Despite steady progress over the past few years, electric cars still make up only a very small percentage of the tens of millions of new cars sold globally every year.

And while that won't change immediately, energy-industry analysts believe a surge in electric-car sales could be just around the corner.

Electric cars and plug-in hybrids could come to represent 35 percent of new light-duty vehicle sales by 2040, according to a recent report by Bloomberg New Energy Finance.

DON'T MISS: Multiple Trends Turning Slowly Against Oil, Says Rocky Mountain Institute

They will achieve that through a major increase in sales beginning in the 2020s, analysts say, driven primarily by steady decreases in the cost of lithium-ion battery cells.

By 2040, they expect electric-car sales to hit 41 million units, around 90 times the number sold in 2015.

Electric cars could also represent about a quarter of the vehicles on world roads by that date, according to Bloomberg.

Projected electric-car sales by 2040 (by Bloomberg New Energy Finance)

Those cars would save 13 million barrels of crude oil per day, but also consume 1,900 terawatt-hours of electricity--equivalent to 8 percent of global electricity demand in 2015.

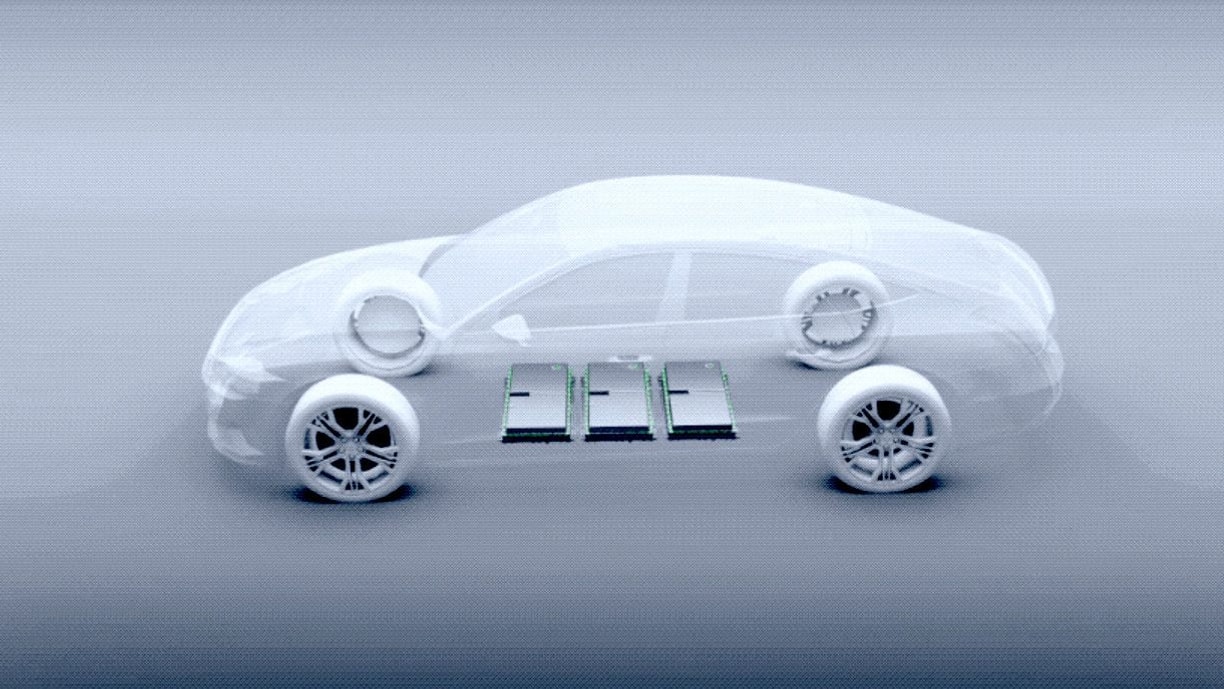

Such a large number of electric cars will be possible because of decreases in the cost of lithium-ion cells, which will make electric cars cost-competitive or better with internal combustion, analysts say.

