Despite electric cars producing no tailpipe emissions, not all of their effects will be environmentally beneficial, according to a recent report by McKinsey & Co.

The group, which is often optimistic about electric car adoption, forecasts that by 2030, plug-in cars will make up at least 20 percent of car sales globally, and up to 35 percent in Europe.

The report was published early this summer and details three resource demands of producing more electric cars, as well as one area where electric cars may fall short of some buyers' expectations.

Land use

Perhaps the most unexpected resource concern the report raises is land use, specifically chargers. All those electric cars have to park someplace to charge.

The report notes that to dispense the same number of driving miles per hour of filling as a gas station does today would take several 120-kw DC fast chargers with eight cords apiece. As they're dispensing that energy, the cars have to park somewhere. Such chargers are the equivalent of Tesla's current Superchargers, many of which include long rows of parking spaces at the edges of rest areas and parking lots.

Demand for public electric car chargers by region, from McKinsey report

Electrify America, Ionity in Europe, and other charging networks are beginning to deploy faster DC fast chargers that dispense up to 350 kw of power, which could reduce this need somewhat. The bottom line is that electric cars will need someplace to park while charging, and the amount of land needed will exceed that dedicated to gas stations today, McKinsey says.

While that may not look like a big deal in America, where 90 percent of electric car owners have their own parking at home where they can access a charger, it's a different story in Europe and China, where electric car sales are growing faster. In Europe, the report estimates that 45 percent of electric car owners rely on public chargers. In China, which the group forecasts will build more chargers, 40 percent of electric-car drivers will not have access to private parking spaces where they can charge.

Natural gas

All that electricity will also have to come from somewhere. While electric utilities are expected to become more efficient with many electric cars charging during off-peak night-time hours, they will still have to generate additional electricity to supply electric cars. (This is especially true in regions with lots of daytime public charging-station use.)

McKinsey forecasts that some of that electric growth in the U.S. will come from coal. However, 80 percent of the increased electricity demand in the U.S. is expected to come from natural gas. The McKinsey report adds that if half the cars on American roads were electric, the demand for natural gas would increase by 20 percent.

U.S. electricity supplies 2018, from EIA

Natural gas burns significantly cleaner than coal or gasoline, and using it to power electric cars still benefits from their improved efficiency. More electricity has to come from somewhere though.

While solar, wind, and other non-hydro renewable energy sources are the fastest growing in the U.S., natural gas produces more power in the U.S. than any other energy source and has grown from about 20 percent of power generation to about 35 percent over the past decade, according to a January report by the federal Energy Information Agency.

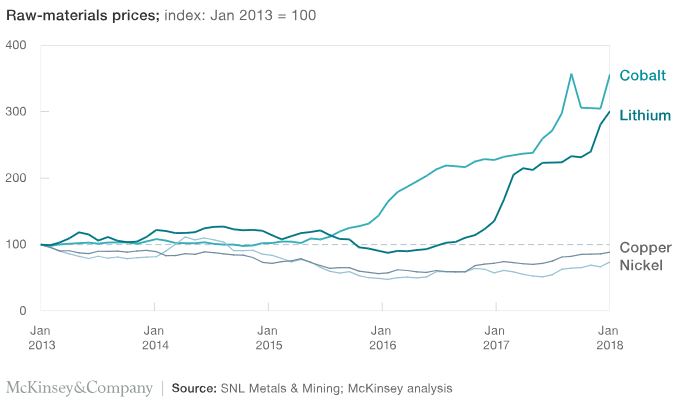

Lithium and cobalt prices 2013-2018, McKinsey & Co.

Battery metals

Green Car Reports has reported a lot on increasing demand for lithium and cobalt to build electric car batteries.

McKinsey says that for plug-in cars to reach its sales forecast, battery production will need to increase threefold by 2020. This will put sharp upward pressure on already-rising prices for lithium and cobalt.

Cobalt prices have tripled since 2015, and lithium prices have nearly done so. Automakers and their battery suppliers are working to reduce the amount of cobalt required in batteries, as mining companies are working to build more lithium mines. The McKinsey report notes that expanding mining operations can take as long as five years, however.

Oil demand

One of the big motivators for electric car buyers is to reduce oil demand. While every car powered by electricity certainly displaces one powered by petroleum, McKinsey forecasts that increased demand for oil from a growing population and increased development will still outstrip the effect of growing electric-car sales through 2025. The company does not anticipate overall petroleum demand decreasing, though electric cars may slow its growth.

Green Car Reports respectfully reminds its readers that the scientific validity of climate change is not a topic for debate in our comments. We ask that any comments by climate-change denialists be flagged for moderation. We also ask that political discussions be restricted to the topic of the article they follow. Thank you in advance for helping us keep our comments on topic, civil, respectful, family-friendly, and fact-based.