Kansas lawmakers want to tax public EV charging

Green Car Reports

FEBRUARY 2, 2023

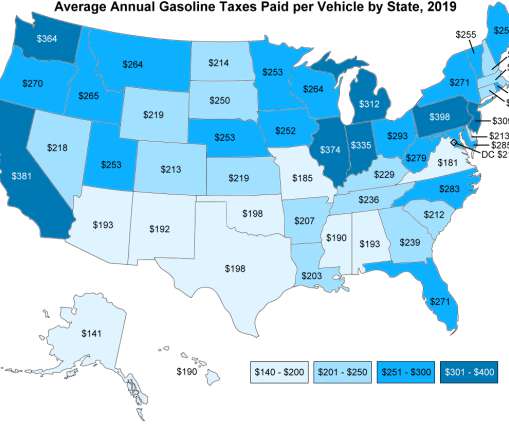

A Kansas House bill calls for a tax on public EV charging—but not home charging. The proposed tax of 3 cents per kilowatt would go to a Kansas highway repair fund reliant on revenue, according to the Kansas Reflector, but it could force EV drivers to pay more than other drivers.

Let's personalize your content