Most reports on startup electric-car maker Faraday Future tend to describe it as "struggling," and that may be an understatement.

It halted work at its Nevada-based production facility in 2016; the startup company's main backer, China's LeEco, acknowledged this past May it was experiencing financial problems; and Faraday Future has been clamoring for investment since this past summer to keep itself afloat.

Following an emergency $14 million loan from California-based Innovatus Capital Partners, Faraday Future may now have found a savior in India's Tata, the parent company of luxury maker Jaguar Land Rover.

DON'T MISS: Faraday Future gets $14 million; factory moved to CA from Vegas

Chinese media reported on Monday that Tata purchased a $900 million stake in the struggling electric-car startup, which would give Faraday Future the lifeline it desperately needs to bring its first car to market—and keep the lights on in general.

If Tata makes its $900 million investment official, it would bring Faraday Future's total value to $9 billion, Chinese automotive news aggregator Gasgoo reported.

UPDATE: Few details of the rumored investment were given in the Chinese media reports, and Tata denied the next day that it had invested in Faraday Future. "The news is not true, and hence we do not have any comment," a Tata Motors spokesperson told Daily News and Analysis, an Indian online news outlet.

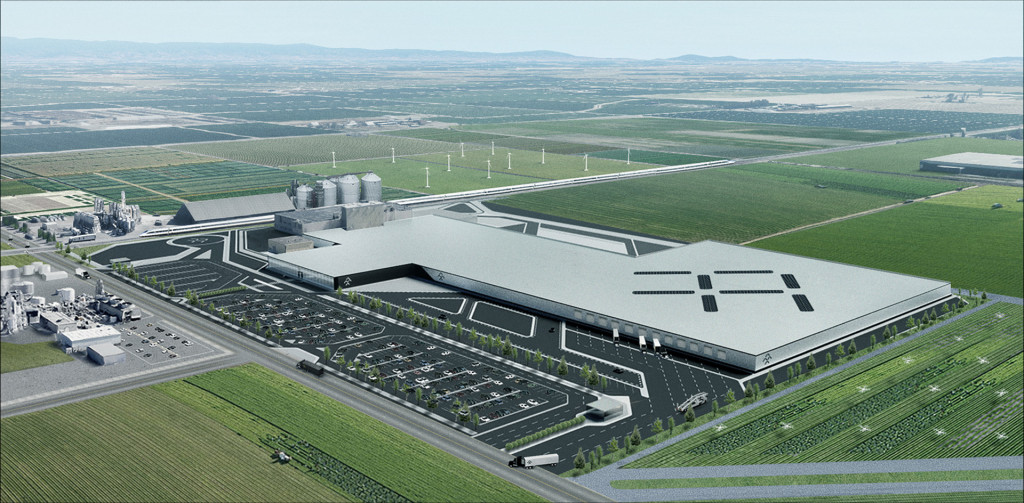

Artist’s impression of Faraday Future’s proposed plant in Hanford, California

As world governments call to end the sale of new cars powered by internal-combustion engines, battery and electric-car development will occur at a rapid pace.

Tata would likely gain access to Faraday Future's electric-car technology with a 10-percent stake in the company itself.

While a production version of its 2019 Jaguar I-Pace is expected to be unveiled within months and start coming off the lines next year, JLR is still a very small maker on a global scale compared to Audi, BMW, and Daimler's Mercedes-Benz.

READ THIS: Faraday Future, short on cash, to leave Formula E electric-car race series: report

It would also give JLR or at least its Tata parent a much larger footprint in China, not only the world's largest car market but a country that plans to outlaw the sale of new vehicles with gasoline and diesel engines after a year yet to be decided.

Faraday Future had appointed two former BMW executives to help implement its strategic vision, but on November 10, the company announced it had parted ways with both of them.

The company fired both Chief Financial Officer Stefan Krause and Chief Technology Officer Ulrich Kranz, and cited "possible violation of law" for Krause's departure in particular.

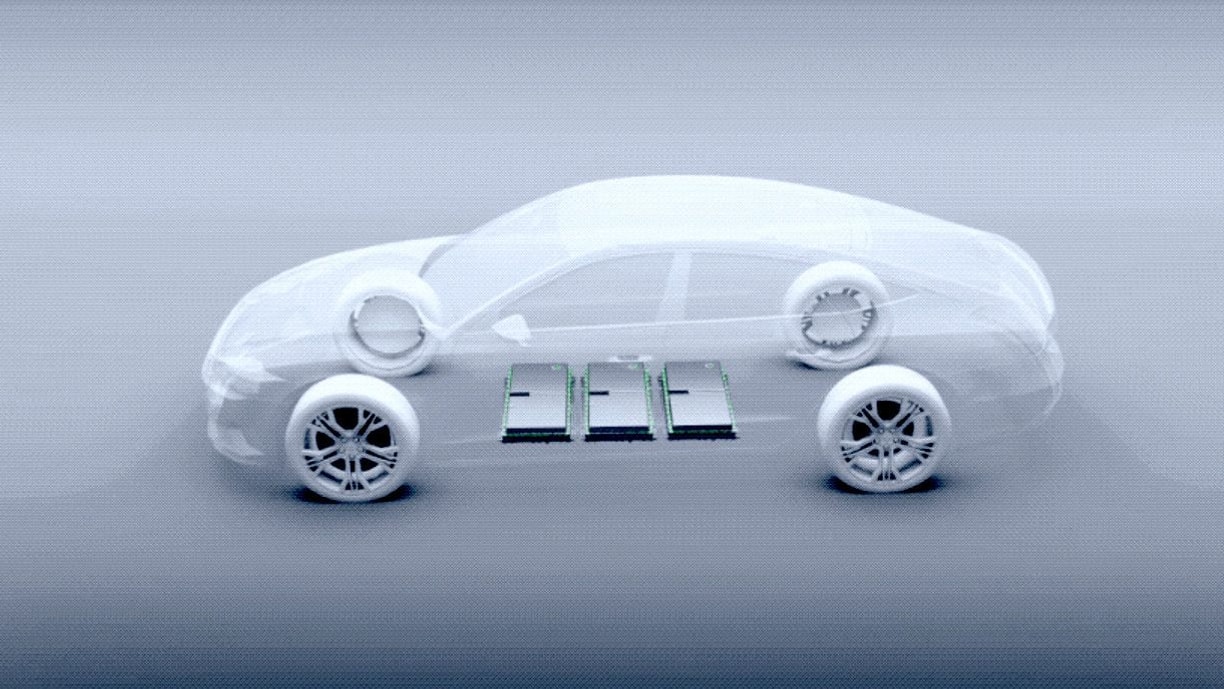

Faraday Future FF 91

It did not give an explanation for Kranz's dismissal, but Krause responded to the company and said Faraday Future’s comments falsely described his departure.

It's unclear who will replace both executives at the company, but Faraday Future continues to work on clearing its new California-based production facility.

CHECK OUT: Faraday Future halts factory work, hopes to resume early 2017 (update)

That 1-million-square-foot "turnkey" facility will serve as its sole assembly plant until work in Nevada can resume, saving it money over further investments in the all-new plant it had intended to build there.

If the fresh funding comes through and it finishes its U.S. production facility, Faraday Future hopes to launch the FF 91, its first production car, in 2019.

EDITOR'S NOTE: This article was published on November 15, based on the cited report from a Chinese media outlet. Tata later denied the report; we have updated this article to reflect that denial. Our thanks to reader Ian Bruce for alerting us to that denial.

_______________________________________