In early 2009, German luxury car maker Daimler effectively saved Silicon Valley electric-car maker Tesla Motors by purchasing 9.1 percent of the company for a reported $50 million.

Now, more than five years later--following a remarkable rise in Tesla's stock price--Daimler has largely cashed out its remaining 4-percent holding, adding a healthy $780 million in cash to its books

DON'T MISS: Tesla's New BFF (And Savior?) Is Mercedes-Benz (May 2009)

In a release, the company took pains to call Tesla a "bold partner" and point out that its partnership with Tesla on the Mercedes-Benz B-Class Electric remains intact for the present.

"The cooperation between the partners on the automotive projects is unaffected," Daimler said. "Development work for the Mercedes-Benz B-Class Electric Drive is completed, the partnership with Tesla remains in place."

2014 Mercedes-Benz B-Class Electric Drive - First Drive, May 2014

Daimler bought its shares in May of 2009, and resold 40 percent of its share within a couple of months to an investment firm in Abu Dhabi--effectively spreading its risk at a time when Tesla was a highly speculative stock.

Tesla CEO Elon Musk admitted three years later that the Daimler investment had been a turning point for the startup carmaker, which was then struggling to deliver its first car, the two-seat Tesla Roadster.

ALSO SEE: Elon Musk: Daimler Saved Tesla, DoE Loans A Bad Idea (Mar 2012)

"We were saved by Daimler," he said at a conference--to such a degree that Tesla was able to launch a successful initial public offering (IPO) of its stock in June 2010.

Just a month before the IPO. Toyota announced that it too had taken a minority share in Tesla--and would sell Tesla its shuttered vehicle assembly plant in Fremont, California.

Kim Price, first buyer of 2014 Mercedes-Benz B-Class Electric Drive, and sales associate Steven Hall

Panasonic, Tesla's longtime lithium-ion cell supplier, followed with its own minority share in November 2010. The two companies are now partners in the huge battery gigafactory project outside Reno, Nevada.

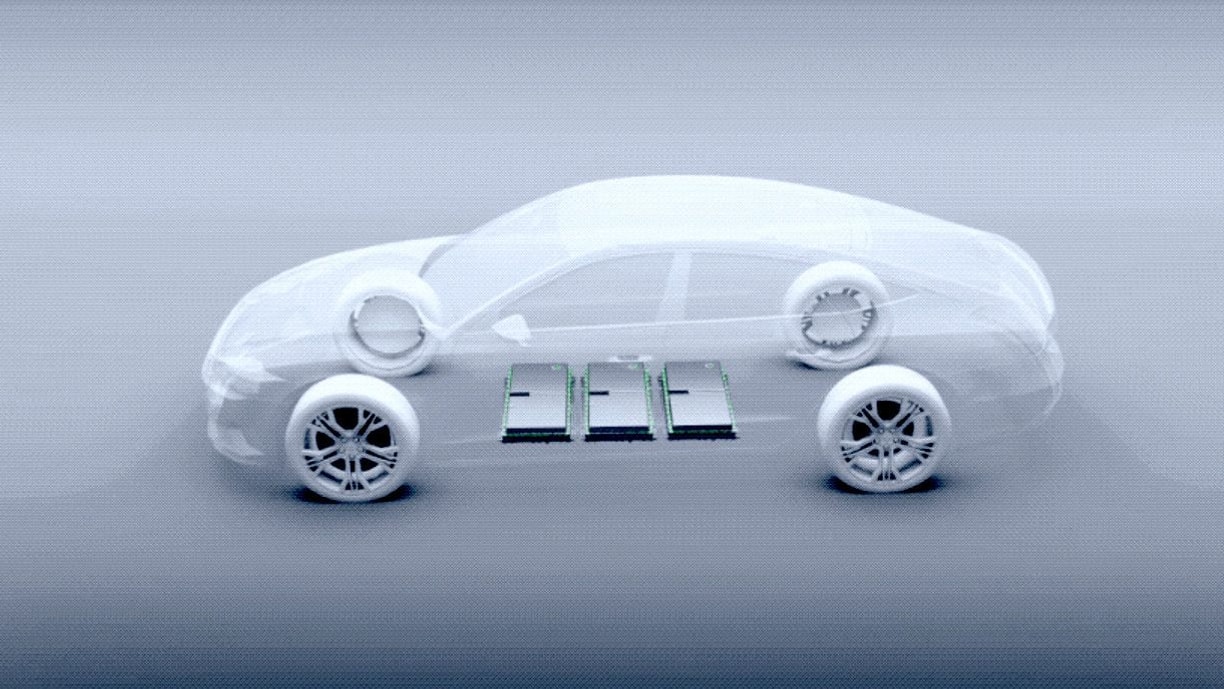

Tesla has provided either battery packs or complete electric powertrains for three different Daimler vehicles: the Mercedes-Benz A-Class E-Cell (sold only in Europe), the second of three generations of electric Smart ForTwo vehicles, and the current Mercedes B-Class Electric Drive that went on sale in July.

MORE: Panasonic To Join Parade of Tesla Investors With Toyota, Daimler (Nov 2010)

Technically, Daimler has terminated a share-price hedge it initiated last year, as well as selling its shares. One way such a strategy works, in layman's terms, would be for Daimler to sell options that require it to sell its Tesla shares at a specific price.

With the recent decline in Tesla's share prices, buyers may have exercised those options.

Mercedes-Benz in the U.S. has delivered 159 B-Class electric cars thus far, and that model will go on sale in Europe next month as well.

_______________________________________________