the pipeline, like the Semi, the Pickup, the Roadster, Model Y, and the smaller car, it’s likely Tesla isn’t going to walk away from something still so potentially lucrative—or critical—to completing its ecosystem as just letting the sun shine in.