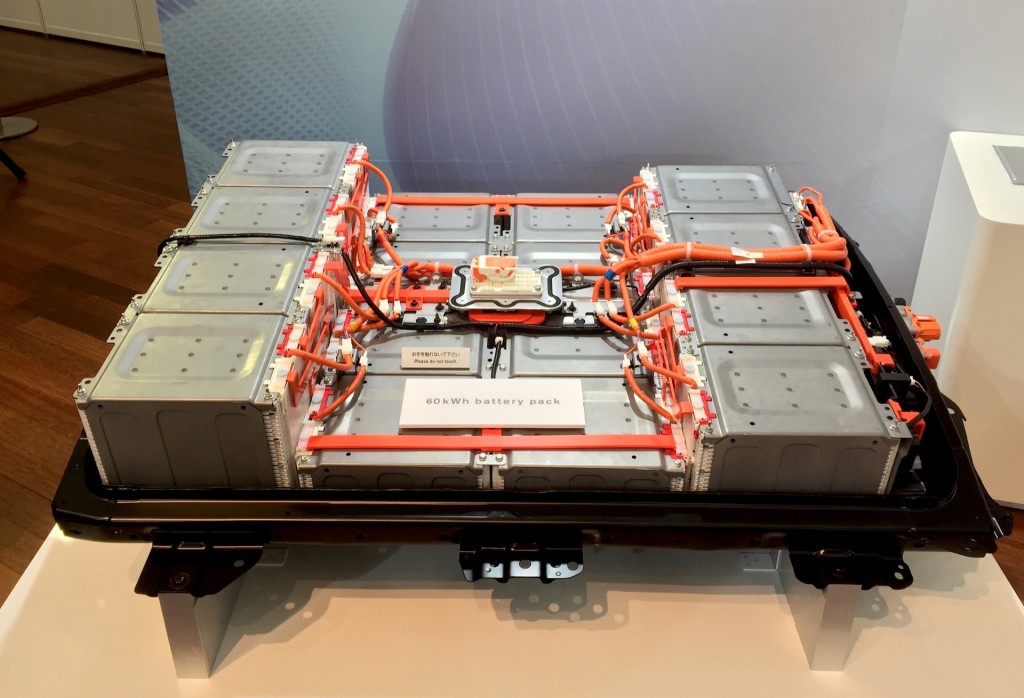

Cell costs have already dropped 65 percent since 2010, reaching $350 per kilowatt-hour in 2015, noted Colin McKerracher, lead advanced transportation analyst for Bloomberg New Energy Finance.

ALSO SEE: What Comes After Lithium-Ion Batteries To Power Electric Cars, And When? (Dec 2015)

Bloomberg expects cell prices to drop "well below" $120 per kWh by 2030, he said.

(It's worth noting that GM's product chief Mark Reuss claims the company will pay just $145 per kilowatt-hour for the cells to be used in the 2017 Chevrolet Bolt EV when it goes into production late this year.)

Analysts generally view $100 per kWh as the point at which electric cars become cost-competitive with internal combustion.

Nissan prototype 60-kWh battery pack - Nissan Technical Center, October 2015

And even if oil prices remain close to the lows witnessed in 2015, that will only temporarily impede the momentum of electric cars, the analysts say.

The study assumes oil would eventually increase to $50 per barrel, noted Salim Morsy, author of the study, and reach highs of $70 per barrel or higher by 2030.

But even if prices fell to $20 per barrel and stayed there, that would only delay mass electric-car adoption to the 2030s, rather than the 2020s, he said.

MORE: Cheap Oil Will Last A Decade, Says Huge Oil Trader

Analysts also assumed that electric cars with 200-mile ranges will become widely available, with plunging lithium-ion cell prices making them more affordable than comparable gasoline or diesel cars.

That means the upcoming 2017 Chevrolet Bolt EV, and the Tesla Model 3 claimed to launch late next year, will have to be followed by many more 200-mile cars that at least match their prices.

The Chevy will sell for $37,500, while the Tesla is expected to start at $35,000.

_______________________________________________