On-again, off-again electric-car startup Faraday may have a future after all.

The company announced two new rounds of financing Monday, a $1.25 billion stock sale expected to be completed by the end of the year, and a $225 million bridge loan to make it to the end of the year.

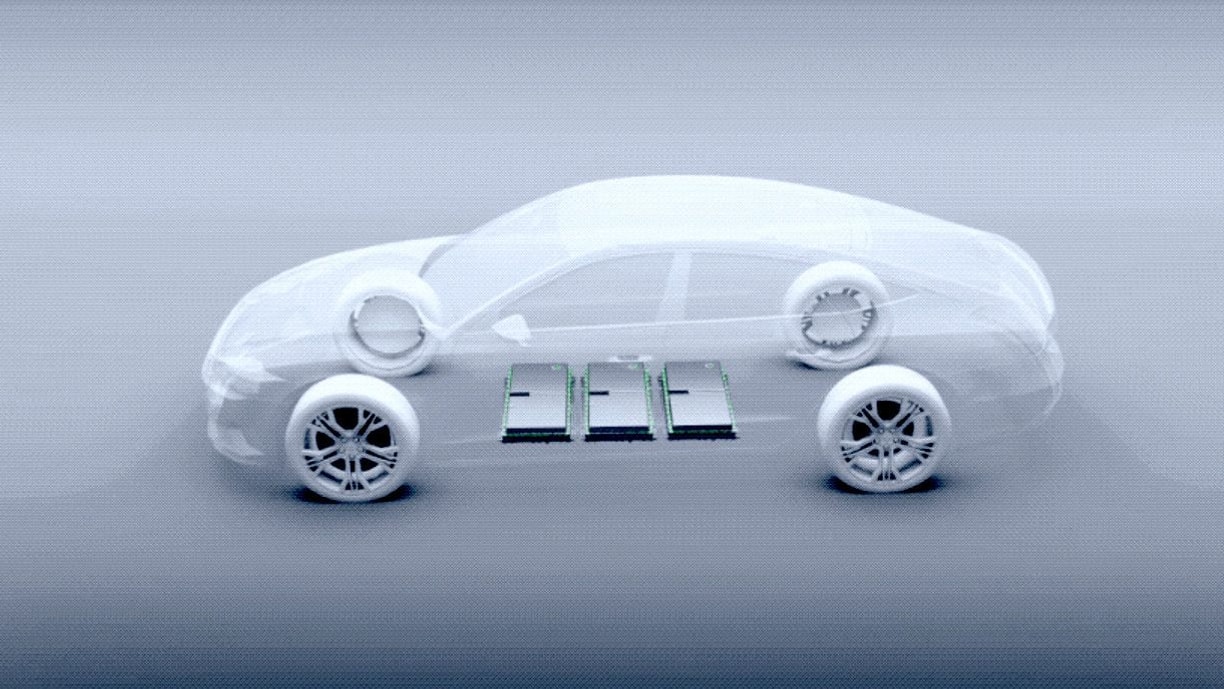

In a statement, Faraday Future said the money will pay for the production of the long-awaited FF91, and pay for continued on its second model, the FF81, for launch in 2021.

DON'T MISS: Faraday Future gets a $2 billion lifeline to build expensive crossover

The new financing round is being led by Stifel Nicolaus & Co., a St. Louis-based "diversified global wealth management and investment banking company."

The bridge loan comes from Birch Lake Associates, a Chicago investment firm, which bills itself as deploying "intellectual and financial capital in stressed and transitional businesses by advising corporations and investors on mergers and acquisitions, financial restructurings and complex situations."

MUST READ: With cease-fire agreement, spark flickers toward Faraday's Future

Faraday Future's situation certainly has been complex.

Backed by a Chinese investor who founded the company along with several big-name automotive engineers, the company brought its FF91 ultra-luxury EV prototype to the Consumer Electronics Show in Las Vegas in 2017 and announced that it would break ground on a giant factory there to build the car and a more affordable subsequent model, the FF81. Financing for the project fell through and the company abandoned the factory, and for a while the car as well, before leasing a smaller factory in California's Central Valley.

CHECK OUT: Faraday Future funder writes its own Saab story

After receiving a new round of financing last summer from a Hong Kong conglomerate, Evergrande Health, with a desire to get into the electric-car business, Faraday built more FF91 prototypes and hired more workers.

When that deal fell apart, amid back-and-forth finger pointing over spending and missed investment targets, the company laid off or furloughed about 80 percent of its workforce, and the five founders with automotive engineering experience left. A barrage of lawsuits and countersuits was settled in January in what amounts to a cease-fire agreement that allowed Faraday Future to seek additional sources of financing.

READ MORE: Faraday Future joint venture to create electric MPV based on FF91

Earlier this month, the company mortgaged its Los Angeles-area headquarters and reached a new agreement with Chinese gaming company The9 to build 300,000 copies of a new, lower-priced electric vehicle called the V9 for the Chinese market. That deal brought Faraday Future another $600 million.

The senior bridge financing note includes $150 million to maintain Faraday Future's supply chain for the FF91.

Working with another investment adviser, Faraday Future has valued its assets at $1.25 billion.

The larger $1.25 billion round of equity financing is expected to be completed early in the third quarter this year, the company said.